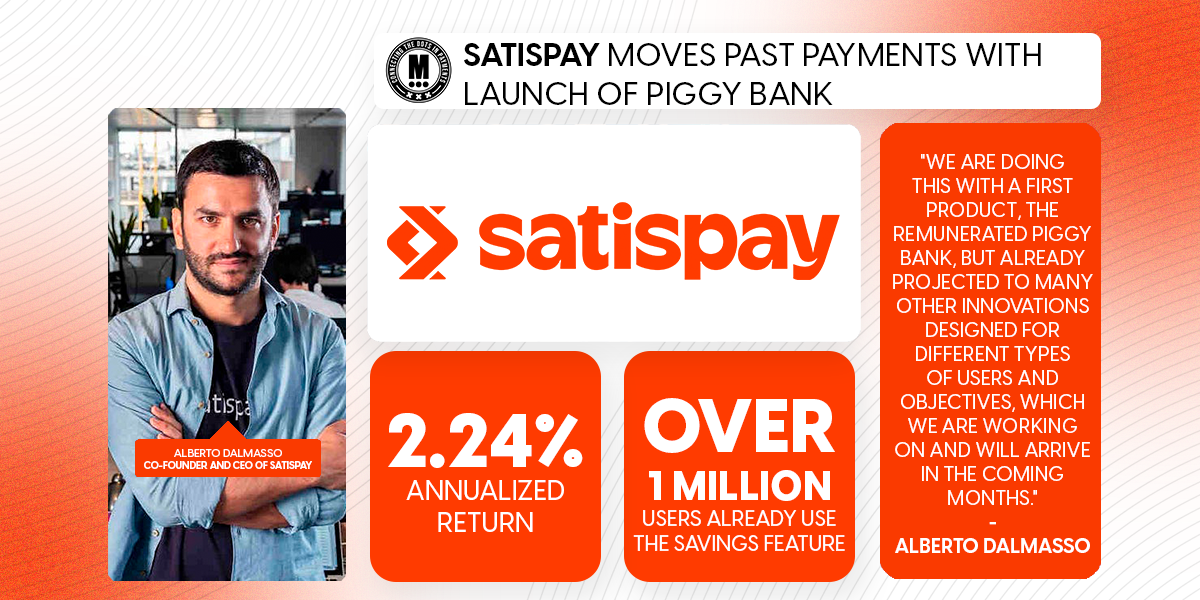

Satispay Moves Past Payments With Launch of Piggy Bank

Hey Payments Fanatic!

Satispay is now offering Invested Savings, introduced under the name "Remunerated Piggy Bank." The Italy-based fintech unicorn, which rolled out its Loyalty Program back in April, is moving beyond payments with its first investment product integrated directly into the app.

Despite the name, this is not a traditional savings account. Funds are invested in a low-risk money market fund, and are not protected by a central bank, marking a shift toward accessible, entry-level investing.

Available without minimums, lock-ins, or complex onboarding, Invested Savings builds on the app’s widely used “Savings” feature, already adopted by over a million users. It offers an annualized return of 2.24% and allows deposits or withdrawals at any time. Managed by Amundi Asset Management, the fund allocates capital to short-term, highly liquid instruments like government bonds and bank deposits.

"We are doing this with a first product, the Remunerated Piggy Bank, but already projected to many other innovations designed for different types of users and objectives, which we are working on and will arrive in the coming months." said Alberto Dalmasso, Co-Founder and CEO of Satispay.

The rollout starts this week in Italy. With no activation or withdrawal fees, automatic tax management, and real-time tracking in-app, Satispay is offering a streamlined path into financial markets, especially for users less familiar with traditional investment platforms.

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

🇬🇧 External payments for app developers: Upgrade your app monetization strategy with Solidgate. The app monetization landscape is evolving fast, and so should your payments. This whitepaper reveals how to capitalize on the latest app market shifts, drive better unit economics, and painlessly move from in-app billing to external payments.

PAYMENTS NEWS

🇧🇭 ila Bank partners with Mastercard to launch innovative solutions and expand into new markets. ila Bank will leverage Mastercard’s expertise to introduce a loyalty program that supports cardholders’ lifestyle, providing added value across a wide range of areas, including dining, luxury shopping, travel, and priceless experiences.

🇱🇰 Mastercard & LankaPay join forces, launch co-branded card and secure QR payments in Sri Lanka. This move supports financial inclusion, better tourist experiences, and safer digital transactions across the country. Read more

🇮🇱 Payoneer suspends 2025 guidance and taps advisors, citing a “rapidly evolving and uncertain global macro and trade environment.” The company had previously projected strong growth in revenue from small- and medium-sized businesses (SMBs) and marketplace sellers, but is now opting for caution.

🇦🇺 Stripe’s Australian lead steers clear of Tyro takeover talks. Stripe’s Australian Chief says there is nothing to reveal about its reported interest in homegrown merchant terminal business Tyro, despite growing intrigue around each company’s next move.

