Mollie Officially Launches in Portugal to Support Ecommerce Growth

Hey Payments Fanatic!

Over the past few years, Lisbon has steadily built a reputation as a growing FinTech corridor. Now, another player is joining the scene. Mollie, the payment platform serving more than 250,000 businesses across Europe, is expanding its presence in Portugal.

With its official launch in the country, Mollie brings a full-stack payments solution tailored to local needs, including MB WAY and Multibanco, alongside more than 35 other payment methods.

This step builds on Mollie’s earlier investment in Lisbon, where it opened a tech hub in 2022. That office now employs 60 people, with plans to grow the team to 80 by the end of 2025. The company is now integrating its commercial and customer support teams into the same space, further embedding itself in the local market.

Mollie’s platform offers businesses, whether startups, SMEs, or larger enterprises, a centralized way to manage financial operations across both online and in-person channels. Reporting tools, real-time data, and fraud prevention features aim to make digital transactions more seamless and scalable.

“Entering the Portuguese market is a big step for Mollie, and we want to be part of this journey, as a partner that supports companies with simple and effective payment solutions,” said Koen Köppen, CEO of Mollie. “Expanding our Lisbon team to include commercial and support functions strengthens our ability to deliver a higher quality of service to our customers,” he added.

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

🇬🇧 Checkout.com launches the inaugural Digital Economy Trust Index. This Index offers a clear view of how people interact with, trust, and adopt digital systems, helping businesses, policymakers, and tech providers understand key trust drivers to boost digital and economic growth. Discover more

PAYMENTS NEWS

🇺🇸 Perplexity selects PayPal to power agentic commerce. Starting this summer in the U.S., consumers can check out instantly with PayPal or Venmo when they ask Perplexity to find products, book travel, or buy tickets. Keep reading

🇸🇬 Kima joins Mastercard sandbox to enable stablecoin card top-ups. Mastercard partners can now rely on Kima’s settlement infrastructure to enable their prepaid cards to be topped up with stablecoins, including USDC and Tether’s USDt, from self-custody wallets across more than 10 blockchains.

🇮🇳 PayU receives final authorization from the RBI to operate as an online payment aggregator. PayU India companies aim to create a full-stack digital financial services platform to serve all (tapped and untapped) financial needs of customers (e-commerce brands, banks, and consumers) through technology solutions.

🇸🇬 MetaComp launches StableX to redefine cross-border FX payments. Developed for cross-border merchants, institutions, payment service providers, FinTechs, and global businesses, StableX enables always-on access to foreign exchange with the speed, cost-efficiency, and reliability required in today’s digital-first economy.

🇬🇧 Monzo launches new bank app feature that lets customers undo payments. The feature will help to reverse a payment if there was a mistake with the amount sent, the recipient, or the decision to send the payment in the first place. By default, users are given 15 seconds to undo a payment, but this can be adjusted to 10 seconds, 15 seconds, 30 seconds, or 60 seconds.

🇫🇷 Nuvei and Quadient launch cloud payments partnership. The collaboration is designed to help businesses worldwide enhance their cloud payments capabilities, integrating Nuvei’s payment processing technology with Quadient’s accounts receivable (AR) and accounts payable (AP) automation tools.

🇫🇷 MyPOS teams with YouLend to simplify SME financing. Through this collaboration, eligible myPOS clients can access revenue-based financing directly on the all-in-one FinTech platform. They will enjoy a flexible repayment structure, where merchants can pay back by allocating a percentage of the funds received.

🇬🇧 PXP launches new POS solution to optimise in-store payments. By leveraging POS, merchants are set to benefit from all-in-one payment acceptance for major card schemes, contactless, and mobile wallets, and ensure a simplified, omnichannel experience.

🇺🇸 Plaid is using ML to counter GenAI with new identity verification features. The new security features make it even harder for fraudsters to manipulate or bypass identity verification, while also streamlining the experience for trusted users. These enhancements are available to all Plaid Identity Verification (IDV) customers.

