Qonto Expands Its Payment Offering with Adyen and Mollie

Hey Payments Fanatic!

Qonto is stepping further into the payment space, following moves by peers like Revolut, Stancer, and SumUp. The FinTech company has announced its first-ever physical Point of Sale (POS) terminals, alongside Tap to Pay functionality and Payment Links, marking a significant expansion of its offering for its customers.

“For entrepreneurs and small businesses, getting paid shouldn’t be complicated,” says Albertine Lecointe, VP Product at Qonto. “For the first time, we’re launching a physical device, marking our entry into in-person payments in a whole new way. This strategic move demonstrates our commitment to meeting our customers where they do business, whether that’s online, in-store, or on the move.”

The new features are powered by two Amsterdam-based providers: Adyen, responsible for the POS terminals and Tap to Pay; and Mollie, enabling Payment Links. These partnerships bring more flexibility to Qonto’s 500,000+ customers, giving them tools to collect payments both online and in person.

This story reflects a growing trend among fintech companies to close the loop between financial management and payment acceptance, giving entrepreneurs and small businesses more ways to serve their customers and streamline how revenue flows.

Read more global payment industry updates below👇 and I'll be back with more tomorrow!

Cheers,

SPONSORED CONTENT

The true cost of paying a $50K contractor.

Why hiring a contractor for $50,000 could actually cost you much more. Learn how hidden currency fees, payment methods, and taxes quietly eat away at your budget, adding an additional $100,000 if you pay 50 contractors.

How confusing tax rules and employee classification mistakes can turn a simple contract into a legal mess, including penalties or being forced to treat the contractor like a full-time employee.

A country-by-country breakdown showing how much money contractors actually take home.

Which countries are the best (and worst) places to hire contractors, based on what they really earn, how complicated the laws are, and what it costs you overall.

PAYMENTS NEWS

🇬🇧 Triple shortlisting for Ecommpay at PayTech Awards 2025. The company has earned recognition in the categories of Best Consumer Payments System, Best Solution for Combatting Fraud in Payments, and Woman in PayTech – Marketing Leader. The 2025 winners will be announced during an exclusive ceremony that last year attracted over 200 industry leaders and decision-makers.

🇺🇸 Papaya Global launches the first enterprise platform for managing and paying global contingent workers. The new platform connects the dots between vendor management systems, payroll compliance, invoice verification, and instant global payments, enabling true end-to-end orchestration for contingent workforce programs at scale.

🇺🇸 ACI Worldwide recognized as a leading provider of fraud orchestration solutions by Datos Insights. The report spotlights ACI’s Payments Intelligence Framework for its unique visibility across the payments ecosystem, proven scalability with major global financial institutions (FI), real-time processing capabilities, advanced model management, and highly flexible deployment options.

🇺🇸 Brex partners with former competitor Zip, with an eye on reducing cash burn to get to an IPO. The new offering embeds Brex’s virtual cards directly into Zip’s platform to give enterprises “the ability to streamline procurement and payment workflows, prevent unauthorized spend before it happens, and simplify global operations with a single card program.”

🇬🇧 Payabl. taps ClearBank for embedded finance services. Through this collaboration, payabl. now provides businesses with seamless access to all major UK payment schemes, enabling real-time transactions in GBP. The integration also strengthens fraud prevention with Confirmation of Payee (CoP).

🇺🇸 Circle denies report it’s considering a potential sale. A media report stated that it was in informal talks about a potential sale to Coinbase Global or Ripple while still pursuing the initial public offering. The Circle spokesperson said, “Circle is not for sale. Our long-term goals remain the same.”

🇺🇸 Stablecoin fight heads to showdown as Senate democrats splinter. The Senate is poised to advance industry-backed stablecoin legislation in a key vote, with a group of crypto-friendly Democrats seeking to end their party’s blockade of one of President Donald Trump’s top priorities.

🇮🇹 Finom integrates F24s to simplify tax payments for Italian entrepreneurs. Their BaaS allows F24 forms to be filled out and sent within Finom's platform, eliminating the need to juggle multiple systems for taxes and contributions. The feature enables various payments, including income taxes, VAT, social security contributions, and local taxes.

🇬🇧 SumUp hires former Mangopay CGO Pierre Lion as Global Director of Enterprise Sales to expand its enterprise offering. He will be responsible for the growth of the FinTech’s enterprise solutions. Pierre joined SumUp in March 2025 and will be based out of its London headquarters.

🇬🇧 UK-based Ontik raises €3.2M to help wholesalers replace spreadsheets with automated payment tools. The company looks to replace these manual processes with digital tools, beginning with industries where extended payment terms are standard.

