PayPal Storefront Ads Enable On-the-Spot Purchases

Hey Payments Fanatic!

"View. Click. Buy." That’s how PayPal is framing Storefront Ads, its latest move to turn everyday browsing into seamless shopping.

Imagine reading an article online and spotting an ad for a pair of shoes. With Storefront Ads, one can check product details, shipping options, and tap “Buy Now,” all without leaving the page. Checkout happens through PayPal or Venmo, and once the transaction is done, you’re returned right where you left off.

This format blends advertising with direct purchase, available across desktop, mobile, and newer digital spaces. “Shopping is no longer something consumers do; it’s something that comes to them,” said Mark Grether, SVP & GM of PayPal Ads.

Behind it is PayPal’s transaction graph, built from the activity of more than 430 million accounts across PayPal, Venmo, and Honey. It tracks real purchases in real time, helping advertisers reach people based on what they actually buy.

"Business Insider's readers expect experiences that are fast, relevant, and intuitive. With PayPal's Storefront Ads, we will be able to deliver commerce that meets them in the moment and engages them through a seamless checkout experience," said Maggie Milnamow, Chief Revenue Officer, Business Insider.

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

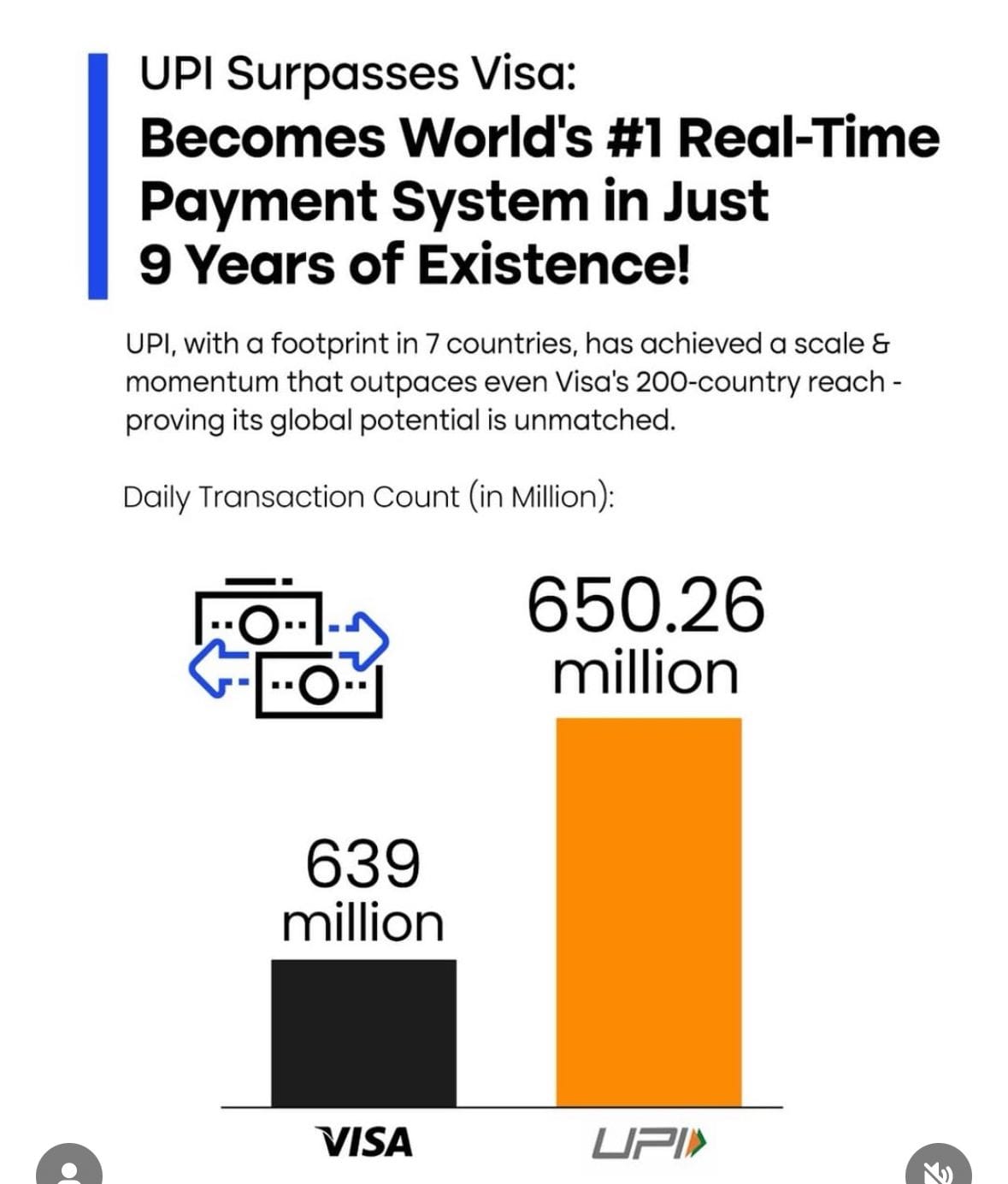

📊 India’s Unified Payments Interface (UPI) has achieved a significant milestone, emerging as a leading digital payment platform within just nine years of its launch. UPI’s monthly transaction growth is currently at 5-7%, with an annual growth of 40%, compared to Visa’s 10% yearly growth.

NEWS

🌎 Mastercard onboards customers up to four times faster with Cloud Edge. Cloud Edge offers customers cost efficiency as well as greater choice, speed, and flexibility. For instance, FinTechs can serve customers easily during demand spikes like national holidays or sales events without needing more physical infrastructure.

🇴🇲 Dhofar Islamic’s Mastercard World credit card: An invitation to experience a world of exceptional privileges. The Dhofar credit card allows customers to enjoy an enhanced spending experience as it unlocks a comprehensive suite of rewards, travel benefits, and lifestyle offerings that can be availed of both locally and internationally.

🇬🇧 LemFi buys Pillar to expand credit services to immigrants. The company plans to offer Credit Cards to customers, starting with the UK, and roll out the full suite of LemFi Credit features publicly. LemFi secures access to Pillar's proprietary credit scoring technology, its FCA credit licence, and Bhatt and Lewis.

🌍 Klarna in collaboration with Norwegian Vipps Mobilepay, which means that Vipps Mobilepay is integrated as a payment method through Klarna both in the app and stores in Norway, Denmark, and Finland. Read more

