PayPal World Launch Targets 2 Billion by 2026

Hey Payments Fanatic!

PayPal has just unveiled PayPal World, a unified platform designed to connect the world’s most widely used digital wallets and payment systems.

The first step rolls out this fall: PayPal and Venmo, interoperable for the first time. Joining them are Mercado Pago, UPI, and Tenpay Global, forming a network that could reach nearly 2 billion users. 🤯

For consumers, it means sending funds across borders with ease. For merchants, it’s access to global payment methods without extra integrations. As CEO Alex Chriss put it, “PayPal World is a first-of-its-kind payments ecosystem that will bring together many of the world’s largest payment systems and digital wallets on a single platform.”

Will Pix and Wero join this network in the future? Scroll down to find more on PayPal news.

As always, the latest and hottest payment updates awaited 👇

Cheers,

P.S. Follow me on Threads for daily scoops!

INSIGHTS

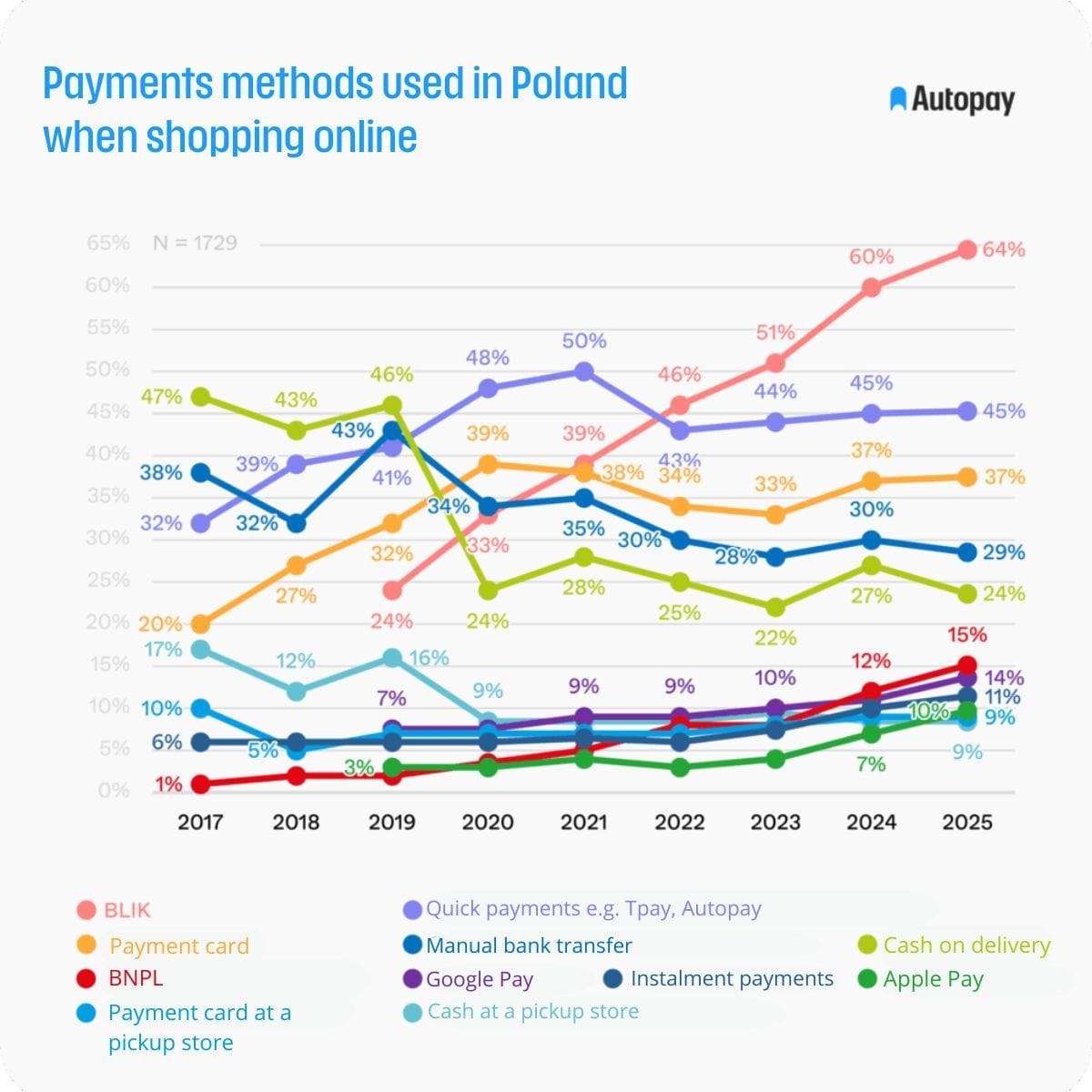

🇵🇱 How do consumers pay in Poland when shopping online?

NEWS

🇺🇸 How Capchase powers KYB globally with Taktile. With Capchase, companies can extend payment terms to their customers without waiting to get the full upfront payment themselves. By bridging the gap between buyer flexibility and a vendor maximizing their working capital, Capchase facilitates faster sales, more revenue, and a smoother customer experience.

🌍 Why real-time AML compliance is now essential for instant payments. According to the 2024 Prime Time for Real-Time report by ACI Worldwide, over 266 billion real-time transactions were processed globally in 2023. That’s a 63% increase from the previous year.

🇺🇸 Introducing PayPal World: a global platform connecting payment systems and digital wallets, starting with interoperability to PayPal and Venmo. Consumers will enjoy benefits including access to shop at millions more businesses, online, in-store, and with AI agents, pay international businesses using their domestic payment system or wallet of choice, and local currency.

🇯🇴 Mastercard partners with Jordan Islamic Bank to expand access to Shari’ah-compliant payments. Through the collaboration, the entities will aim to support the development of new digital channels and customer engagement platforms, enabling the bank to deliver more personalised, accessible, and secure banking experiences.

