Pay-by-Face Gains Ground in South Korea

Hey Payments Fanatic!

What started as a small pilot in a company cafeteria in 2019 is now spreading across South Korea. Facial recognition is moving beyond phones and airports, showing up in stores, gas stations, and on university campuses.

Naver Pay and Toss have added new momentum to facial payments. With in-app face registration and their own terminals, they’ve made pay-by-face smoother for both users and merchants.

Still, even with 160,000 merchants on board, facial recognition is touchy stuff. In Korea, better watch where you look... blink the wrong way and your lunch might end up on someone else’s tab 😅

But the story doesn’t end here. Scroll down for more details 👇

See you tomorrow!

Cheers,

Get the Latest in Paytech! Join my new Telegram channel for daily updates on paytech trends and exclusive insights. Connect with industry enthusiasts and stay on top of innovation!

INSIGHTS

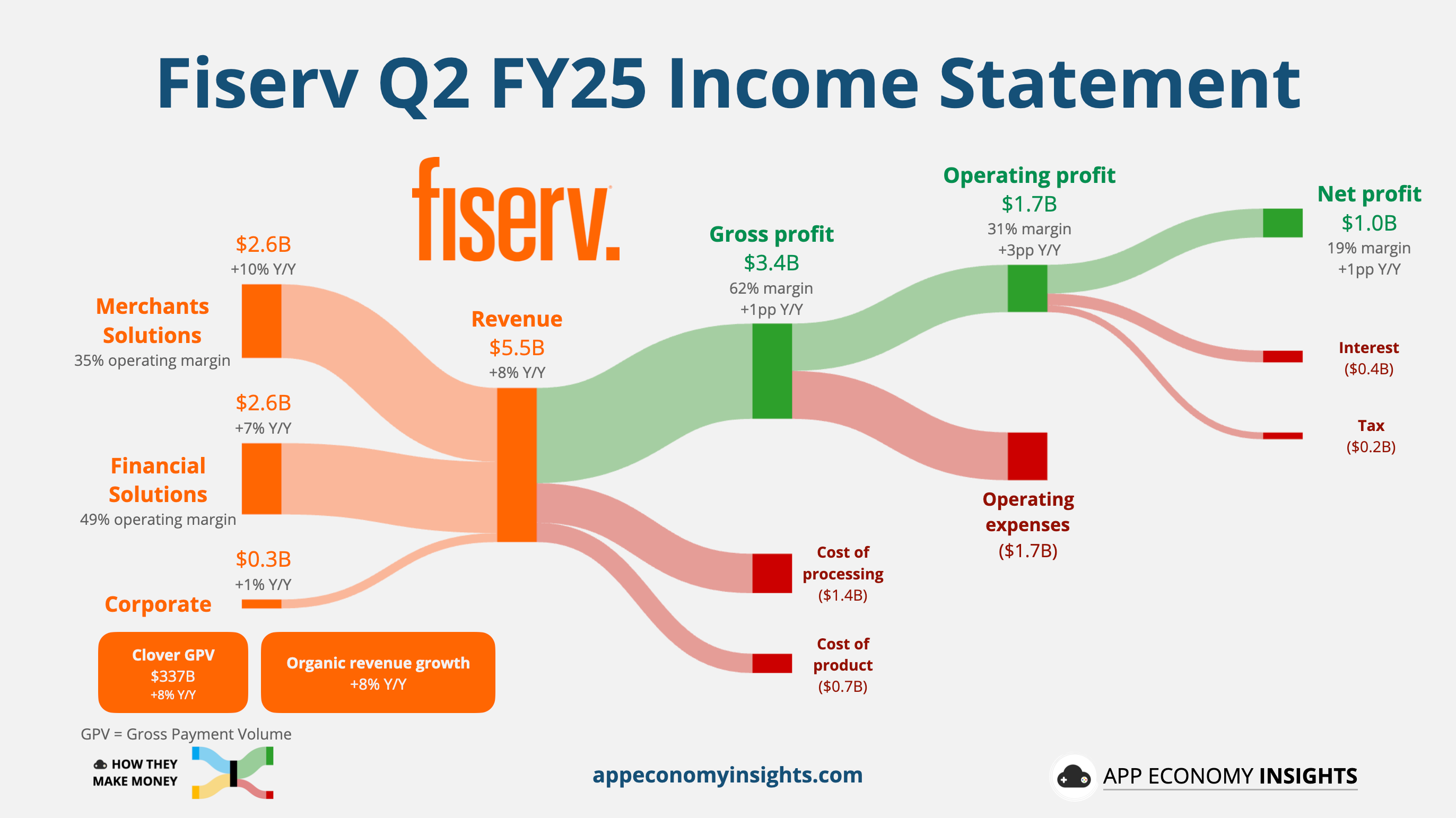

Fiserv's Q2 2025 Financials: Growth Slows.

