Razorpay Reportedly Plans $500M IPO… and Public Markets Are Back in Play

Hey Payments Fanatic!

Razorpay is reportedly gearing up for an IPO, with plans to raise up to $500M in fresh capital.

The company has already invited merchant bankers to pitch for the mandate, with Kotak Mahindra and Axis Capital emerging as early frontrunners. That’s usually when things start getting real.

Razorpay was last valued at $7.5B during the 2021 funding boom, backed by names like GIC, Peak XV, Z47, and Tiger Global. Now the focus is shifting toward public markets.

There’s also talk of a pre-IPO round, largely secondary, to clean up the cap table ahead of a listing. A familiar playbook.

And the UK Just Took a Big Step on Crypto Payments...

Ripple has secured both an EMI license and Cryptoasset Registration from the Financial Conduct Authority.

This isn’t a pilot. It has full regulatory clearance to scale enterprise-grade crypto payments in the UK.

UK institutions can now run compliant cross-border payments using digital assets, without touching blockchain complexity. Faster settlement.

Cassie Craddock, Managing Director UK and Europe at Ripple, says the FCA’s standards mirror Ripple’s own approach to compliance. That alignment matters.

If you want to see what else is moving across Payments today, scroll down and catch the updates 👇 Tomorrow I’ll be back with more firsthand stories shaping the Payments industry.

Cheers,

Marcel

INSIGHTS

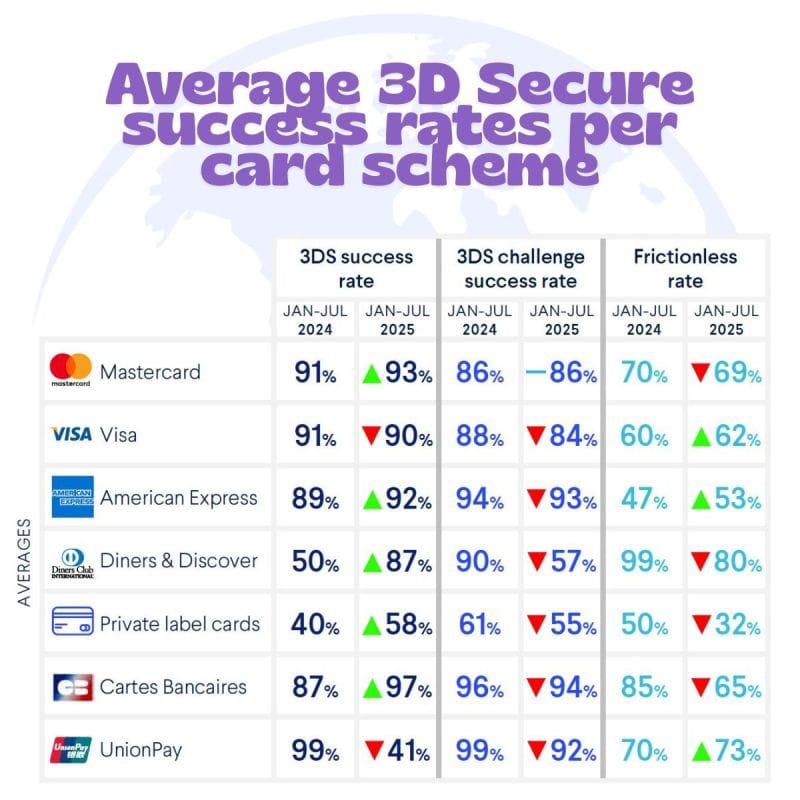

📈 Average 𝟯𝗗 𝗦𝗲𝗰𝘂𝗿𝗲 success rates per card scheme 👇

NEWS

🇮🇳 Razorpay reportedly plans $500m IPO. The company has invited merchant bankers to pitch for the IPO mandate, with Kotak Mahindra and Axis Capital among the leading contenders for the underwriter role. Read more

🇬🇧 Ripple receives FCA permissions to scale Ripple Payments in the UK. Through its fully licensed solution, Ripple handles the underlying blockchain and operational complexity so businesses can launch digital payment services quickly, without taking on the cost or burden of infrastructure management.

🇺🇸 AWS and Ripple exploring Amazon Bedrock AI for the XRP Ledger. The initiative aims to cut XRPL incident investigation times from days to minutes by automating log and code analysis. Keep reading

🇺🇸 Rain raises $250m Series C to scale stablecoin-powered payments infrastructure for global enterprises. The new funding enables Rain to scale its global, compliant footprint, deepen platform capabilities, and invest in new products that redefine how payments work worldwide.

🇫🇷 Worldline shareholders back 500 million euro capital raise plan. The capital raise will begin with a 110 million euro share sale to Bpifrance, Credit Agricole, and BNP Paribas, followed by a 390 million euro rights issue open to all shareholders. Continue reading

🇫🇷 Worldline CEO open to further disposals after payment scandal. Chief executive Pierre-Antoine Vacheron noted that activities outside Europe, including in Australia and Asia, remain under review, following recent divestments such as PaymentIQ.

🇺🇸 PayPal Powers Microsoft’s launch of copilot checkout, enabling shoppers to discover, decide, and pay, without ever leaving the Copilot experience. PayPal will power surfacing merchant inventory, branded checkout, guest checkout, and credit card payments, starting with Copilot.com.

🇺🇸 Plaid has appointed Jelena McWilliams as President of Corporate and External Affairs. The company said her background in regulation, consumer protection, and innovation will support Plaid’s role in advancing open banking, data rights, and innovation amid rapid technological and regulatory change.

🇨🇴 Clinng Payments signed an alliance with Kamin to enable interoperable payments. The alliance will allow companies and FinTechs throughout the region to operate payments and collections in the country in a modern way, integrating technology, security, and even regulatory compliance into a solution.

🇺🇸 Fiserv launches Unknown Shopper at NRF, helping merchants better understand in-store customers. Unknown Shopper from Fiserv is a new analytics capability designed to help merchants and their marketing partners better understand in-store customer behavior and build actionable customer segments from card-present transactions.

🇧🇷 New payments startup PagAmerican bets on AI to compete in the market. PagAmerican has entered the market with an AI-driven, vertically integrated platform for global sales of physical products. The company generated $233,000 in its first month and aims to scale rapidly by enabling Brazilian merchants to sell internationally without opening foreign entities.

🇨🇳 PhotonPay raises tens of millions in Series B to pioneer stablecoin-centric financial infrastructure. The funds will enable PhotonPay to accelerate the expansion of its next-generation stablecoin financial rails, hire key talent, and broaden its global regulatory footprint.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()