Noah and NALA Launch Instant Stablecoin Settlement… and this Fixes a $850B Problem

Hey Payments Fanatic!

Noah and NALA just rolled out an instant stablecoin settlement network focused on Africa and Asia.

For decades, cross-border flows into these markets were slow, expensive, and inefficient. Three to five days to settle. Close to nine percent in fees. Liquidity stuck in the middle.

According to the companies, the goal is to help close an estimated $850B annual liquidity gap caused by slow settlement cycles and correspondent banking dependencies.

Always on. Fully regulated. No correspondent banking loops. This isn’t crypto for crypto’s sake. It’s stablecoins plus licensed infrastructure doing what legacy rails never optimized for.

And the traction is real. NALA scaled from zero to $1B in volume in just 18 months. Rafiki is growing fast and already powers partners like MoneyGram.

If you’re watching where Payments is actually getting rebuilt, scroll down and check what’s next 👇

Cheers,

Marcel

INSIGHTS

➡️ Ingenico’s new terminal, Joel Beukers Edition 🤣. Would you flex this on your counter? Ingenico’s Next Generation Axium devices, on Android, are coming throughout 2026. Including our Digital Currency application to enable in-store stablecoin acceptance (all major stablecoins), the Digital Identity application to verify identity/age and keep a record, Device Management, and more.

NEWS

🌍 Noah and NALA launch instant stablecoin settlement network to modernise $850bn emerging-markets payments. Global businesses in Africa and Asia can now collect USD and pay out local currency in minutes, instead of days, bypassing a century-old banking system that costs users billions in fees.

🇸🇦 STC Bank joins hands with Mastercard to transform Saudi remittances through Mastercard Move. The collaboration is fully geared towards transforming the Saudi payments landscape by accelerating the digital transformation of Saudi financial services in accordance with growing digital adoption and consumers’ changing preferences.

🇫🇷 Adyen becomes a principal member of CB and a direct participant in STET, thus strengthening the integration of its offering in France. By becoming a direct participant in the STET clearing system, Adyen will now handle all transactions without intermediaries.

🇳🇱 Klearly raises $14 million Series A led by PayPal Ventures to expand restaurant payments platform. The company’s solution is a payments layer that integrates directly with existing POS systems and runs on merchants’ current hardware. Read more

🇦🇹 Worldline strengthens long-term partnership with PSA to deliver next-generation payments in Austria. Worldline will support PSA in upgrading to a next-generation payments platform, delivering enhanced scalability, resilience, security, and future-ready capabilities aligned with European standards.

🌎 Ingenico, Samsung, and Talus bring a mobile business operating solution to North America. The three-way partnership expands access to mobile payments for North American businesses, delivering frictionless operations with more flexible ways to accept payments wherever business happens.

🌍 Akurateco and Payaza announce strategic partnership to expand payment capabilities across Africa and global markets. Through this collaboration, Payaza’s payment services are now available on the Akurateco platform, offering businesses seamless access to reliable African payment coverage supported by strong local acquiring, settlement efficiency, and cross-border expertise.

🇬🇧 Moonrise partners with Moneff to bring local SEK, NOK, and DKK payment rails to customers across the Nordics. Moneff can now offer eligible customers unique virtual account numbers with access to local Scandinavian rails, alongside EUR and GBP.

🌏 HitPay and Primer partner to boost cross-border payments. Singapore-based HitPay will use Primer’s unified payments infrastructure to connect local merchants with global acquirers. This will make it easier to accept multicurrency card payments and manage cross-border transactions.

🇺🇸 ACI Worldwide enables Paze℠ for online checkout, advancing speed and convenience for digital commerce. The convenient Paze checkout experience enables consumers to pay online with their preferred credit and debit cards via added security through tokenization and streamlined digital authentication.

🇰🇪 Uber ends Visa card payments in Kenya. Ride-hailing firm Uber has quietly stopped accepting Visa cards as a payment option for users in Kenya, forcing customers to switch to alternative methods like cash and mobile money. Continue reading

🇬🇧 ClearBank selects Taurus to support its stablecoin-related services. The agreement will enable ClearBank to leverage Taurus’ technology to advance its digital asset strategy in a secure, scalable, and compliant manner, with a focus on supporting stablecoin-related services for its clients.