🇺🇸 Euronet’s Money Transfer Segment adds Visa Direct to expand its industry-leading Dandelion Real-Time Payments Network. Through this partnership, Dandelion extends its network as an industry leader, expanding its digital payout capabilities, which include more than 3.2 billion mobile wallet accounts.

🇬🇧 Ebury becomes a certified Xero app partner to optimise business automation. Through this integration, Ebury and Xero aim to help businesses scale their operations by driving optimal automation, accuracy, and financial control across international markets, achieving their strategic growth goals.

🇺🇸 JPMorgan Chase steps beyond ‘walled garden’ to settle transactions on public blockchain on a public ledger with the help of the crypto firms Chainlink and Ondo Finance. Continue reading

🇺🇸 Square debuted Square Releases, a new biannual product launch that delivers the most important new features and tools, all at once. It gives businesses a simple, consistent way to discover what’s new, understand what’s next, and take action to grow.

GOLDEN NUGGET

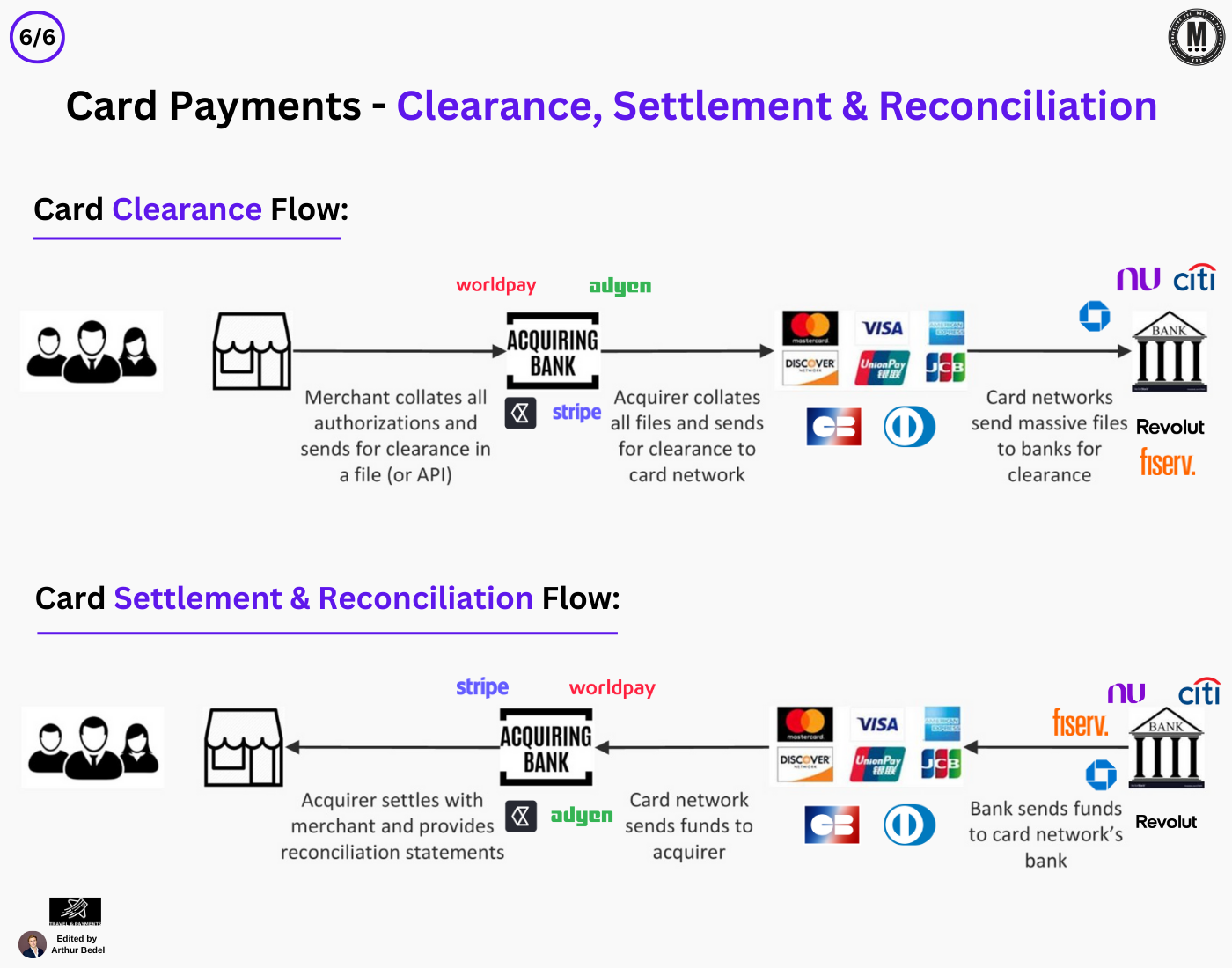

𝐓𝐡𝐞 𝐈𝐧𝐭𝐫𝐨𝐝𝐮𝐜𝐭𝐢𝐨𝐧 𝐭𝐨 𝐂𝐚𝐫𝐝𝐬 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 — Clearance, Settlement and Reconciliation in Card Payments by Travel & Payments 👇 Created by Arthur Bedel

What is 𝐂𝐥𝐞𝐚𝐫𝐚𝐧𝐜𝐞 in 𝐂𝐚𝐫𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬?

Clearance refers to the exchange of financial transaction information between a merchant, acquiring bank, card network, and issuing bank. It ensures that each authorized transaction is captured, validated, and prepared for the final movement of funds.

It is the data validation layer between authorization and settlement, typically executed via structured batch files or APIs.

How the 𝐂𝐥𝐞𝐚𝐫𝐚𝐧𝐜𝐞 Process Works:

1️⃣ From merchant (via a PSP - Worldpay, Checkout.com, CellPoint Digital), compiles all card authorizations for the day.

2️⃣ These are transmitted to the acquirer (either same as Gateway or a different PSP, Adyen, Stripe etc.), which aggregates data from multiple merchants.