🇧🇬 Bulgaria's CC Bank and MeaWallet partner to launch Click to Pay. CC Bank customers will be able to add their cards to Click to Pay directly from their banking app upon completion of the integration. Keep reading

🇬🇧 UK’s Moneycorp selects Temenos SaaS to scale global business. The UK headquartered payments and FX specialist will adopt Temenos SaaS for core banking and payments to achieve speed to market and scale efficiently as it expands products and services around the world.

🇮🇳 ZikZuk receives in-principle approval from the RBI for issuance of prepaid payment instruments (PPIs). With this strategic approval, ZikZuk is set to enter India's dynamic digital payments space with powerful prepaid wallet and card-based payment offerings.

🌍 Visa enables Click to Pay on UEFA ticketing platforms. Fans will be able to purchase UEFA Women’s Football tickets using Visa Click to Pay, which offers a seamless and secure online ticket purchasing experience for fans eager to support their teams.

🇬🇧 Mastercard is paying out millions in compensation to customers after a landmark legal battle. Customers will be entitled to a compensation payout worth up to £70 each. The move comes after a long-running case that was put forward almost a decade ago.

🇸🇨 KuCoin Pay integrates with AEON to revolutionize Web3 mobile payments in retail. Through this integration, KuCoin Pay users can seamlessly pay for goods and services across a wider range of real-life scenarios using leading cryptocurrencies such as USDT, USDC, ETH, TON, and BNB.

GOLDEN NUGGET

Welcome to 𝐓𝐡𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐀𝐜𝐚𝐝𝐞𝐦𝐲 by Checkout.com — Episode 14 👋 Created by Arthur Bedel

