Shopify and Solidgate Unlock Smarter Payments for Merchants

Hey Payments Fanatic!

Shopify and Solidgate are taking their partnership further. With the new Solidgate Payments App now live, merchants can access smarter payment orchestration, without leaving the Shopify environment.

The integration connects Shopify sellers directly to Solidgate’s infrastructure, giving them more control over how transactions are handled.

With just a few clicks, Shopify merchants can activate Solidgate’s infrastructure. That means fewer failed payments, local method support, and built-in smart routing. Setup is fast. Control is back in merchants’ hands.

Max Botyk, Solidgate’s Business Development Executive, puts it clearly: “Payments are too often a black box – expensive, fragile, and disconnected from business goals. This integration puts merchants back in control.”

But the story doesn’t end here, scroll down for more details 👇 I'll be back tomorrow!

Cheers,

P.S. Follow me on Threads for daily scoops!

INSIGHTS

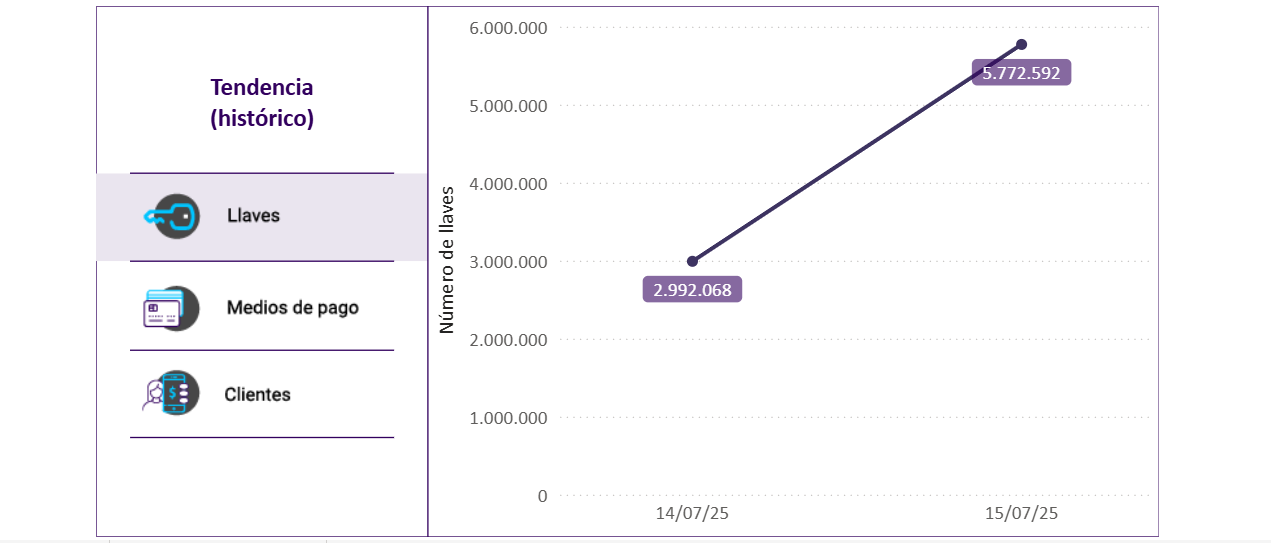

🇨🇴 Bre-B recorded 3 million new key registrations on its first day of operation. According to the central bank, in the first 24 hours, Bre-B had 5.77 million active keys, 3.37 million were linked to payment methods, 2.67 million were individual users, and these users made an average of 1.2 payments per person.

NEWS

🇬🇧 Solidgate expands partnership with Shopify: Bring payment orchestration to your storefront. With the new Solidgate Payments App, merchants on Shopify can connect to Solidgate’s powerful payment infrastructure, bringing smarter routing, access to local payment methods, advanced payment acceleration technologies, real-time analytics, and billing flexibility.

🇳🇱 What is Wero? By Mollie. Wero has ambitious plans to establish a new, uniform standard for online payments across the continent. In this guide, Mollie explains exactly what Wero is, how it works, and, most importantly, what it can do for your checkout process and your turnover.

🇳🇬 Update on Wabeh regarding recent articles on closure. The company stated in a LinkedIn post that it is not shutting down. It remains fully operational, continues to serve users and merchants, shows strong portfolio performance, and upholds regulatory compliance. Read the full post here

🇺🇸 PayPal has launched AI-powered scam alerts for friends and family payments. Designed to proactively alert customers to potential scams and prevent losses in real-time, the alerts intervene when it matters most, before any funds are sent.

🇺🇸 Crypto payments are the 'next big category' for Coinbase, says CEO Brian Armstrong. Coinbase CEO joins 'Closing Bell Overtime' and CNBC's Emily Wilkins to talk about the recent passage of new crypto legislation and what that will mean for the sector as a whole. Watch the interview here

🇺🇸 Block joins S&P 500 as crypto’s mainstreaming marches on. Block will replace Hess on the S&P beginning July 23 at the start of trading, the report said. In addition, the company is integrating bitcoin payment capabilities into its Square terminals.