🇵🇹 Klarna reaches 700,000 consumers and 6,000 partner brands in Portugal in less than four years. The company now works with six thousand retailers in the national market, including internationally renowned brands. Also, Klarna grows 56% in Spain and reaches 1.8 million customers. Its rapid growth in Spain is explained by its commitment to services beyond payment methods.

🇧🇷 Automatic Pix for recurring bills starts working in Brazil. The Central Bank explains that with automatic PIX, payments can be made by giving prior authorization through the account app, without needing to authorize each payment. The new tool promises to simplify the way payments are made for recurring bills.

🇲🇾 Ria Money Transfer sets sights on supporting businesses in Malaysia to manage worker wages. The Ria Wallet enables users to deposit funds, withdraw cash from ATMs, pay bills, and also facilitates domestic and international transfers. Customers can also make payments in millions of locations via QR payment linked to DuitNow.

🇦🇪 Jingle Pay collaborates with Western Union to power and enable the delivery of international money transfers (remittances) from select markets. Jingle Pay will serve as a key partner for Western Union, providing support to the flow of cross-border money transfers currently to bank accounts & mobile wallets.

🇸🇬 Interlace launches white-label card solutions to power personalized enterprise payments. A white-label card allows enterprises to customize their design, such as adding a brand logo or tailoring the card appearance, giving their bank cards a distinct and branded look.

🇺🇸 TreviPay names Matt Dewell as new Chief Information Security Officer. Dewell will work to establish security as a true competitive advantage within the firm's suite of solutions. These offerings include payment processing, credit and risk management, invoicing, automated accounts receivable, and collection management services.

🇬🇧 RiseUp and Salt Edge join forces to bridge financial insights and payments with open banking. By partnering with Salt Edge, RiseUp is doing just that. UK businesses will receive a richer financial experience and a deeper understanding of their customers’ financial behaviours.

🇨🇦 Accept/Pay Global enables real-time payments in Canada with Interac. The platform allows integration with current business systems, supporting audit trails, reporting, and automated reconciliation. Continue reading

🇬🇧 MoneyGram names Lamia Pardo its Chief Marketing Officer. In this role, Pardo will lead global marketing across all channels and markets, with a clear mandate to accelerate sustainable growth by scaling customer acquisition, increasing retention, and strengthening long-term loyalty.

