Solidgate and RozetkaPay Join Forces to Enhance Polish E-Commerce Payments

Hey Payments Fanatic!

After attending Money20/20 in Bangkok, I flew straight to Dubai for Token2049 — and it was worth it. One highlight: catching up with Christina Smedley, co-founder of Lightspark, to talk about their latest big news — the new collaboration with Coinbase.

Plenty more is coming from Lightspark, and based on what I heard, I'd highly recommend keeping a close eye on them. Stay tuned 😉

Solidgate has teamed up with RozetkaPay, the payment arm of Ukrainian e-commerce giant Rozetka.ua, to make shopping on Rozetka.pl easier for Polish customers.

The partnership brings two big wins to Polish shoppers: local currency payouts and support for BLIK, Poland’s go-to payment method. That means faster, smoother checkouts and fewer failed transactions.

"We're excited to partner with RozetkaPay to deliver tailored payment solutions for their clients in Poland," said Andrey Kononenko, Head of Merchant Operations at Solidgate. "By providing streamlined payment services with local currency payouts, we'll help Rozetka grow and thrive in a competitive market."

But they’re not stopping at Poland. Solidgate and RozetkaPay are already eyeing new markets like Romania and Turkey, with plans to roll out more localized payment options and keep the expansion rolling.

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

Transform Your Banking Experience! Subscribe to my Daily Banking Newsletter for the latest trends and updates delivered daily to your inbox. Embrace the Future of Banking—Never miss an update!

PAYMENTS NEWS

🇧🇷 Vlademir Santos, Head of ACI Worldwide in Brazil, discusses the challenges and technological solutions for managing payment disputes in the Brazilian e-commerce sector. Santos emphasizes that managing these disputes is complex and costly, involving various stakeholders like consumers, banks, merchants, card networks, and payment processors.

🇺🇸 Write off paper checks, ACI Worldwide CEO Tom Warsop advises. He praised the Trump administration’s move to eliminate paper checks and suggested businesses should do the same. Read more

🇨🇦 Jeremiah Glodoveza joined Nuvei as SVP of Brand and Communications. Jeremiah brings deep global experience and a passion for storytelling that will help the company continue to shape and share Nuvei’s journey with the world. Read more

🇳🇱 Adyen sales grew 22% as firm warns of economic uncertainties, with net revenue rising to €534.7 million. The company warned that risks related to rising economic uncertainty could slow growth, citing a more uncertain macroeconomic environment this year.

🇺🇸 Affirm Launches “AdaptAI” to Merchant Partners. Retailers can now introduce personalized, real-time financial benefits, on top of Affirm’s flexible pay-over-time plans, to customers at the point of purchase. Continue reading

🇧🇷 Clara raises $80 million and is close to profitability. The new capital will be used to invest in technology and expand operations across Latin America, with a focus on Brazil. Keep reading

🇨🇦 DailyPay expands into Canada. Launching in May 2025, its innovative platform will be available to new and existing clients with operations in the country. DailyPay’s On-Demand Pay solution has been proven to help workers in the U.S. pay fewer late fees on their bills and incur less credit card interest charges.

🇷🇴 Bogdan Hristescu new Chief Commercial Officer at BLIK Romania. His expertise and knowledge of the Romanian market will support BLIK’s long-term growth strategy and play a key role in the upcoming launch of the BLIK payment system in the national currency (RON), starting with the e-commerce sector.

🇧🇷 PagBrasil completes the integration of Pix Automático on its platform. The Central Bank of Brazil expects to officially roll out the new feature on 16 June 2025, Pix Automático aims to improve recurring payments in the country by enabling automated, pre-authorised debits through the country’s popular Pix and Open Finance systems.

🇫🇷 Lydia, the French mobile payment app, has launched a new online banking service called Sumeria, offering a remunerated current account with interest rates of up to 4% annually. This move marks Lydia's transition from a peer-to-peer payment platform to a full-fledged neobank.

🇺🇿 Paysend unlocks instant payments to Uzbeckistan's Uzcard and Humo. The integration supports cross-border payments for enterprise clients by simplifying technical infrastructure and reducing the need for multiple third-party providers. Paysend’s Payouts to Cards API offers to over 12 billion cards globally.

🇺🇸 Cross River expands borderless finance with launch of international payments powered by Smart-Routing. Leveraging Cross River’s proprietary banking core and API technology, this new International Payments solution offers seamless, efficient, and cost-effective cross-border transactions for businesses.

🇲🇽 Stablecoin-enabled FX, Now Live in Mexico. Bridge is launching local on and off-ramps, enabling developers to move funds seamlessly between dollars, pesos, and stablecoins through a simple set of APIs. This rollout is the first step in a broader effort to support cross-border financial operations across Latin America.

🌍 Qliro and Two integrate B2B BNPL for Nordic SMEs. The integration of Two’s solution into Qliro’s existing checkout is designed to support business buyers with more flexible terms while maintaining real-time risk assessment and instant credit decisions.