🇺🇸 Block Inc. settles $12.5 million cash app referral lawsuit. The settlement is specifically relevant to Washington state residents who received the disputed spam messages, with eligibility dependent on having received such texts during the settlement period, which began on November 14, 2019, and will conclude at a date yet to be determined.

🇬🇧 GoCardless powers Cashflow Payouts, a solution promising to eliminate delays in sending payments. Cashflows Payouts aims to enhance how businesses handle disbursements by enabling instant, branded, and secure payouts through an intuitive self-service portal.

🇬🇧 SpacePay raises $1.1M to bring crypto payments to everyday card machines. This London-based startup enables merchants to accept cryptocurrency payments through their existing Android card machines with just a software update. The platform supports over 325 wallets, charges a transaction fee of only 0.5%.

🇧🇷 PicPay announces the hiring of André Tonelini as the new Head of the Company's Card Division. The Executive's mission will be to drive growth and consolidate PicPay Card's value proposition. Tonelini spent the last nine years at Banco Carrefour, where he held different positions.

🇺🇸 PublicSquare adds Apple Pay and Google Pay to payment platform. The integration comes as mobile payment adoption continues to grow in the United States. According to data cited in the company’s statement, over 50% of U.S. smartphone users currently use mobile wallets at checkout.

🇫🇷 Worldline increases payment authorisation rates with AI-powered routing solution. Khalil Kammoun, Head of Shared Services, commented: “With AI-driven routing, we’re enhancing authorisation rates through smarter decision-making and unlocking new revenue for our customers. We aim to enable businesses to achieve new levels of efficiency, cost savings, and payment optimisation.”

🇮🇳 FinTech firm PayU India to invest $120 mn by end of FY26. The credit business is expected to get an investment of $50-$60 million. PayU is considering another $60-$70 million infusion in payments infrastructure firm Mindgate Solutions, in which it acquired a 43.5% stake in March.

🇺🇸 Folio raises $14M series A to transform financial operations at hotels. The capital will help Folio continue to power profitability at hotels and deliver even faster implementations. Folio’s modern procure-to-pay platform delivers increased profitability to hotels through its managed marketplace.

🇲🇽 User demand drives integration of tax payments in Mercado Pago. This initiative is part of a broader strategy focused on promoting financial inclusion and strengthening the digital payment network. Continue reading

🇮🇳 WhatsApp Pay growth stalls in India as Meta shifts focus on stablecoins. Meta Platforms’ attempt to position WhatsApp as a major player in India’s massive FinTech sector has largely failed, primarily due to regulatory restrictions but also because of the company’s lack of significant product improvements.

🇪🇬 Lime Consumer Finance enters Egypt’s FinTech market with education-focused app. It aims to address a vital need for families seeking affordable and flexible payment options. Through the app, families can access installment plans ranging from 6 to 12 months, for amounts up to EGP 1M.

🇮🇳 NPCI International expands UPI-PayNow linkage to drive cross-border remittances. This update for real-time cross-border payments makes it easier for people, especially migrant workers and students, to send and receive money between the two countries safely and easily.

🇮🇪 Codec and Yavrio announce strategic partnership. The partnership enables seamless integration of Yavrio’s open banking platform into Business Central, allowing users to access real-time banking data, initiate payments, and automate reconciliation, all within their ERP system.

GOLDEN NUGGET

🚨 Final Recap: 𝟐𝟓 𝐘𝐞𝐚𝐫𝐬 𝐨𝐟 𝐈𝐧𝐟𝐫𝐚𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞, 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 & 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞 by DEUNA👇 Created by Arthur Bedel 💳 ♻️

Over the past two decades, the payments ecosystem has undergone three fundamental shifts:

→ From static, rigid infrastructure

→ To programmable orchestration

→ To real-time, reasoning intelligence

This post brings the full transformation together in a single strategic framework.

