Next Stop for Wero: Luxembourg Goes Live in 2026

Hey Payments Fanatic!

Big news from the heart of Europe: Luxembourg is next in line to join the Wero revolution 🇱🇺

Payconiq International, Buckaroo, and the European Payments Initiative (EPI) just inked a strategic deal to clear the runway for Wero’s 2026 launch in Luxembourg.

The move will see Payconiq’s local merchant portfolio transferred to Buckaroo, which will then roll out Wero acceptance for all merchants once the standalone app goes live mid-2026.

For Luxembourg’s merchants and consumers, this means faster, cheaper, and truly European payments. No intermediaries, no friction, just instant A2A transfers.

With this step, EPI continues to deliver on its mission: a single, sovereign digital payments network built in Europe, for Europe.

Another milestone on Wero’s road to becoming Europe’s answer to Visa, Mastercard, and PayPal.

Now, let’s dive into today’s other top payments stories 👇

Cheers,

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

NEWS

🇬🇧 Solidgate Treasury joins the global SWIFT network. Solidgate Treasury is designed to simplify the complexities of managing global operations. With direct integration with SWIFT, businesses can now transfer funds globally in multiple currencies with fewer intermediaries, reducing delays, risks, and costs.

🇱🇺 Wero is set to launch in Luxembourg through a partnership with Payconiq International, Buckaroo, and EPI Company. With this rollout, merchants in Luxembourg will be able to accept Wero payments, while consumers can use the app for peer-to-peer transfers and instant payments at checkout.

🇺🇸 Jack Dorsey’s Block targets card network fees in latest push. Block is helping local businesses offer their own branded rewards programs, which consumers manage through the company’s Cash App. It’s now looking to incentivize shoppers to pay directly with their stored balances on the app to sidestep card networks, while collecting rewards.

🌍 Major banks explore issuing stablecoin pegged to G7 currencies. The project, which is in its early stages, will explore whether there is value in issuing assets on public blockchains that are pegged 1:1 to real-world currencies, a type of cryptocurrency known as stablecoins.

🇸🇦 Paymentology scales card programs in Saudi Arabia. By providing modular, configurable platforms, Paymentology enables clients to create unique propositions, giving cardholders dynamic control over spend limits, timeframes, and other personalized features.

🇦🇪 Tabby launches Saudi AI factory using NVIDIA HGX systems. The move aims to accelerate its AI roadmap while retaining data sovereignty and meeting regulatory constraints. The company said it will initially use the systems to power AI tools across customer support, fraud detection, risk scoring, and shopping personalisation.

🇺🇸 Coinbase to launch American Express-backed credit card offering bitcoin rewards. The card, expected to launch in the fall of 2025, will operate on the American Express network and allow users to earn up to 4% back in Bitcoin rewards. The Coinbase One Card will be available exclusively to Coinbase One members, subscribers to the platform’s premium service.

🇺🇸 Israeli FinTech firm Navan targets $6.5b valuation in IPO. The company aims to raise about US$960 million by offering 36.9 million shares priced between US$24 and US$26 each. The firm’s shares are expected to trade on the Nasdaq under the symbol “NAVN.”

🇨🇴 Colombian FinTech Bold raises $40M funding round. Bold will use the funding to accelerate expansion into other Latin American countries, starting with Peru, where the company recently acquired VendeMás, the payment facilitator owned by Niubiz. Continue reading

🌍 REasy raises USD 1.8 million pre-seed round to simplify international payments for African SMEs. This new system allows small businesses to conduct compliant and instant international payments, even for transactions below USD 10,000, a breakthrough that significantly reduces delays and costs for cross-border trade.

🇬🇧 Leeds-based FinTech Nochex acquired by PAYSTRAX. According to CEO Johannes Kolbeinsson, the move aligns with PAYSTRAX’s long-term growth strategy of combining organic expansion with strategic acquisitions. He highlighted Nochex’s strong brand heritage, trusted reputation, and pioneering role in the UK’s online payments industry as key reasons for the integration.

🇪🇬 FABMISR taps Noon Payments to advance FinTech evolution. By combining FABMISR’s banking expertise and technological infrastructure with Noon Payments’ dynamic FinTech platform, the initiative will streamline digital transactions, improve security, and simplify payment processing for merchants across Egypt’s fast-growing online retail sector.

🇧🇷 Volkswagen selects Nuvei to launch payment solutions for connected vehicles. This collaboration enables Volkswagen to offer subscription-based connectivity services through an integrated app in the VW Play Connect multimedia system, which debuted in the New Nivus in 2024 and is already available for the New T-Cross and New Tera in 2025.