3️⃣ The acquirer forwards clearance files to the respective card networks (Visa, Mastercard, GIE Cartes Bancaires).

4️⃣ Card networks then send structured clearance files to the relevant issuing banks (Citi, Nubank, Revolut, Chase) for verification.

5️⃣ Once validated, transactions are marked as cleared and queued for fund settlement.

✔️ Clearance typically operates on a T+1 or T+2 schedule (transaction date plus one or two business days).

What is 𝐒𝐞𝐭𝐭𝐥𝐞𝐦𝐞𝐧𝐭?

Settlement is the actual movement of funds from the issuing bank to the acquiring bank and ultimately to the merchant. It ensures that merchants receive payment for cleared transactions and issuers collect funds from cardholders.

What is 𝐑𝐞𝐜𝐨𝐧𝐜𝐢𝐥𝐢𝐚𝐭𝐢𝐨𝐧?

Reconciliation is the post-settlement validation process, where merchants and acquirers ensure that transaction records align with actual funds received. It involves matching authorization logs, clearance files, and settlement amounts.

This step is essential for accuracy, compliance, and resolving disputes or chargebacks.

𝐇𝐨𝐰 𝐒𝐞𝐭𝐭𝐥𝐞𝐦𝐞𝐧𝐭 & 𝐑𝐞𝐜𝐨𝐧𝐜𝐢𝐥𝐢𝐚𝐭𝐢𝐨𝐧 𝐰𝐨𝐫𝐤

1️⃣ Once cleared, issuing banks (Citi, NU, Revolut) send funds to the card networks’ settlement bank, facilitated by processors like Fiserv.

2️⃣ The card network (e.g., Visa, Mastercard) transfers the funds to the acquiring bank (e.g., Stripe, Worldpay, Adyen).

3️⃣ The acquirer then deposits the net funds into the merchant’s account and issues detailed reconciliation statements.

4️⃣ Settlement moves the money. Reconciliation ensures accuracy, completeness, and transparency.

Clearance, settlement, and reconciliation form the operational foundation of card payments. While authorization may happen in milliseconds, these back-end flows ensure the payment is valid, the money is transferred, and records are aligned — creating trust.

Source: Travel & Payments & Vishal Mehta

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()