Payoneer Taps Bridge and Goes All-In on Stablecoins to Power 2M Customers

Hey Payments Fanatic!

Payoneer just announced plans to launch embedded stablecoin capabilities across its platform, powered by Bridge (Stripe).

It’s stablecoin workflows built directly into Payoneer’s existing stack. Receive in stablecoin. Hold. Send. Convert to local currency when needed. All inside the same compliance framework that already serves nearly 2 million businesses globally.

That matters...

Because for years, stablecoins promised faster settlement and always-on money movement. But integration was messy. Wallets. Off-ramps. Fragmented flows. Regulatory gray zones.

Payoneer is clearly betting that abstraction wins. Remove blockchain complexity. Keep compliance tight. Make it usable for wholesalers, agencies, and SMB exporters.

As CEO of Payoneer, John Caplan put it, this is about rethinking cross-border money movement for real businesses, not as an experiment, but as a scalable capability.

In Amsterdam, Quantoz Becomes Visa Principal Member 🇳🇱

This one really feels close to home for me.

Whenever a Dutch FinTech makes a structural move like this, it’s more than just another partnership headline.

Amsterdam-based Quantoz Payments B.V. has partnered with Visa to become a direct Visa principal member.

In practice, that means regulated e-money and stablecoin balances can now be spent wherever Visa is accepted: online, in-store, or via Apple Pay and Google Pay.

Visa’s local leadership framed it as enabling innovation while maintaining security and compliance standards. From where I sit, this is another example of digital money meeting existing card rails, not replacing them, but plugging into them.

Scroll down and check out today's latest stories! 👇 As always, I'll be back tomorrow!

Cheers,

INSIGHTS

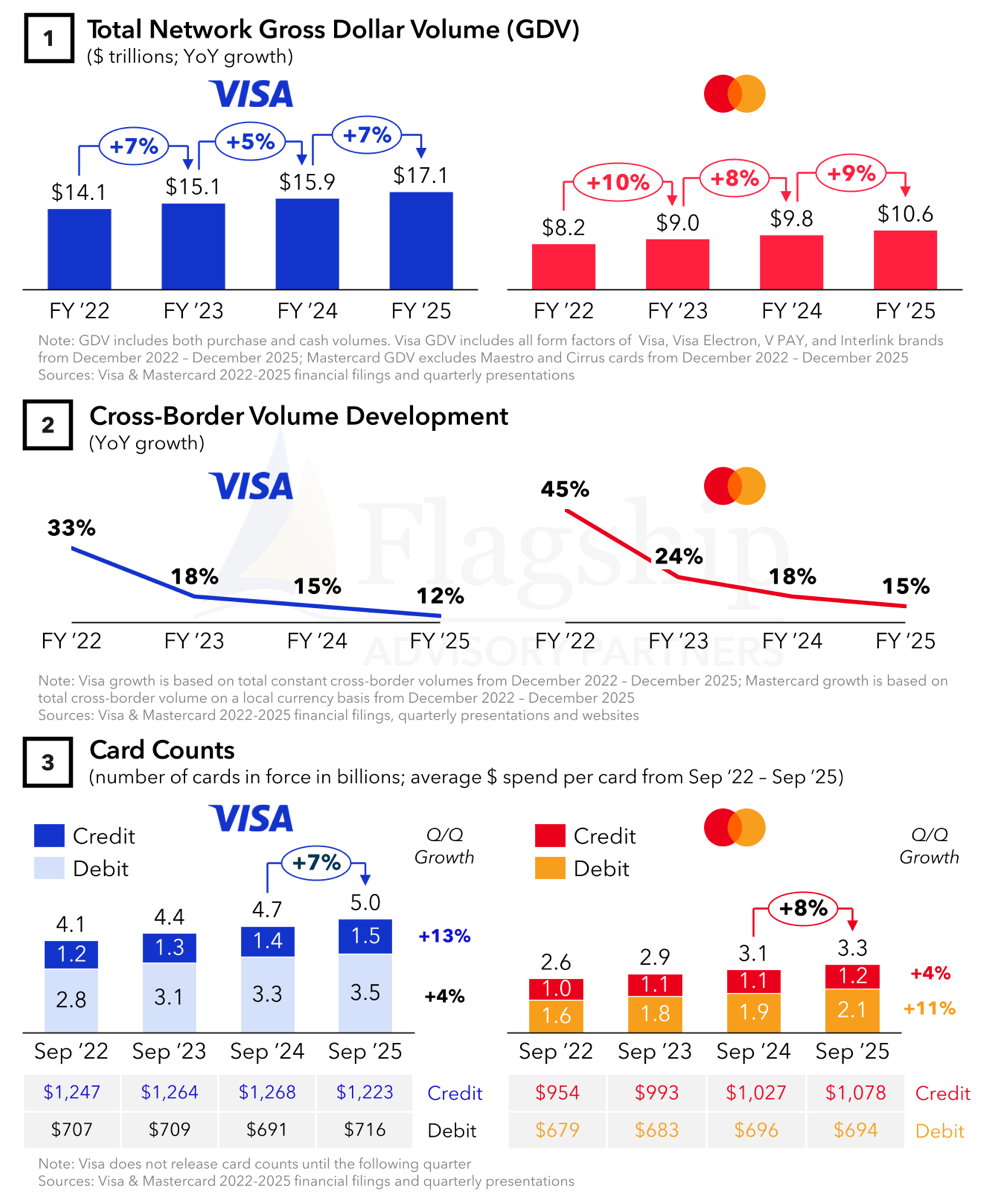

💳 Visa and Mastercard just closed another strong year.