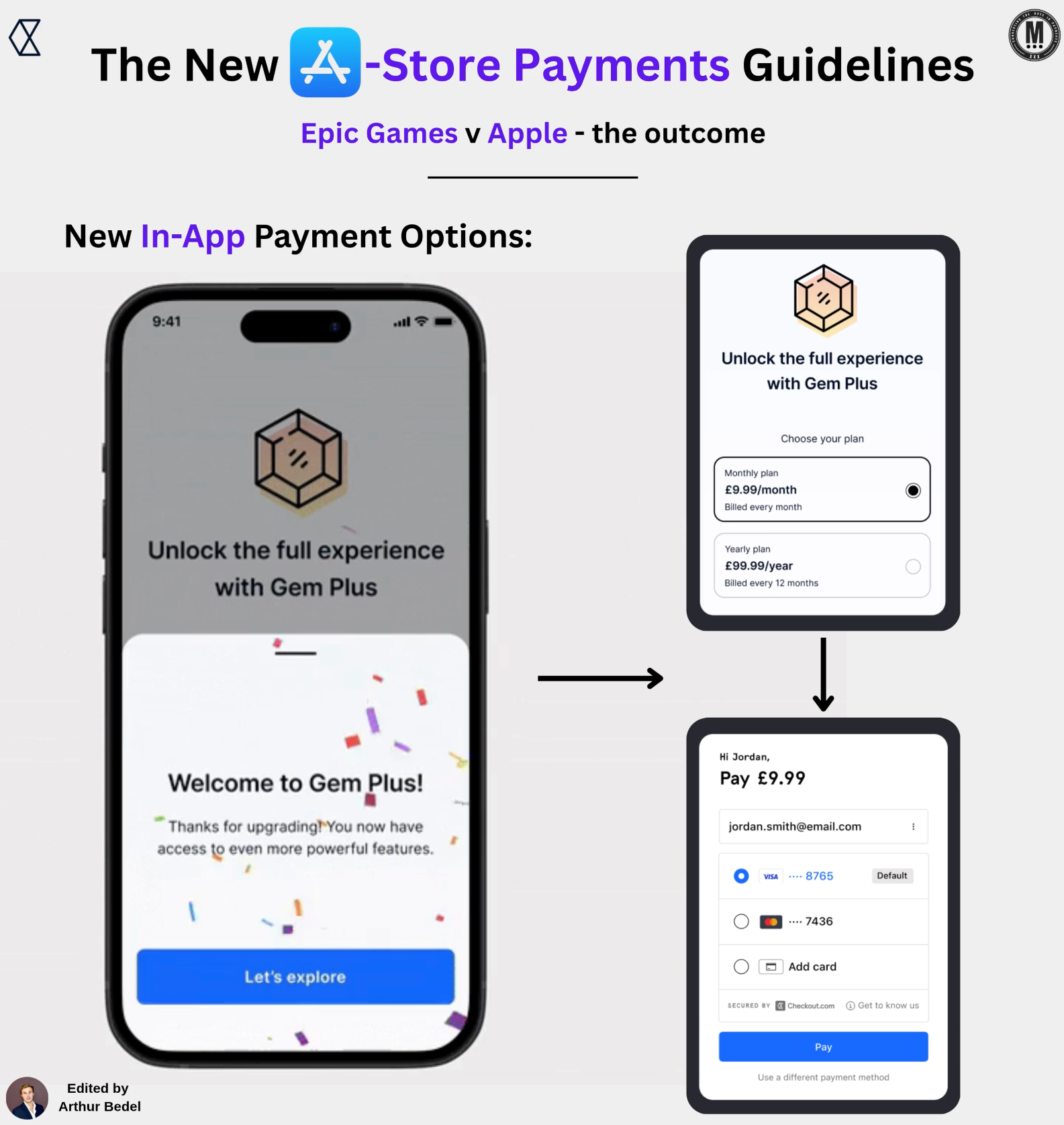

The 𝐍𝐞𝐰 Apple 𝐒𝐭𝐨𝐫𝐞 Payment Guidelines → Epic Games v. Apple Case

In 2020, Epic Games challenged Apple's App Store policies by introducing an alternative payment system within Fortnite, aiming to bypass Apple's 30% commission on in-app purchases. This led to Apple removing Fortnite from the App Store, prompting Epic to file an antitrust lawsuit.

In 2021, a U.S. District Court ruled that Apple must allow developers to direct users to alternative payment methods outside the App Store. However, Apple introduced a 27% commission on these external transactions, which the court later deemed as non-compliant with the injunction.

In April 2025, Judge Yvonne Gonzalez Rogers found Apple in civil contempt for violating the court's order and prohibited the company from collecting commissions on external purchases.

𝐍𝐞𝐰 𝐈𝐧-𝐀𝐩𝐩 𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭 𝐄𝐱𝐩𝐞𝐫𝐢𝐞𝐧𝐜𝐞, developers can now:

→ Include a single external link or button within their app that directs users to a website for purchasing digital goods or services.

→ Offer alternative payment options outside the App Store's in-app purchase system.

→ Avoid Apple's commission on transactions completed through these external links.

These changes apply specifically to apps available in the 𝐔.𝐒. 𝐀𝐩𝐩 𝐒𝐭𝐨𝐫𝐞.

𝐓𝐡𝐞 𝐍𝐞𝐰 𝐅𝐥𝐨𝐰 𝐨𝐟 𝐅𝐮𝐧𝐝𝐬

► User initiates a purchase within the app and is directed to the developer's external website.

► Transaction is processed through the developer's chosen payment processor (e.g., Checkout.com, PayPal).

► Funds are received directly by the developer, bypassing Apple's in-app payment system.

► Apple does not collect any commission.

𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬 𝐟𝐨𝐫 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭𝐬

► 𝐈𝐧𝐜𝐫𝐞𝐚𝐬𝐞𝐝 𝐑𝐞𝐯𝐞𝐧𝐮𝐞 𝐑𝐞𝐭𝐞𝐧𝐭𝐢𝐨𝐧 → Developers retain the full amount from external transactions.

► 𝐆𝐫𝐞𝐚𝐭𝐞𝐫 𝐏𝐫𝐢𝐜𝐢𝐧𝐠 𝐅𝐥𝐞𝐱𝐢𝐛𝐢𝐥𝐢𝐭𝐲 → Ability to offer discounts or pricing structures not constrained by Apple's policies.

► 𝐄𝐧𝐡𝐚𝐧𝐜𝐞𝐝 𝐂𝐮𝐬𝐭𝐨𝐦𝐞𝐫 𝐑𝐞𝐥𝐚𝐭𝐢𝐨𝐧𝐬𝐡𝐢𝐩𝐬 → Direct interactions with customers allow for personalized experiences and marketing opportunities.

𝐊𝐞𝐲 𝐓𝐚𝐤𝐞𝐚𝐰𝐚𝐲𝐬:

► 𝐋𝐞𝐠𝐚𝐥 𝐈𝐦𝐩𝐚𝐜𝐭 → The Epic Games v. Apple case has led to significant changes in App Store policies, granting developers more control over their payment systems.

► 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬 → Developers can now retain the full revenue from external transactions.

► Google 𝐏𝐥𝐚𝐲 𝐒𝐭𝐨𝐫𝐞 → Attention is turning to Google. The company has faced similar scrutiny over its Play Store policies and may implement comparable changes to accommodate alternative payment methods.

Source: Checkout.com

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()