🇺🇸 Mastercard announced a $300 million investment in the cross-border corporate payments division of Corpay. The deal involves the purchase of a minority stake of approximately 3%, valuing Corpay at $10.7 billion. This implies a valuation multiple of 20 times the company’s projected EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), a key metric used to gauge operational cash flow potential.

🇰🇿 MasterCard takes lead in Kazakhstan’s exploding card market in early 2025. According to the National Bank of Kazakhstan, Mastercard had approximately 14.5 million cards in circulation by February 1, 2025, up from 11 million a year earlier. This represents a 31% YoY increase, outpacing the 8% growth of Visa cards during the same period.

🇦🇪 PayPal opens first regional hub in the Middle East and Africa with new office in Dubai. PayPal’s expanded presence will bring global commerce capabilities to the region, including frictionless payments, robust security, and broader access to international payment networks to help large enterprises and small businesses.

🇲🇽 TruBit joins Circle Payments Network as early design partner to advance borderless finance. The CPN is designed to modernize today's fragmented cross-border payment systems, enabling financial institutions to move money with internet-level speed, transparency, and efficiency.

GOLDEN NUGGET

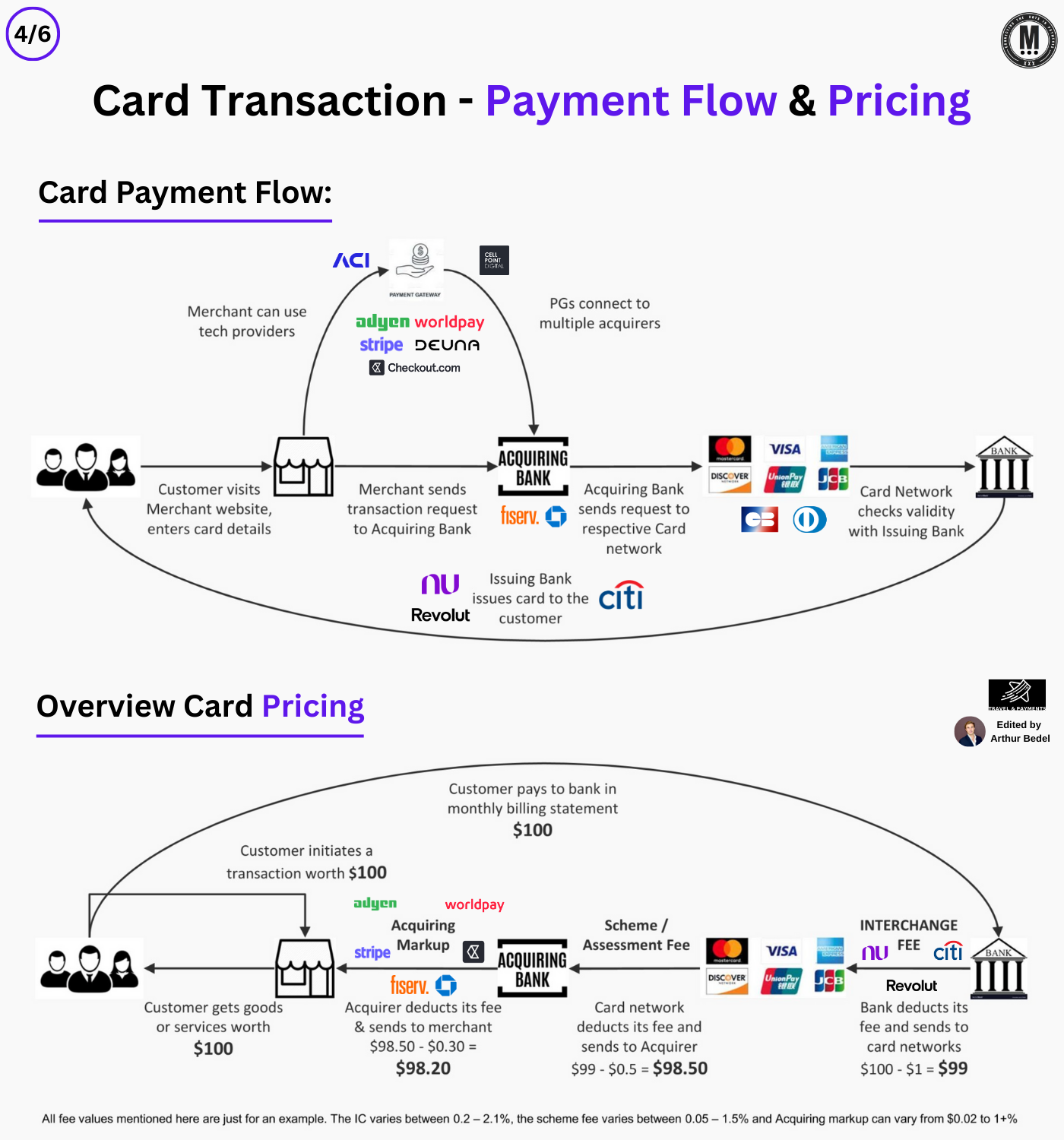

𝐓𝐡𝐞 𝐈𝐧𝐭𝐫𝐨𝐝𝐮𝐜𝐭𝐢𝐨𝐧 𝐭𝐨 𝐂𝐚𝐫𝐝𝐬 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 by Travel & Payments👇 — Created by Arthur Bedel

𝐂𝐚𝐫𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐅𝐥𝐨𝐰 - Simplified

At the heart of every card payment is a variety of participants, from merchants to banks, gateway, PSPs and card networks. Understanding how these parties interact is key to grasping the complexity of payment processing.