🇺🇸 Wise faces fresh scrutiny from proxy adviser over move to US. While Glass Lewis continues to support the company’s overall proposal, it is concerned that the vote on July 28 to approve the plan also requires shareholders to approve extending the dual-class shareholder structure, according to the advisory firm.

🌎 Thredd and Inswitch join forces to streamline FinTech market entry in LatAm. By integrating Thredd’s platform with in-country regulatory and operational infrastructure, the two companies will provide FinTech innovators with a scalable, frictionless path to market, accelerating time to launch and enabling local currency and USD card issuance.

🇬🇧 Payments firm Corpay to buy UK's Alpha Group in $2.2 billion private markets. Its corporate foreign-exchange business will also strengthen Corpay's cross-border business in the UK and Europe and open up new markets in Germany, Malta, and the Netherlands, executives said.

🇺🇸 Aurora Payments appoints Ryan Cross as Chief Financial Officer. He will be responsible for leading the company’s finance organization and driving financial excellence, operational efficiency, and growth. Keep reading

🇺🇸 MoneyGram appoints Colin Walsh, Chris Trendler, and Katherine Carroll to its Board of Directors. Walsh brings a wealth of experience as a founder, entrepreneur, and global business leader. Trendler will provide deep expertise in organizational effectiveness and talent strategy. Carroll will provide significant regulatory insight and compliance leadership to the company’s industry.

🇦🇺 PayPal Australia appoints former ANZ executive Jenny Fagg to its board. Fagg joins PayPal Australia at a critical moment when its 20-year reign as the country’s most popular online payment method is threatened by a swarm of rivals led by Stripe and Apple Pay.

🇳🇱 Mondu enhances its B2B payments suite with new ‘Pay Now’ product. Pay Now allows buyers to pay directly from their bank accounts, providing a secure and streamlined checkout experience. It enables merchants to serve all buyers, whether they are eligible for deferred payments or not.

🇵🇹 Ifthenpay had revenue of 3.9 million euros in the first half of the year. The Portuguese FinTech's payment volume reached €834 million, and its client portfolio now includes around 30,000 companies. In this context, business volume increased 17% year-on-year.

🇺🇸 SquareWorks Consulting launches international payments, simplifying end-to-end payments for global accounts payable teams. Benefits include real-time exchange rates and payment tracking, SWIFT wire payments to 200+ countries, and built-in compliance with country-specific vendor onboarding fields.