🇬🇧 Zilch surpasses 4.5 million customers and £600 million in consumer savings. This milestone customer announcement marks a significant achievement. Zilch is now in the wallets of nearly 15% of the UK’s 34 million working adult population.

🇱🇹 Lithuania prepares an offline card payment system for national emergencies. The card payment system is to ensure people can still make purchases in the event of an emergency internet outage, an official from the country’s national bank has said.

🇰🇷 RedotPay enters South Korea with crypto-powered payment cards. The company’s crypto debit cards, both physical and virtual, are now accepted at all Korean merchants that support Visa. The move marks RedotPay’s latest step in global expansion.

🇨🇦 Square launches new unified point of sale app in Canada. The newly released Square Point of Sale app consolidates these features into one interface, enabling Canadian sellers to personalize tools for their unique needs, whether they run a quick-service café, full-service salon, or multi-location retail operation.

🇬🇧 Irina Chuchkina joins ‘Wallet in Telegram’ as Chief Growth Officer. "Telegram is the ideal platform for launching accessible financial tools because investing and managing money should be a right, not a privilege. Anyone should be able to invest in their future, send money as easily as a message," she stated.

🌎 Wise appoints Ricardo Amaral as the new Head of Banking for Latin America and Country Manager for Brazil. He will be responsible for delivering the PIX integration and driving a highly localized growth strategy across all customer segments to further Wise's contributions to a faster, more convenient, and efficient international payment experience for Brazilians.

🇰🇷 Bank of Korea pushes for control over won-based stablecoins. Koh Kyung-chul, head of the BOK’s Electronic Finance Team, said, “Stablecoins have a significant impact on central bank policy implementation, including monetary policy, financial stability, and payment and settlement.”

GOLDEN NUGGET

Paze℠ — The 𝐅𝐮𝐭𝐮𝐫𝐞 of 𝐁𝐚𝐧𝐤-𝐁𝐚𝐜𝐤𝐞𝐝 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 to 𝐫𝐢𝐯𝐚𝐥 Apple𝐏𝐚𝐲 & Google Pay👇 Created by Arthur Bedel

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐏𝐚𝐳𝐞?

Paze℠ is a 𝐛𝐚𝐧𝐤-𝐛𝐚𝐜𝐤𝐞𝐝 𝐝𝐢𝐠𝐢𝐭𝐚𝐥 𝐰𝐚𝐥𝐥𝐞𝐭 designed for secure, streamlined eCommerce checkout. Unlike traditional wallets, Paze℠ is automatically provisioned through the customer’s existing banking relationship — no downloads, no new credentials, no manual card entry.

It enables consumers to check out online with a single sign-in experience by pulling payment and shipping credentials directly from their bank or credit union.