🇧🇷 PPRO adds Pix Automático to payments platform. This newest enhancement to Brazil’s instant payment system, Pix, offers consumers an effortless and cost-effective way to manage recurring payments by enabling seamless cross-regional recurring transactions.

🇱🇺 Digital Payment Wallet Wero arrives in Luxembourg. Luxembourgish consumers will have access to EPI’s services via the Wero standalone app, allowing them to make instant account-to-account payments, both within Luxembourg and across borders with Belgium, France, Germany, and subsequently the Netherlands.

🇪🇺 ConnectPay partners with InSoil for EU expansion. The integration will allow InSoil users to access features such as personal IBAN accounts, multi-currency settlements, and digital wallets. Users will also be able to reinvest funds without topping up accounts manually.

🇹🇿 CRDB Bank migrates card systems to BPC's SmartVista platform. The platform features multi-card issuance capabilities, including corporate and virtual cards, as well as acquiring services for processing transactions across POS networks, cardless withdrawals, and foreign exchange (FX) at ATMs, among others.

🇺🇸 Luxury credit card rivalry heats up as Amex and JPMorgan tease updates to their premier cards. The expectation among industry experts is that both companies will offer ever-longer lists of perks in travel, dining, and experiences like concerts, while potentially raising their annual fees.

GOLDEN NUGGET

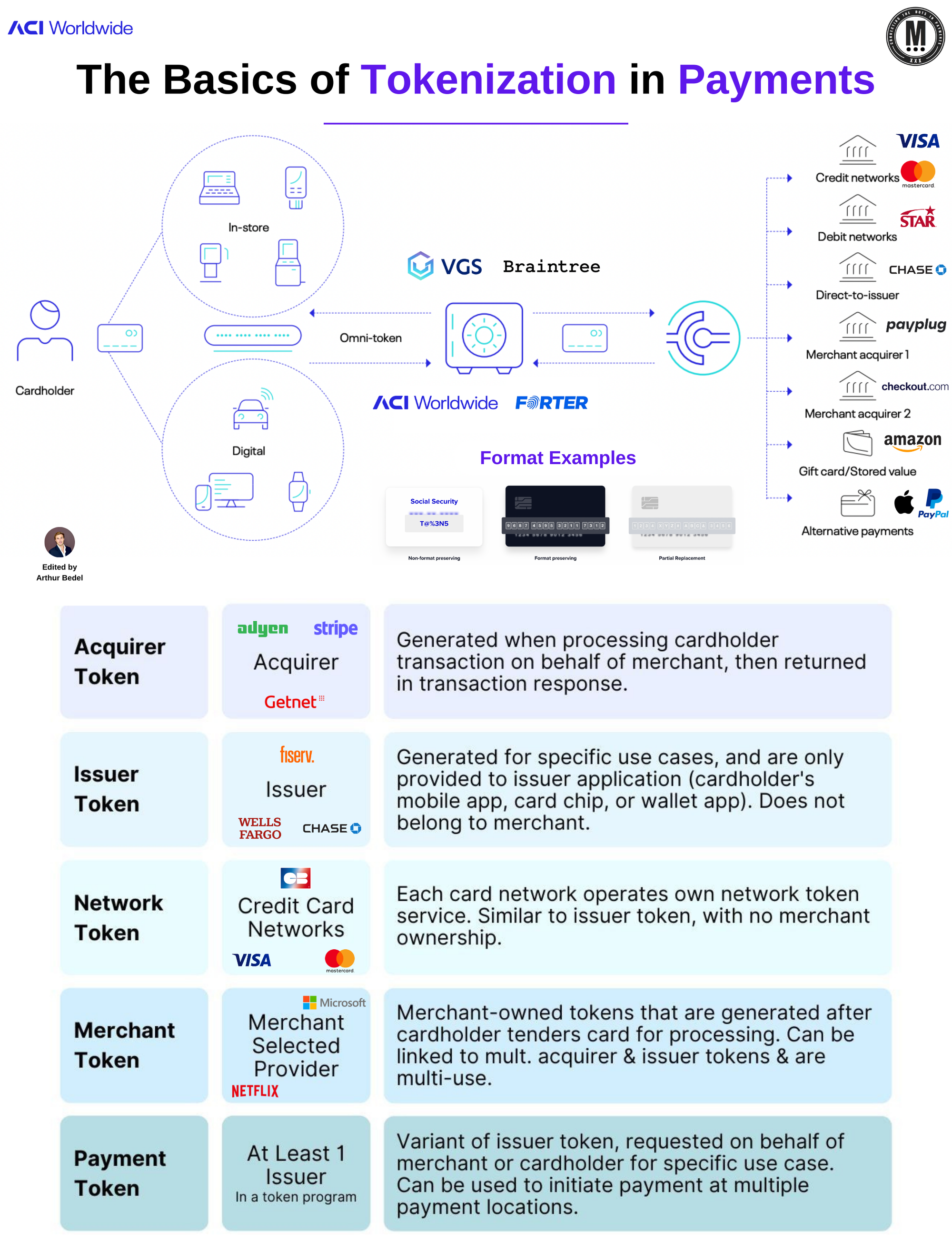

𝐓𝐡𝐞 𝐁𝐚𝐬𝐢𝐜𝐬 𝐨𝐟 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 → 𝐚 𝐜𝐫𝐮𝐜𝐢𝐚𝐥 𝐩𝐫𝐨𝐜𝐞𝐬𝐬 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬👇 Created by Arthur Bedel 💳 ♻️

Tokens are unique, randomly generated strings of characters or symbols used to represent sensitive data, such as Primary Account Numbers (#PANs). Tokens are nonconvertible — they can’t be reverse-engineered to reveal a customer’s original PAN unless provided back to the provisioner or network.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧:

It’s the process of replacing personal information with a token stored in a PCI-compliant token vault owned by the token creator, which can be an entity such as an acquirer, issuer, 3rd party token vault & network or payment processor. To discover the PAN a token represents, a merchant needs to present that token to its creator who uses it to authorize a transaction