🇬🇧 LHV Bank joins RT1 to boost instant euro payments. This milestone marks a significant advance in the Bank’s commitment to driving digital transformation and delivering faster, more efficient cross-border payment solutions. By integrating directly with the RT1 SCT Inst scheme, LHV Bank removes the traditional limitations associated with indirect access.

🇺🇸 Block’s Square opens bitcoin payments to 4 million merchants, using the digital currency’s Lightning Network for faster, low-cost settlements. By integrating Lightning, Square aims to reduce transaction fees and processing times compared with traditional card networks.

🇵🇹 SIBS announces that Madalena Cascais Tomé will leave in September. Her departure will take place during September, and after that date, the executive functions on the SIBS Board of Directors will be performed by the Chairman of the Board of Directors, Vítor Fernandes, as revealed by the payment methods company.

🇺🇸 Fiserv stock tumbles as outlook softens despite deal with TD. The company reported quarterly revenue growth of 8% year-over-year to $5.52 billion, beating the analyst consensus estimate of $5.20 billion. Growth was 10% in the Merchant Solutions segment and 7% in the Financial Solutions segment.

🇬🇧 CloudPay and Workday join forces for global payroll unity. This integration aims to improve transparency, consolidate payroll data, and streamline cross-border payroll operations, enabling global payroll teams to operate more cohesively and effectively.