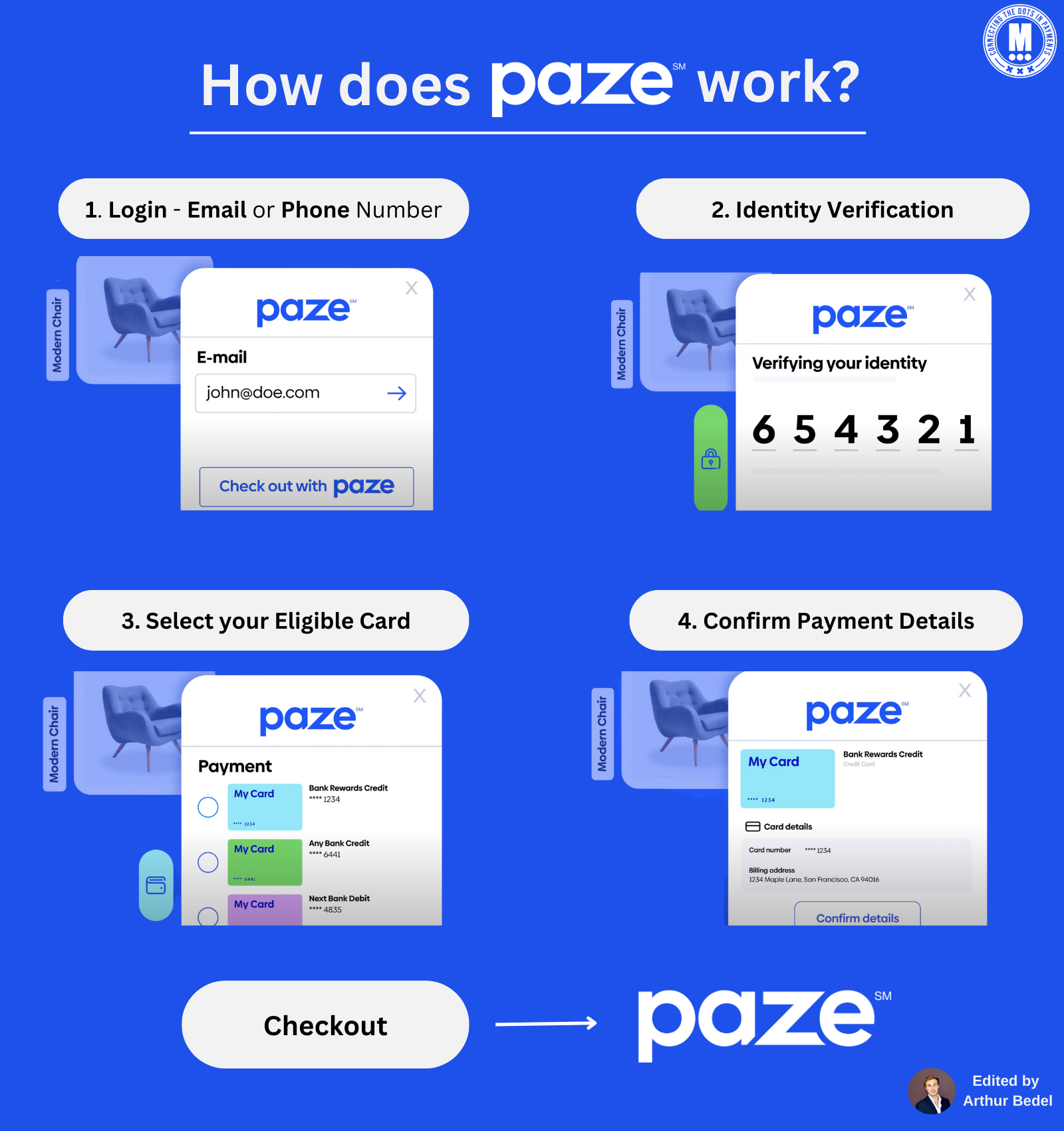

𝐇𝐨𝐰 𝐃𝐨𝐞𝐬 𝐏𝐚𝐳𝐞 𝐖𝐨𝐫𝐤?

1️⃣ 𝐋𝐨𝐠𝐢𝐧 — User enters phone number or email

2️⃣ 𝐈𝐝𝐞𝐧𝐭𝐢𝐭𝐲 𝐕𝐞𝐫𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧 — OTP-based verification

3️⃣ 𝐒𝐞𝐥𝐞𝐜𝐭 𝐂𝐚𝐫𝐝 — Choose from eligible debit/credit cards

4️⃣ 𝐂𝐨𝐧𝐟𝐢𝐫𝐦 𝐃𝐞𝐭𝐚𝐢𝐥𝐬 — Payment data + shipping info prefilled

✅ 𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭 𝐜𝐨𝐦𝐩𝐥𝐞𝐭𝐞 in seconds, no form-filling required

Is Paze℠ the 𝐧𝐞𝐱𝐭 𝐛𝐢𝐠 𝐭𝐡𝐢𝐧𝐠 in the 𝐔.𝐒.?

Paze℠ addresses the long-standing eCommerce friction of card entry and consumer authentication by using:

► 𝐏𝐫𝐞-𝐩𝐫𝐨𝐯𝐢𝐬𝐢𝐨𝐧𝐞𝐝 𝐜𝐚𝐫𝐝𝐬 from issuers (nothing to manually enroll)

► 𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐮𝐩𝐝𝐚𝐭𝐞𝐫 to ensure cards stay current (no expired card rejections)

► 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐭𝐨𝐤𝐞𝐧𝐬 to maximize authorization success and reduce fraud

It's built into the ecosystem, not layered on top of it — making it merchant-agnostic, secure, and scalable.

𝐁𝐚𝐧𝐤𝐬 𝐞𝐧𝐚𝐛𝐥𝐢𝐧𝐠 𝐏𝐚𝐳𝐞 𝐢𝐧𝐜𝐥𝐮𝐝𝐞:

► Bank of America

► Capital One

► JPMorganChase Chase

► PNC

► Truist

► U.S. Bank

► Wells Fargo

► Navy Federal Credit Union, and hundreds of regional banks

𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬 𝐟𝐨𝐫 𝐂𝐨𝐧𝐬𝐮𝐦𝐞𝐫𝐬:

✔ No need to create a new account

✔ No passwords to remember

✔ Autofilled cards and addresses

✔ Works at checkout — no app download required

𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬 𝐟𝐨𝐫 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭𝐬:

✔ Reduces form abandonment

✔ PCI compliance simplified via tokenization

✔ Integrates with existing payment processors

✔ No fees to accept Paze℠

✔ One-click-style experience with bank-verified credentials

𝐌𝐲 𝐏𝐎𝐕:

Paze℠ has the ingredients to become a serious native wallet alternative to Big Tech solutions like ApplePay or Google Pay. What makes it different is its ecosystem-level integration: card issuers, networks, and merchants all participate — bridging the fragmentation gap.

If user adoption follows through, Paze℠ could shift the balance in favor of bank-centric checkout experiences.

Source: Paze℠

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()