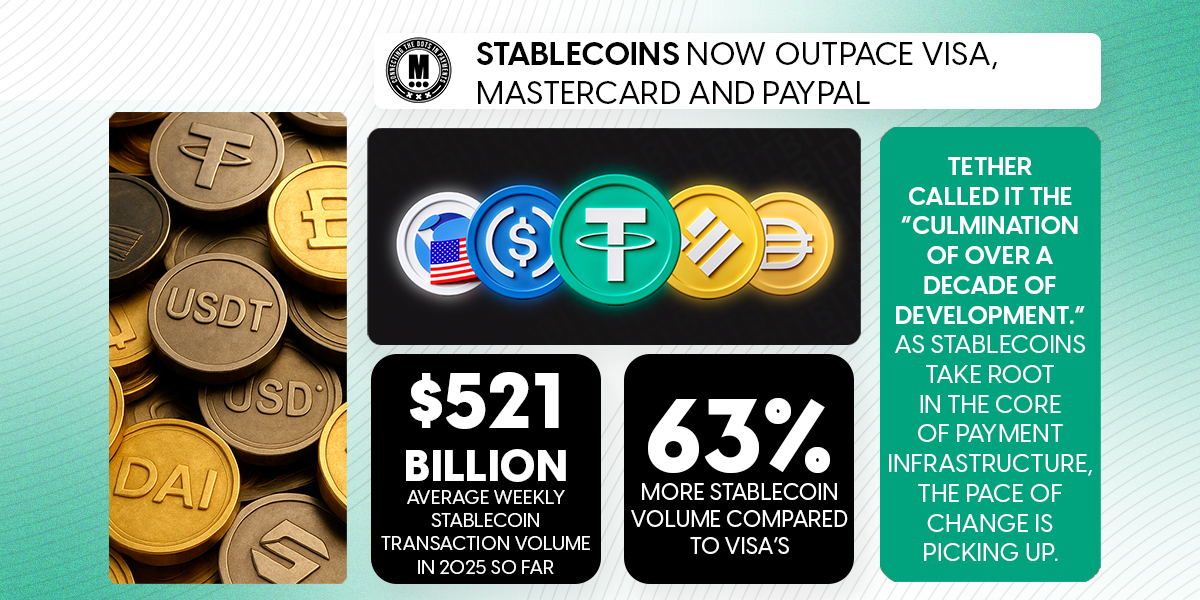

Stablecoins Now Outpace Visa, Mastercard and PayPal

Hey Payments Fanatic!

The payments landscape is shifting, and the first half of 2025 is offering a glimpse into how deep those changes might go. Stripe acquired Bridge, a $1.1 billion stablecoin payments platform. MoonPay picked up infrastructure provider Iron in a deal reportedly worth over $100 million. Ripple made two bids to acquire Circle, first at $5 billion, then at $20 billion – for now, it’s unclear where that stands.

Most recently, Circle announced a new global payments and remittance network designed to challenge incumbents like Visa and Mastercard. And this is only part of what’s unfolding.

Stablecoins aren’t just keeping pace with traditional finance anymore. They're also starting to pull ahead. Tether’s USDT has now surpassed $150 billion in supply, accounting for nearly two-thirds of the stablecoin market, according to Artemis data.

So far this year, stablecoins have averaged $521 billion in weekly transaction volume. That’s 63% more than Visa and more than 1,500% above PayPal. On weeks like January 20, the gap widened to over $300 billion. The trend is becoming harder to ignore, week after week, stablecoins are powering the movement of money on a massive scale.

This growth isn’t just driven by headlines. Tether attributes the momentum to over 400 million users worldwide. Meanwhile, traditional players are adjusting their strategies. Visa is working with banks to tokenize fiat currencies. Mastercard reported that 30% of its 2024 transactions were tokenized.

PayPal’s PYUSD, after losing traction late last year, has nearly doubled since February, and now, through a new partnership with Coinbase, is pushing further into adoption, distribution, and real-world use.

Tether called it the “culmination of over a decade of development.” As stablecoins take root in the core of payment infrastructure, the pace of change is picking up. A year from now, who can say what the payments world will look like?