GOLDEN NUGGET

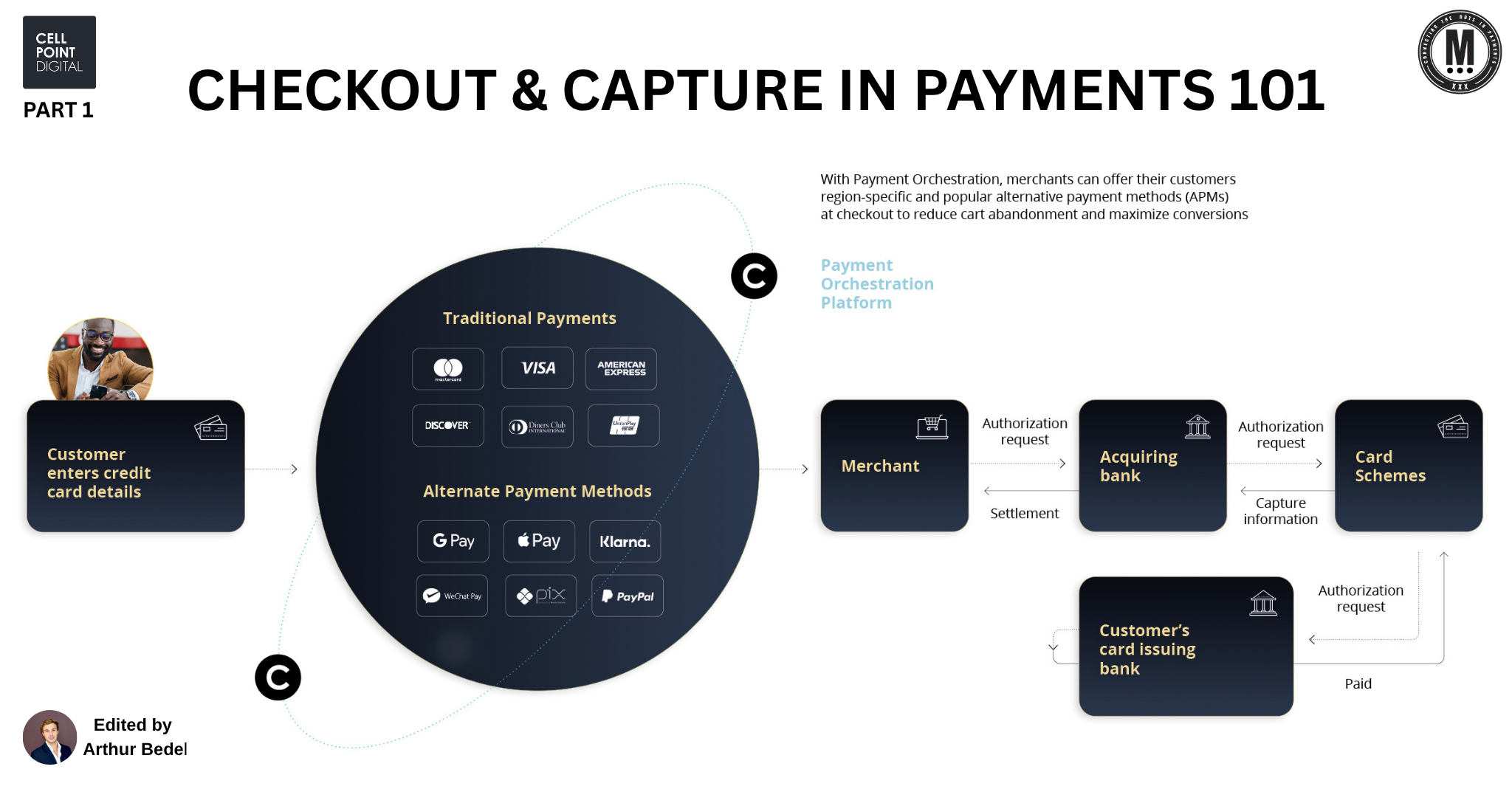

𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭 & 𝐂𝐚𝐩𝐭𝐮𝐫𝐞 — 𝐓𝐡𝐞 𝐅𝐨𝐮𝐧𝐝𝐚𝐭𝐢𝐨𝐧 𝐨𝐟 𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐭 𝐓𝐫𝐚𝐯𝐞𝐥 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 by CellPoint Digital 👇 Created by Arthur Bedel 💳 ♻️

For airlines, OTAs, and travel brands, payments are no longer a back-office task — they’re a key enabler of seamless digital experiences. And it all begins with two core functions: checkout and capture.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭?

Checkout is the customer-facing layer where the traveler selects a payment method and enters their credentials — card, wallet, or alternative method.

To support global travelers, modern payment stacks must go beyond cards. Through payment orchestration, merchants can offer a wide mix of alternative payment methods (APMs):

▪️ PIX in Brazil

▪️ WeChat Pay in China

▪️ Klarna in Europe

▪️ Apple Pay, PayPal, globally

Providing the right payment options at checkout improves acceptance, reduces drop-off, and boosts overall conversion

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐂𝐚𝐩𝐭𝐮𝐫𝐞?

Capture refers to the authorization and settlement flow that occurs after a customer initiates a payment. It ensures that approved transactions are securely completed — and merchants get paid.

Here’s a simplified breakdown of the process:

1️⃣ The customer enters payment details

2️⃣ The merchant sends an authorization request

3️⃣ The acquiring bank forwards the request to the card network (e.g., Visa, Mastercard)

4️⃣ The issuing bank approves or declines the request

5️⃣ Upon approval, the capture phase finalizes the transaction by settling funds to the merchant

A successful capture depends on speed, resilience, compliance, and orchestration across all these touchpoints. Failures at any step — whether due to fraud filters, routing errors, or regional mismatches — can lead to lost revenue or negative customer experiences.

𝐑𝐞𝐚𝐥-𝐖𝐨𝐫𝐥𝐝 𝐄𝐱𝐚𝐦𝐩𝐥𝐞𝐬 𝐢𝐧 𝐓𝐫𝐚𝐯𝐞𝐥

✔️ United Airlines integrates local payment methods like PIX, Elo, and domestic card schemes into its checkout experience — enabling real-time payments that align with Brazilian consumer behavior. The result: higher mobile conversion rates and broader reach across underserved segments.

✔️ Booking.com implements instant payment capture to confirm reservations in seconds. This not only improves the user experience but also helps the platform reduce fraud exposure, since the payment is finalized before the booking is fulfilled.

✔️ Emirates uses a multi-acquirer strategy powered by orchestration to intelligently route transactions through the most performant PSPs in each market. By avoiding single points of failure and optimizing for cost and success rates, they achieve stronger global acceptance.

These brands aren’t just processing payments — they’re architecting intelligent payment flows that adapt to local behaviors, minimize friction, and maximize revenue.

Source: CellPoint Digital

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()