GOLDEN NUGGET

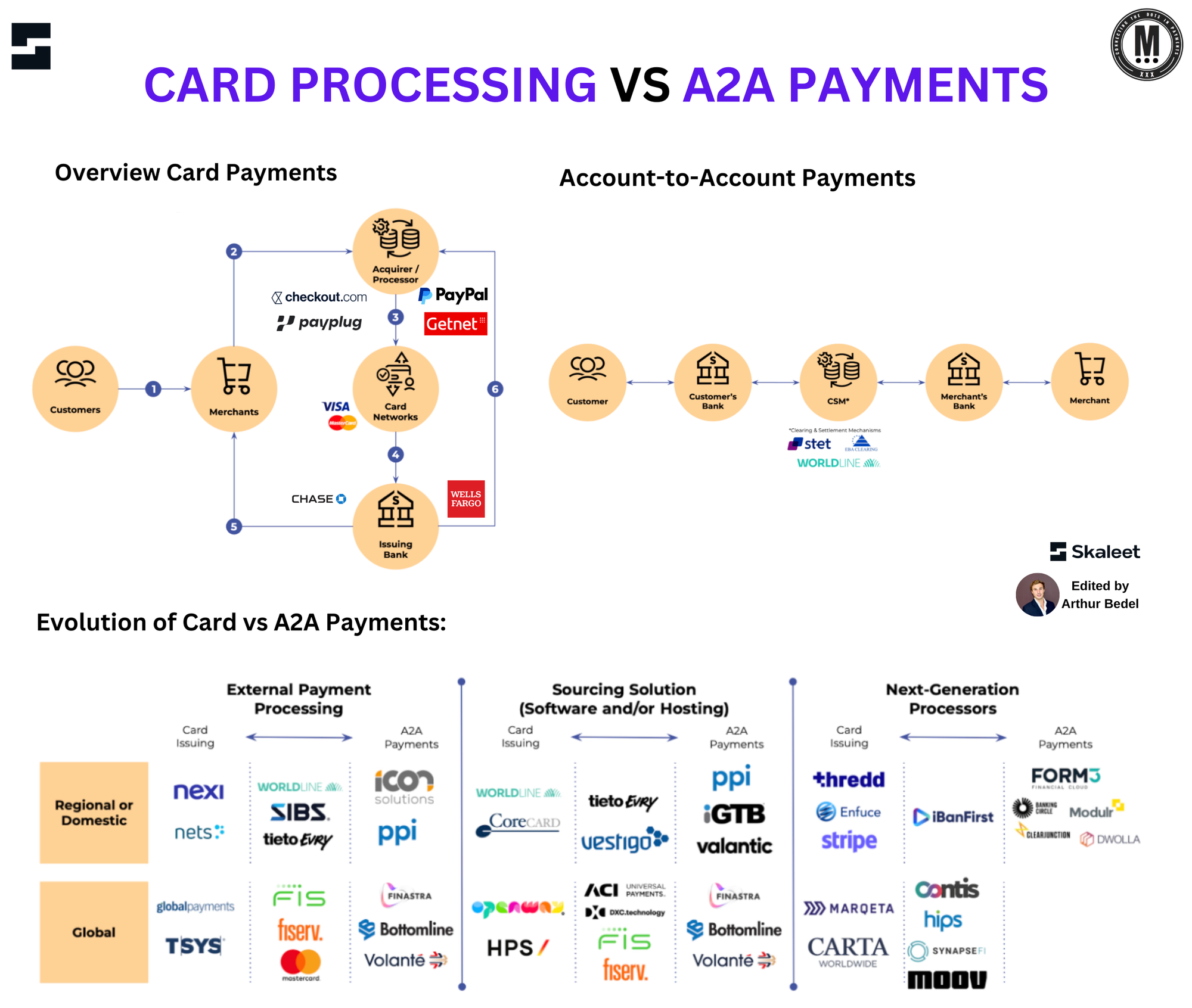

𝐂𝐚𝐫𝐝 𝐏𝐫𝐨𝐜𝐞𝐬𝐬𝐢𝐧𝐠 𝐯𝐬 𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐭𝐨 𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 — it's getting hot in here by Skaleet👇Created by Arthur Bedel 💳 ♻️

The payment landscape remains dynamic. Card transactions and Account to Account payments are undergoing significant changes in technology and business models, whilst witnessing a rise in new market entrants.

𝐂𝐚𝐫𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 101:

Card payments involve several parties:

► Customer

► Merchant

► Acquirer

► Card networks (Visa/Mastercard/GIE Cartes Bancaires)

► Issuing banks

When a customer makes a purchase, the merchant sends the transaction to the acquirer. The acquirer contacts the card network, which forwards the request to the customer’s issuing bank for authorization. After approval, funds are transferred from the issuing bank to the merchant’s account. The process, though secure, can take a few days due to multiple intermediaries and often incurs processing fees at each stage.

𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐭𝐨 𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 101:

👉 A2A payments transfer money directly between the payer's bank and the recipient's bank, bypassing intermediaries like card networks. The process involves a customer initiating a payment that their bank processes, transferring funds to the recipient's bank. Clearing and settlement mechanisms (CSMs), such as Worldline or STET, ensure the transfer is executed securely and in real-time or near-real-time. Unlike card payments, A2A transactions are cheaper and faster since fewer parties are involved.

𝐓𝐡𝐞 𝐄𝐯𝐨𝐥𝐮𝐭𝐢𝐨𝐧 𝐨𝐟 𝐂𝐚𝐫𝐝 𝐚𝐧𝐝 𝐀2𝐀 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐏𝐫𝐨𝐜𝐞𝐬𝐬𝐢𝐧𝐠:

👉 Card-based payments have been the backbone of global commerce for decades. Card payments have evolved to include innovations like contactless payments, mobile wallets, and tokenization. At the same time, A2A payments have emerged as a viable alternative, driven by the rise of Open Banking and real-time payment infrastructures. Next-generation processors, like Stripe and Marqeta, and Checkout.com, are reshaping card payments with digital-first, API-based platforms, while A2A leaders like Form3 and Modulr are pioneering direct bank transfers.

𝐓𝐡𝐞 𝐈𝐦𝐩𝐚𝐜𝐭 𝐨𝐟 𝐎𝐩𝐞𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐨𝐧 𝐀2𝐀 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬:

👉 Open Banking allows third-party providers (TPPs) to access bank accounts securely through APIs, enabling A2A payments without needing card networks. By facilitating the seamless exchange of financial data between banks and TPPs, Open Banking is allowing A2A payments to thrive.

The payments ecosystem continues to be dominated by card payments, but A2A payments are rapidly gaining ground. The rise of Open Banking has propelled A2A as a viable alternative, cutting out intermediaries and speeding up payment processes. The leaders in card-based payments have and are investing in Account to Account payments. The race continues

Source: Skaleet

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()