NEWS

🇳🇿 Mastercard has demonstrated its Agent Pay technology in New Zealand, with country manager Megan Simons using an AI agent to purchase movie tickets and book accommodation through natural language commands. Issued via Westpac and secured with PassKey biometric authentication, the system removes the need to manually enter card details.

🇮🇳 Cashfree, Mastercard, and Swiggy bring in-chat payments to AI apps in India, enabling businesses to accept UPI and card payments directly within AI applications. The solution allows users to complete transactions inside conversational interfaces without being redirected to external payment pages.

🇺🇸 Cloudflare and Mastercard partner to extend comprehensive cyber defense across critical infrastructure and small businesses. The partnership intends to develop tools to help small businesses, critical infrastructure, and governments protect themselves from today’s most pressing cyber threats without putting the brakes on innovation.

🇬🇧 ACI Worldwide has announced the first UK deployment of ACI Connetic, a cloud-native SaaS platform designed to unify SWIFT, CHAPS, and faster payments processing. The platform enables institutions to consolidate siloed systems, meet regulatory demands more efficiently, and accelerate innovation in real-time and cross-border payments.

🇬🇧 UK bank bosses plan to set up Visa and Mastercard alternative amid Trump fears. The meeting will take place this Thursday and bring together a group of City funders that will front the costs of a new payments company to keep the UK economy running if problems were to occur.

🇺🇸 Payoneer to launch stablecoin capabilities, powered by Bridge, bringing secure, always-on digital money to global businesses. These new capabilities will enable businesses to securely receive, hold, and send stablecoins as part of their day-to-day global financial operations.

🇲🇹 Paytently partnered with SEON to deploy advanced fraud prevention and anti-money laundering controls across its payment orchestration platform. SEON’s command centre for fraud prevention and AML compliance provides real-time fraud detection, risk scoring, sanctions and PEP screening, device intelligence, velocity checks, and centralised case management.

🇬🇧 Former Adyen CTO Alexander Matthey joins PPRO as Bernie Miles departs. In a statement, PPRO says its new CTO will work to enhance platform scalability, resilience, and developer experience, while accelerating the strategic adoption of AI across the stack.

🌎 Monnet Payments unifies LatAm payments with new virtual accounts. The solution enables regional and global companies to collect locally through a single technological integration. The service is designed to simplify cross-border operations and reduce payment friction for businesses expanding across the region.

🇳🇱 Quantoz partners with Visa to make stablecoins spendable. Through the partnership, Quantoz will support the issuance of virtual Visa cards that can be used wherever Visa is accepted, online, in-store, and via mobile wallets such as Apple Pay and Google Pay.

🇺🇸 Payabli and Huntington Bank join forces to bring seamless payments to the digital banking experience. This integration empowers businesses to accept, issue, and manage transactions entirely within Huntington's digital ecosystem. This will deliver a unified, end-to-end financial experience powered by Payabli's infrastructure.

🇮🇳 Razorpay partners with Replit. By integrating Replit’s AI software creation platform with Razorpay’s payments infrastructure, the partnership allows AI-built products to accept UPI from day one. So what gets built can be adopted, paid for, and scaled instantly across India.

🌍 Medius partners with Adyen to launch corporate expense cards and cashback rewards across Europe. By offering rebates and seamless integration with Expensya, the partnership aims to differentiate in competitive markets and support CFOs in driving compliance and cost efficiency.

🇵🇱 Owners of Polish FinTech Blik discuss potential Warsaw IPO. It’s still unclear whether the listing would be intended to raise capital for Blik’s planned foreign expansion or also be an exit ramp for some of the company’s investors. Blik could fetch a valuation of about $2 billion.

🌎 Airbnb expands its Reserve Now, Pay Later globally. This allows users to cancel their bookings if their plans change without losing money upfront. With this option, users get charged closer to their check-in date rather than at the time of booking.

🌎 Peruvian FinTech Khipu expands to Colombia and Chile. The company aims to address a critical operational challenge for businesses across Latin America. This move signals Khipu's ambition to become a regional leader in the rapidly evolving financial technology sector.

🇺🇸 OLB Group announced a global partner agreement with PayPal. The integration is designed to simplify merchant onboarding, consolidate settlement and reporting, and expand access to buyers in more than 200 markets. Keep reading

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()