Ripple Expands UAE Footprint with Zand Bank and Mamo Partnerships

Hey Payments Fanatic!

Ripple, the blockchain powerhouse for financial institutions, has just inked deals with Zand Bank and Mamo in the UAE to power faster, more transparent cross-border payments via Ripple Payments.

Backed by its newly secured DFSA license, the first of its kind for a blockchain-enabled payment provider in Dubai, Ripple can now deliver 24/7/365 global payment flows with near-instant settlement, slashing costs and delays for banks and fintechs alike.

“Our new partnerships with Zand Bank and Mamo are a testament to the momentum that the license has created for our business,” said Reece Merrick, Ripple’s MD for Middle East and Africa.

The partnerships reflect rising demand across the Middle East. According to Ripple’s 2025 report, 64% of MEA finance leaders see speed and settlement efficiency as the top reasons for adopting blockchain-based payments.

Zand Bank is also preparing to launch an AED-backed stablecoin, while Mamo aims to support the UAE’s rapidly growing business ecosystem.

“Our partnership with Ripple is a big step forward,” said Imad Gharazeddine, CEO of Mamo.

With $ 70 B+ in processed volume and coverage in 90+ payout markets, Ripple continues to build the rails for a global digital asset economy, now with the UAE in the driver’s seat.

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

🇺🇸 Circle pursues IPO, but talks with Coinbase and Ripple could mean a sale. There is a chance, though, that Circle’s IPO won’t come to fruition since the company has recently taken part in informal talks to sell itself to Coinbase Global or crypto payments company Ripple.

PAYMENTS NEWS

🇺🇸 Klarna’s losses widen after more consumers fail to repay loans. The company, which makes money by charging fees to merchants and consumers who fail to repay on time, said its customer credit losses had risen to $136mn, a 17% year-on-year increase.

🇬🇧 UK to regulate ‘buy now, pay later’ lenders in legal overhaul. Under the rules, lenders such as Klarna and Clearpay will be required to check shoppers’ affordability before offering loans, while borrowers will be able to make complaints to the Financial Ombudsman.

🇮🇳 PhonePe’s 5% dilemma: Payments still dominate revenue as it gets IPO-ready. The company’s revenue still relies heavily on its payments business, while financial services contribute only a small portion. The insurance arm is growing, and the credit segment remains in its early stages.

🌍 Nuvei joins the European Payments Initiative to launch Wero for e-commerce. Nuvei's merchant clients will gain early access to this swiftly expanding European payment solution through their existing single integration with Nuvei's core payments platform.

🇮🇳 Paytm adds 'Hide Payment' feature to help users keep transactions private. While the 'Hide Payment' feature doesn’t allow deletion of any transaction, it enables users to temporarily remove specific payments from plain view within the Paytm app. Read more

🇺🇸 No card filling required as Etsy brings instant bank payments to US buyers in partnership with Stripe. Brian Gallagher, Staff Product Manager at Etsy, explained that the new feature allows shoppers to securely connect their bank account during checkout, offering a streamlined purchasing experience without the need to manually enter card details.