🇺🇸 Deutsche Bank expands support for PayPal to strengthen global payment capabilities. Under this expanded agreement, Deutsche Bank will scale up the merchant settlement, payouts, and begin withdrawals and collection solutions for PayPal in the US.

GOLDEN NUGGET

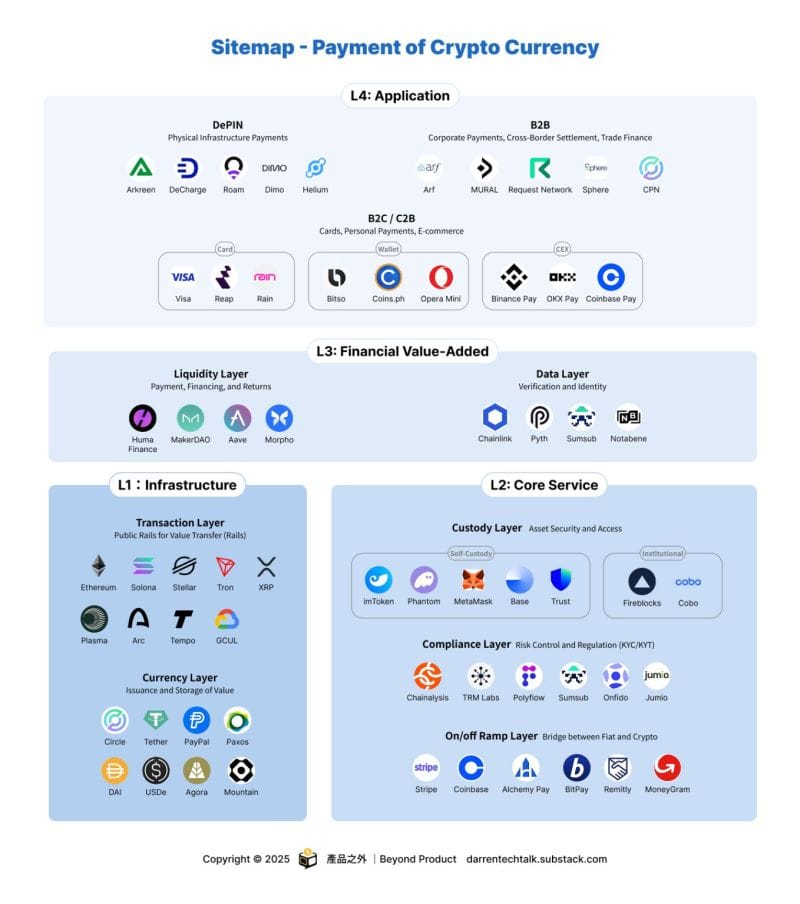

Deconstructing the Crypto Payment Stack: Where is Value Actually Created?

Darren Fran mapped the ecosystem into a 4-layer stack:

Layer 1️⃣ — Infrastructure (Settlement Rails)

Blockchains and stablecoin issuers (e.g. Ethereum, Solana, Circle, Tether).

This layer sets cost, speed, and finality. It’s already in a winner-takes-most dynamic driven by liquidity and network effects.

Layer 2️⃣ — Core Services (Trust & Compliance)

Custody, compliance, and on/off-ramps (e.g. Fireblocks, Chainalysis, Stripe).

This is where regulatory moats are built. Control compliance, and you control value flow.

Layer 3️⃣ — Financial Value-Add (Capital Efficiency)

Yield, liquidity, and treasury optimization (e.g. Aave, MakerDAO).

Here crypto payments start to look like banking: yield on float becomes structural, not optional.

Layer 4️⃣ — Applications (Orchestration)

Wallets, cards, B2B settlement, enterprise flows.

The winners don’t own the stack — they orchestrate it and hide complexity from users.

I highly recommend following Darren Fan and checking it the original source piece on this topic to learn more.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()