NEWS

🇸🇬 Airwallex launches Yield in Singapore, unlocking smarter returns after MAS licence approval. With this license, Airwallex can now offer regulated investment solutions and custodial services to businesses through its Airwallex Yield product. Airwallex Yield is an investment fund management service that allows businesses to earn competitive returns on surplus funds held within their business.

🇺🇸 How Lithic enhanced real-time transaction monitoring with Taktile. To elevate its fraud and anti-money laundering (AML) strategy, Lithic turned to Taktile’s AI-powered Decision Platform, enabling its risk team to monitor transactions more effectively, iterate faster, and protect customers at scale.

📰 How to increase transaction success rates for online merchants. A study by ACI Worldwide and Edgar, Dunn & Company found that 85% of merchants with multiple acquirer relationships saw increased conversion rates, with 23% reporting a rise of over 10%.

📰 Why FX management means competitive exchange rates for everyone by David García Amado, Global Head FX & International Solutions, PagoNxt Payments. Platform-based FX services fundamentally alter the dynamics of corporate banking, creating new opportunities for financial institutions to serve previously underserved market segments cost-effectively.

🇬🇧 Mastercard strengthens trust in Account-to-Account payments. By combining cutting-edge fraud prevention technology and a new, clear dispute resolution framework, Mastercard A2A Protect will enable banks to provide consumers with the appropriate levels of protection against fraudsters.

🇰🇷 Pay-by-face expands in Korea. Payments made solely through facial recognition, or "pay-by-face," are being adopted rapidly as financial companies compete to gain an early foothold in next-generation financial services. While the initiative was bold, the requirement to register one's face in person at banks proved inconvenient.

🇬🇧 Henry Allen joins travel money FinTech Caxton as new CFO. He will work across the Caxton Group, including Nimbl, a youth money app. Allen has a lengthy history of serving as CFO for companies such as TipJar, Augmentive, Inicio AI, and, most recently, for vehicle management app Fleetsmart.

🇮🇳 Kenro Capital eyes up to $40 mn stake in Pine Labs as early backers seek exits. The deal may likely have a slight discount in valuation, as it usually happens in a secondary transaction. Shareholders in a secondary transaction sell their stakes to other investors, and no new capital is injected into the company.

🇮🇹 Crédit Agricole Italia and Nexi renew their strategic partnership until 2029. The agreement will enable the bank to further enhance its offering on digital payments, allowing customers to benefit from highly innovative, cutting-edge, and secure products and services provided by Nexi.

🇿🇦 Peach Payments and MoneyBadger partnership goes live. This collaboration expands consumer payment choices and reflects the growing use of crypto for daily purchases. With this partnership, Peach Payments and MoneyBadger are making Bitcoin and crypto payments available to a much wider group of consumers.

🇵🇭 GCash’s IPO is not expected this year. In an interview, the president and CEO, Martha Sazon, noted that while the IPO is still being considered, no specific timeline has been established. GCash continues to wait for the best timing before it proceeds with the filing of what could be the largest IPO in the country.

🇧🇭 Stc Bahrain becomes the first telecom to launch Samsung Pay, pioneering digital payments. This service enables users to complete transactions for bills, add-ons, and digital gift cards with ease, reflecting stc Bahrain’s commitment to introducing innovative solutions that align with modern digital lifestyles.

🇺🇸 Interactive Brokers considers launching a new stablecoin for customers. In an interview, Interactive Brokers' billionaire founder Thomas Peterffy said the company is working on potentially issuing stablecoins, but has yet to make a final decision on how that will be offered to customers.

🇺🇸 Paze's move beyond big bank owners gets a credit union boost. Paze is getting a boost from Star One Credit Union, which says a subtle difference in the bank-owned Paze, the fact that it does not share credit card numbers with merchants, helped win it over.