GOLDEN NUGGET

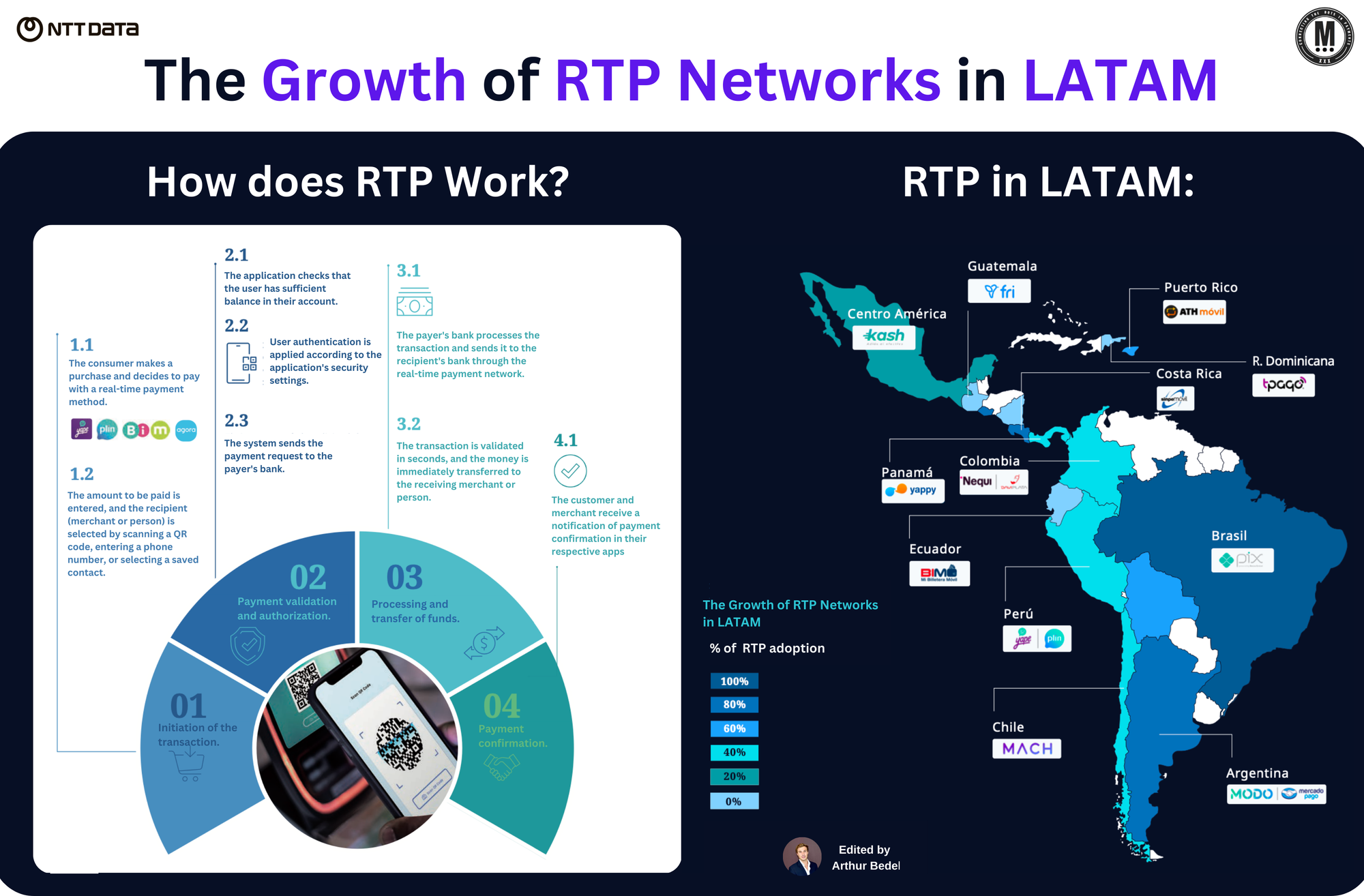

𝐓𝐡𝐞 𝐆𝐫𝐨𝐰𝐭𝐡 𝐨𝐟 𝐑𝐞𝐚𝐥-𝐓𝐢𝐦𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐢𝐧 𝐋𝐀𝐓𝐀𝐌 by NTT DATA 👇 Created by Arthur Bedel

► 𝐑𝐞𝐚𝐥-𝐓𝐢𝐦𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 (#RTP) are revolutionizing the way payments are processed in Latin America. These systems enable instantaneous money transfers, offering a more efficient, secure, and accessible way of conducting transactions. As shown in the map, countries like 𝐁𝐫𝐚𝐳𝐢𝐥 🇧🇷 (𝐏𝐈𝐗), 𝐂𝐨𝐥𝐨𝐦𝐛𝐢𝐚 🇨🇴 (Nequi), and 𝐏𝐞𝐫𝐮 🇵🇪 (𝐏𝐥𝐢𝐧) are leading the RTP charge in the region.