𝐓𝐲𝐩𝐞 𝐨𝐟 𝐓𝐨𝐤𝐞𝐧 𝐅𝐨𝐫𝐦𝐚𝐭𝐬:

1️⃣ Non-Format Preserving:

→ The token doesn't look like the original data — a social security number could be represented as "T@%3N5."

2️⃣ Format Preserving:

→ The token retains the format of the original data but scrambles the numbers

3️⃣ Selective Masking:

→ A hybrid approach, some original numbers are left unchanged for verification purposes, such as the last four digits of a credit card

𝗧𝗼𝗸𝗲𝗻𝗶𝘇𝗮𝘁𝗶𝗼𝗻 𝘃𝘀. 𝗘𝗻𝗰𝗿𝘆𝗽𝘁𝗶𝗼𝗻

If sensitive information is encrypted rather than tokenized, the data could potentially be decrypted, bringing it back into the PCI DSS scope and increasing risks. Tokenization prevents that due to its non-convertible feature

𝗧𝘆𝗽𝗲𝘀 𝗼𝗳 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗧𝗼𝗸𝗲𝗻𝘀:

► 𝗔𝗰𝗾𝘂𝗶𝗿𝗲𝗿 𝗧𝗼𝗸𝗲𝗻𝘀: Generated by transaction processors, usually restricted to specific merchants - Payplug, Checkout.com, Stripe

► 𝗜𝘀𝘀𝘂𝗲𝗿 𝗧𝗼𝗸𝗲𝗻𝘀: Created by card issuers - Chase, Fiserv

► 𝗡𝗲𝘁𝘄𝗼𝗿𝗸 𝗧𝗼𝗸𝗲𝗻𝘀: Produced by credit card networks themselves, not bound to specific issuers - Visa, Mastercard, American Express, GIE Cartes Bancaires

► 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗧𝗼𝗸𝗲𝗻𝘀: A category generated on behalf of issuers & merchants, usable across multiple locations - CellPoint Digital, DEUNA

► 𝗠𝗲𝗿𝗰𝗵𝗮𝗻𝘁 𝗧𝗼𝗸𝗲𝗻𝘀: Tailored for individual merchants, these can be integrated into a merchant's specific customer journey & can link to multiple other types of tokens - Netflix, Microsoft

3𝐫𝐝-𝐩𝐚𝐫𝐭𝐲 𝐩𝐫𝐨𝐯𝐢𝐝𝐞𝐫𝐬 — VGS, Forter, Braintree — generate agnostic tokens interoperad across channels & providers

𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬 𝐨𝐟 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧:

🔸 Ensure PCI DSS compliance

🔸 Control costs

🔸 Increase payments efficiency

🔸 Reduce the risk of data breaches

🔸 Improve the customer experience

Tokenization is one of the most crucial processes in payments, from acceptance, to security, compliance, cost, ux and more 🚀

Source: ACI Worldwide & Terry Rourke

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()