🇪🇺 PayDo secures MFSA licence to grow in the EU. Their EMI licence authorizes PayDo to issue electronic money and provide payment services throughout the EU via passporting rights. This means that PayDo complies with key EU standards in anti-money laundering (AML), customer protection, and financial security.

🇱🇺 Stablecoin issuer dtcpay receives green light for EMI licence. The EMI license will authorise dtcpay to deliver a comprehensive suite of regulated payment services across the European Economic Area (EEA), including issuing electronic money, facilitating payment transactions, and enabling cross-border transfers.

🇺🇸 Citizens delivers open finance payment features and direct deposit tools. It helps customers manage payments in one place using their debit card or checking account. With Citizens’ new switch payments capability, customers can update payment methods directly with the likes of Netflix, Amazon, Spotify, Lyft, and Verizon.

🇰🇪 Safaricom Adds New PayPal Withdrawal Feature to M-Pesa App. The withdrawal feature allows users to access their PayPal funds directly. The new integration is expected to benefit Kenya’s growing population of freelancers and remote workers who rely on PayPal for international payments.

🇺🇸 PayPal drives crypto payments into the mainstream, reducing costs and expanding global commerce. Supporting transactions across 100+ cryptocurrencies and wallets such as Coinbase and MetaMask, the solution expands merchant revenue opportunities and taps into a global base of more than 650 million crypto users.

🇺🇸 Wise shareholders overwhelmingly approve plans to ditch UK primary listing. More than 90% of Class A shareholders and 84.6% of Class B shareholders approved the deal, which will see the firm swap its London primary listing for New York.