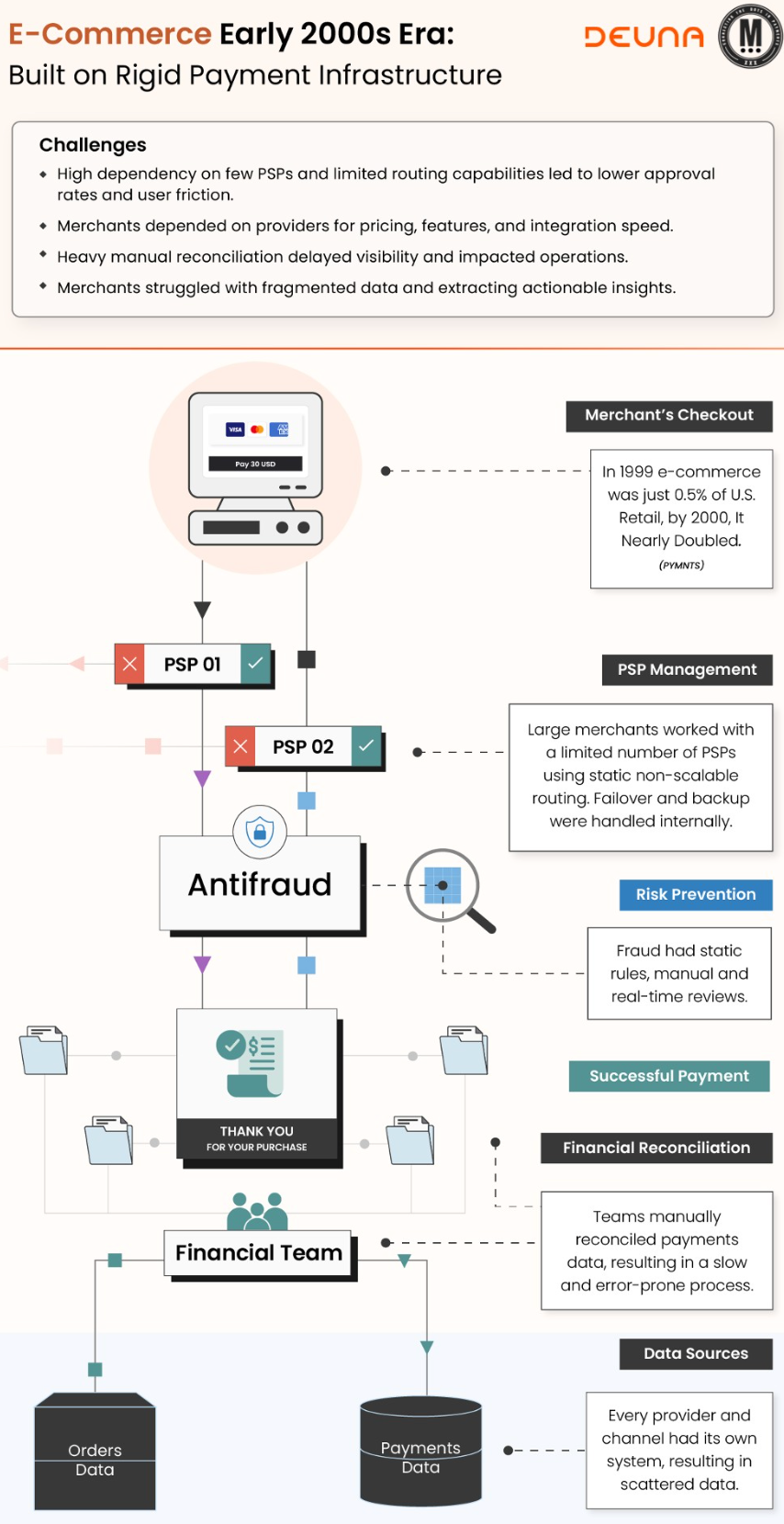

𝐏𝐚𝐫𝐭 1 — 2000s: 𝐓𝐡𝐞 𝐋𝐞𝐠𝐚𝐜𝐲 𝐈𝐧𝐟𝐫𝐚𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞 𝐄𝐫𝐚

🔹 Characteristics:

Merchants relied on single PSP setups, limited routing, and siloed data. Fraud was handled manually. Reconciliation was slow and error-prone.

🔹 Key Constraints:

→ No fallback logic or retry mechanisms

→ No fraud orchestration or dynamic controls

→ Data scattered across PSPs, acquirers, and tools

🔹 Business Impact:

→ Failed transactions = lost revenue

→ Limited visibility into payment performance

→ No ability to optimize or adapt in real time

➡️ Payments were operational—but not strategic.

𝐏𝐚𝐫𝐭 2 — 2010s: 𝐓𝐡𝐞 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝐋𝐚𝐲𝐞𝐫 𝐄𝐦𝐞𝐫𝐠𝐞𝐬

🔹 The Evolution:

The rise of payment orchestration decoupled logic from providers, enabling intelligent routing, backup PSPs, tokenization, and unified reporting.

🔹 Technical Capabilities Introduced:

→ Routing engines (BIN, amount, geography)

→ Automated transaction recovery

→ Real-time fraud controls and smart 3DS

→ Centralized reconciliation and compliance

→ Token vaulting and PSP abstraction

🔹 Strategic Benefits:

✅ Increased approval rates

✅ Improved cost efficiency

✅ Faster market expansion

✅ Better governance and reporting

➡️ Payments became a modular, resilient system for growth.

𝐏𝐚𝐫𝐭 3 — 2020s: 𝐓𝐡𝐞 𝐀𝐠𝐞 𝐨𝐟 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞

🔹 The Shift:

We are now entering a phase where payments infrastructure doesn’t just execute—it reasons.

🔹 Why This Matters:

Despite orchestration, over $300B is lost annually due to missed opportunities, fragmented data, and reactive operations.

🔹 What Defines Agentic Payments Intelligence:

1️⃣ Unified, intelligent data layer

→ Structures commerce, payments, fraud, and behavioral data into a single, actionable foundation.

2️⃣ Context-aware reasoning engine

→ Detects issues, trends, and opportunities based on business context—not static rules.

3️⃣ Real-time execution framework

→ Automates action: retry logic, provider switching, checkout optimization, and more.

➡️ Payments now serve as a strategic decisioning engine—not just infrastructure.

The future of commerce will belong to those who evolve with the stack.

From infrastructure → to orchestration → to intelligence.

Source: DEUNA

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()