► 𝐈𝐬𝐬𝐮𝐞𝐫 → Provides / Issues cards to customers (Revolut, Citi, Nubank)

► 𝐀𝐜𝐪𝐮𝐢𝐫𝐞𝐫 → Processes merchant transactions, those include Acquiring Banks and PSPs with Acquiring licenses (Fiserv, Chase, Worldpay, Checkout.com, Payplug)

► 𝐂𝐚𝐫𝐝 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 → Connects Issuers, Acquirers and PSPs (Visa, Mastercard, GIE Cartes Bancaires)

► 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐆𝐚𝐭𝐞𝐰𝐚𝐲 → Connects merchants to acquirers, those include traditional gateways, orchestrators and PSPs - only listed traditional and orchestration in examples (ACI Worldwide, CellPoint Digital, DEUNA, Cybersource)

𝐇𝐨𝐰 𝐝𝐨𝐞𝐬 𝐚 𝐂𝐚𝐫𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐰𝐨𝐫𝐤?

1️⃣ 𝐒𝐭𝐞𝐩 𝟏: Customer visits a merchant’s website and enters their card details.

2️⃣ 𝐒𝐭𝐞𝐩 𝟐: Merchant sends the transaction request to an Acquiring Bank (Fiserv, Chase) via a Payment Gateway (ACI Worldwide, CellPoint Digital).

3️⃣ 𝐒𝐭𝐞𝐩 𝟑: The Acquirer forwards the request to the Card Network (Visa, Mastercard).

4️⃣ 𝐒𝐭𝐞𝐩 𝟒: The Card Network checks with the Issuing Bank to validate the transaction.

5️⃣ 𝐒𝐭𝐞𝐩 𝟓: If approved, the Issuer confirms the transaction, and funds are authorized.

𝐓𝐡𝐞 𝐂𝐚𝐫𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐏𝐫𝐢𝐜𝐢𝐧𝐠 — 𝐓𝐡𝐞 𝐅𝐞𝐞𝐬 𝐁𝐫𝐨𝐤𝐞𝐧 𝐃𝐨𝐰𝐧 💳

1️⃣ 𝐂𝐮𝐬𝐭𝐨𝐦𝐞𝐫 𝐢𝐧𝐢𝐭𝐢𝐚𝐭𝐞𝐬 $𝟏𝟎𝟎 𝐩𝐮𝐫𝐜𝐡𝐚𝐬𝐞.

2️⃣ 𝐈𝐬𝐬𝐮𝐢𝐧𝐠 𝐁𝐚𝐧𝐤 (Revolut, Citi) deducts an 𝐈𝐧𝐭𝐞𝐫𝐜𝐡𝐚𝐧𝐠𝐞 𝐅𝐞𝐞 ($1), sends $99 to Card Network.

3️⃣ 𝐂𝐚𝐫𝐝 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 (Visa, Mastercard) deducts 𝐒𝐜𝐡𝐞𝐦𝐞 𝐅𝐞𝐞 ($0.50), sends $98.50 to Acquirer.

4️⃣ 𝐀𝐜𝐪𝐮𝐢𝐫𝐢𝐧𝐠 𝐁𝐚𝐧𝐤 (Fiserv, Adyen) deducts 𝐌𝐚𝐫𝐤𝐮𝐩 (~$0.30), sends $98.20 to the Merchant.

Notes:

► Payment Gateways also may take a transaction fee.

► All fee values mentioned here are just for an example. The IC varies between 0.2 – 2.1%, the scheme fee varies between 0.05 – 1.5% and Acquiring markup can vary from $0.02 to 1+%

𝐒𝐢𝐦𝐩𝐥𝐢𝐟𝐢𝐞𝐝 𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧 𝐅𝐥𝐨𝐰 𝐄𝐱𝐚𝐦𝐩𝐥𝐞:

✔ $100 spent → Merchant receives $98.20.

✔ Total fees ($1.80) split between Issuer, Card Network, and Acquirer.

✔ Fees depend on card type, transaction type, and region.

𝐍𝐞𝐱𝐭 𝐔𝐩 → 𝐀𝐮𝐭𝐡𝐞𝐧𝐭𝐢𝐜𝐚𝐭𝐢𝐨𝐧 & 𝐀𝐮𝐭𝐡𝐨𝐫𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐂𝐚𝐫𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬

Source: Travel & Payments

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()