GOLDEN NUGGET

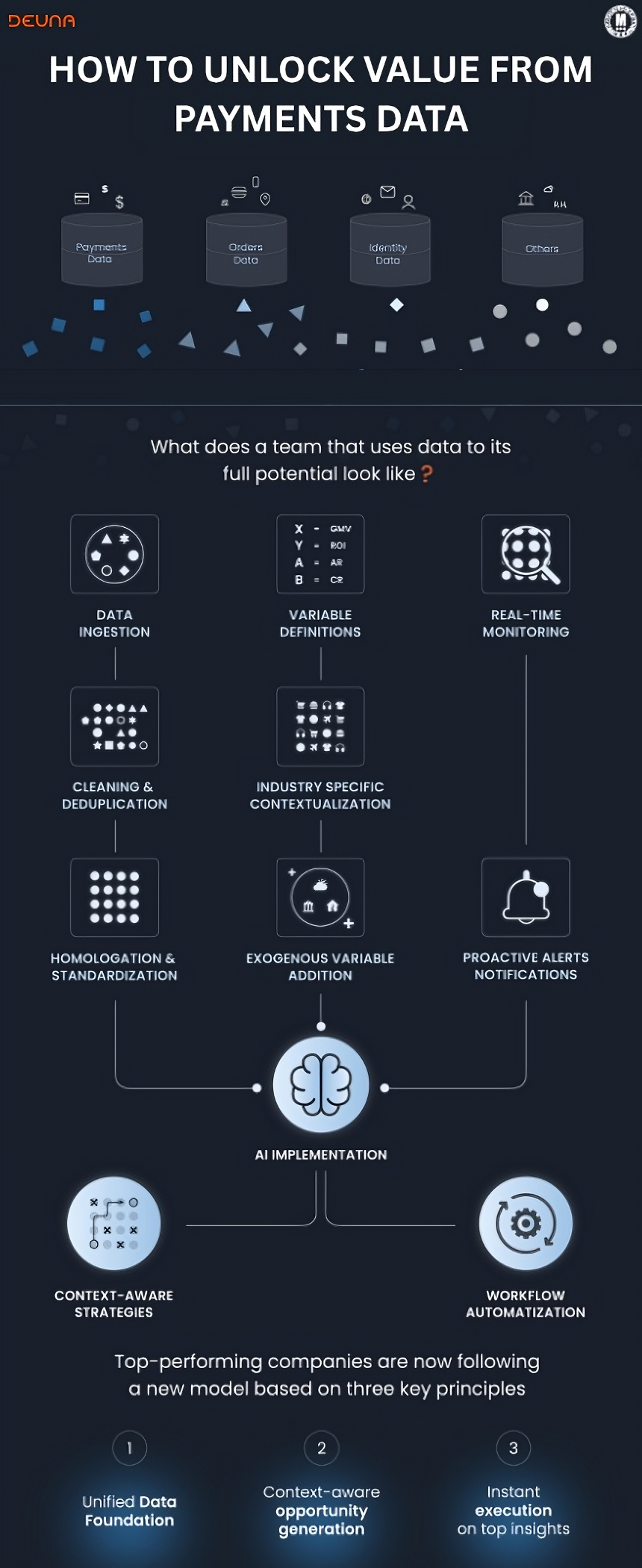

🚨 𝐇𝐨𝐰 𝐭𝐨 𝐔𝐧𝐥𝐨𝐜𝐤 𝐕𝐚𝐥𝐮𝐞 𝐟𝐫𝐨𝐦 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐃𝐚𝐭𝐚 — 𝐛𝐲 DEUNA 👇 Created by Arthur Bedel 💳 ♻️

As commerce evolves into an intelligent, agent-driven ecosystem, payments data is emerging as a critical strategic asset — but one that remains vastly underutilized.

This post outlines the key limitations holding teams back — and how leading merchants are transforming data into a competitive advantage.

𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐃𝐚𝐭𝐚

Today’s commerce stack generates rich and interconnected data from multiple systems:

→ Payments Data: transaction metadata, approval rates, methods, issuer response

→ Orders Data: cart value, SKUs, timestamps, discounts

→ Identity Data: device fingerprinting, customer behavior, fraud signals

→ Other Sources: CRM, logistics, loyalty, geography, and more

𝟑 𝐒𝐲𝐬𝐭𝐞𝐦𝐢𝐜 𝐁𝐥𝐨𝐜𝐤𝐞𝐫𝐬 𝐓𝐨 𝐕𝐚𝐥𝐮𝐞 𝐑𝐞𝐚𝐥𝐢𝐳𝐚𝐭𝐢𝐨𝐧

1️⃣ Fragmented & Inconsistent Data

→ 80% of data teams’ time is spent cleaning instead of analyzing

→ Siloed PSPs, fraud tools, and BI platforms prevent unified decision-making

2️⃣ Context-less AI doesn't deliver

→ 90% of AI projects fail to operationalize

→ Without business context, generic AI outputs remain disconnected from strategic goals

3️⃣ Constant Firefighting, Minimal Strategy

→ Operational teams are stuck responding to incidents instead of driving outcomes

𝐇𝐨𝐰 𝐋𝐞𝐚𝐝𝐢𝐧𝐠 𝐓𝐞𝐚𝐦𝐬 𝐔𝐧𝐥𝐨𝐜𝐤 𝐕𝐚𝐥𝐮𝐞

The process to transform raw payments data into actionable intelligence:

1️⃣ Data Ingestion

→ Consolidating data streams from PSPs, checkout systems, CRMs, fraud tools, and commerce platforms into a central layer

2️⃣ Variable Definition & Structuring

→ Translating raw fields into business metrics (e.g., GMV, approval rate, ARPU)

3️⃣ Real-Time Monitoring & Alerts

→ Establishing live observability for key indicators (e.g., spikes in declines, fraud signals, latency issues)

4️⃣ Cleaning, Deduplication & Standardization

→ Removing duplicates, normalizing formats (e.g., date, currency, identifiers)

5️⃣ Industry-Specific Contextualization

→ Applying domain knowledge (e.g., travel refunds, retail loyalty...) to reclassify and enrich data

6️⃣ Addition of Exogenous Variables

→ Integrating external factors such as FX volatility, holidays, weather, or marketing campaigns to reveal hidden correlations and refine models.

7️⃣ AI Implementation

→ Using ML and intelligent agents to detect anomalies, identify high-impact opportunities, and automate routing, retries... in real time.

𝐂𝐨𝐧𝐜𝐥𝐮𝐬𝐢𝐨𝐧: 𝟑 𝐏𝐫𝐢𝐧𝐜𝐢𝐩𝐥𝐞𝐬 𝐃𝐞𝐟𝐢𝐧𝐢𝐧𝐠 𝐓𝐡𝐞 𝐍𝐞𝐰 𝐒𝐭𝐚𝐧𝐝𝐚𝐫𝐝

1️⃣ Unified Data Foundation

2️⃣ Context-Aware Opportunity Detection

3️⃣ Real-Time Execution on Intelligence

→ Automate retry logic, fraud triggers, routing adjustments, and more

Source: DEUNA

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()