𝐇𝐨𝐰 𝐝𝐨𝐞𝐬 𝐑𝐓𝐏 𝐖𝐨𝐫𝐤?

1️⃣ 𝐈𝐧𝐢𝐭𝐢𝐚𝐭𝐢𝐨𝐧 𝐨𝐟 𝐭𝐡𝐞 𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧

► The consumer makes a purchase and decides to pay with a real-time payment method.

2️⃣ 𝐀𝐦𝐨𝐮𝐧𝐭 & 𝐑𝐞𝐜𝐢𝐩𝐢𝐞𝐧𝐭 𝐒𝐞𝐥𝐞𝐜𝐭𝐢𝐨𝐧

► The amount to be paid is entered, and the recipient (merchant or person) is selected by scanning a QR code, entering a phone number, or selecting a saved contact.

3️⃣ 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐕𝐚𝐥𝐢𝐝𝐚𝐭𝐢𝐨𝐧 & 𝐀𝐮𝐭𝐡𝐨𝐫𝐢𝐳𝐚𝐭𝐢𝐨𝐧

► The application checks that the user has sufficient balance in their account.

► User authentication is applied according to the application’s security settings.

4️⃣ 𝐏𝐫𝐨𝐜𝐞𝐬𝐬𝐢𝐧𝐠 & 𝐓𝐫𝐚𝐧𝐬𝐟𝐞𝐫 𝐨𝐟 𝐅𝐮𝐧𝐝𝐬

► The payer's bank processes the transaction and sends it to the recipient’s bank through the real-time payment network.

► The transaction is validated in seconds, and the money is immediately transferred to the receiving merchant or person.

5️⃣ 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐂𝐨𝐧𝐟𝐢𝐫𝐦𝐚𝐭𝐢𝐨𝐧

► The customer and merchant receive a notification of payment confirmation in their respective apps.

𝐌𝐨𝐬𝐭 𝐏𝐨𝐩𝐮𝐥𝐚𝐫 𝐑𝐓𝐏 𝐍𝐞𝐭𝐰𝐨𝐫𝐤𝐬 𝐩𝐞𝐫 𝐂𝐨𝐮𝐧𝐭𝐫𝐲:

🇧🇷 Brazil (PIX)

🇵🇪 Peru (Plin)

🇨🇴 Colombia (Nequi)

🇪🇨 Ecuador (BIM)

🇵🇦 Panama (Yappy)

🇨🇱 Chile (MACH)

🇦🇷 Argentina (MODO)

🌐 Central America (Kash)

And many more...

𝐓𝐡𝐞 𝐊𝐞𝐲 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬 & 𝐓𝐫𝐞𝐧𝐝𝐬 𝐨𝐟 𝐑𝐓𝐏 𝐢𝐧 𝐋𝐀𝐓𝐀𝐌:

► 𝐅𝐚𝐬𝐭𝐞𝐫 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬: Funds are transferred in seconds, boosting both consumer and business satisfaction.

► 𝐈𝐦𝐩𝐫𝐨𝐯𝐞𝐝 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐈𝐧𝐜𝐥𝐮𝐬𝐢𝐨𝐧: RTP offers access to banking services for the unbanked, especially in rural and underserved areas.

► 𝐂𝐨𝐬𝐭-𝐞𝐟𝐟𝐞𝐜𝐭𝐢𝐯𝐞: Reduces transaction fees compared to traditional methods, benefiting both businesses and consumers.

► 𝐒𝐞𝐜𝐮𝐫𝐢𝐭𝐲: Real-time validation of payments helps prevent fraud and enhances transaction security.

Source: NTT DATA

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()