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

🇳🇱 Powering SaaS growth with embedded payments by Mollie. This report reveals best practices for partnering with payment providers, building a strong value proposition with payments, and rolling them out successfully. Download here

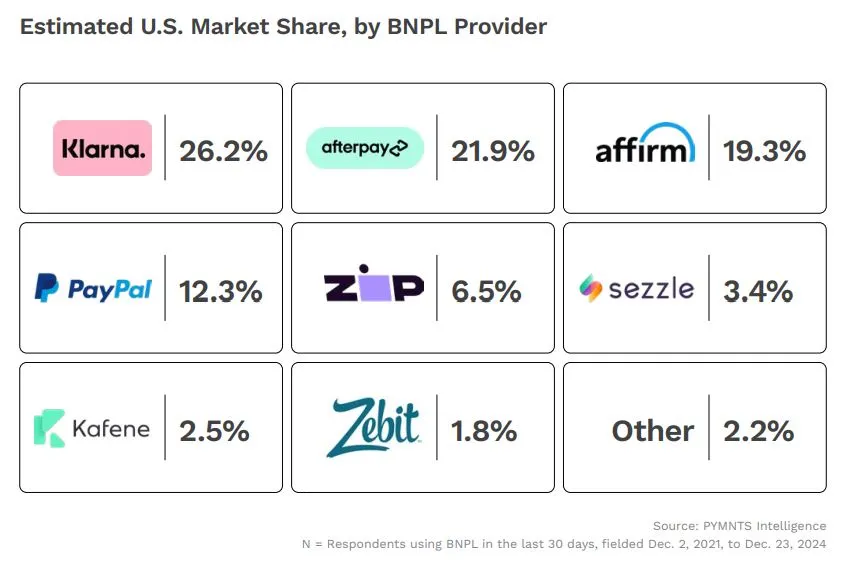

🇺🇸 US BNPL transactions hit $175 billion amid shifting consumer demands. The report, “Pay Later Revolution: Redefining the Credit Economy,” highlights this evolution, detailing an ecosystem where traditional banks, nonbank lenders, and FinTech startups are both competing and collaborating to offer flexible financing solutions.

PAYMENTS NEWS

🇸🇰 Revolut to offer merchants in Slovakia a new payment terminal. Offering Wi-Fi, a SIM card, and a battery that lasts all day, the Revolu Terminal allows users to accept card payments, mobile wallets, and payments in 19 currencies in seconds. For Revolut, the terminal represents a new source of revenue.

🇬🇷 JPMorgan to withdraw UK lawsuit against Greek FinTech Viva Wallet. According to legal filings, JPM plans to discontinue its claim in the UK but intends to continue pursuing it in Greece. A JPM spokesperson said: “We have not withdrawn our damages claim for €917m filed in Greece and we do not have any intention to.”

🇪🇺 ClearBank partners with Ozone API to accelerate open banking worldwide. This combination will empower ClearBank’s customers to use open APIs that comply with standards and regulations. They will have the tools to capitalise on the open finance opportunity, offering a scalable and future-proof approach.

🇸🇬 American Express cards can be used on public transport. Passengers will be able to use their cards to make contactless payments on public transport from May 15, with the current slate of accepted credit cards expanded. Those using these cards can also add them to their mobile wallets for easier access.

🌍 Adyen and JCB launch Card-on-File Tokenization to enhance payment security. The introduction of COF tokenization will further enhance the security of online payments, providing JCB’s cardholders and merchants with even greater peace of mind and safety.

🇫🇮 Froda and wamo partner to strengthen SME financing in Finland through Card-Based lending and instant loans. The partnership aims to close the SME financing gap by offering fast, flexible financing of up to €200,000 to Finnish businesses, with an ambition to support over 25,000 SMEs and drive nationwide economic growth.

🇦🇪 Dubai taps Crypto.com to enable crypto payments for govt services. The partnership will go a long way to achieve its goal of getting 90% of financial transactions fueled by cashless technology by 2026. Keep reading

🇧🇷 Neon adopts contactless Pix on Android phones. According to the company, users only need to connect their bank account to Google Pay once. The process is practically identical to paying with cards in your digital wallet: access the feature, use the system's authentication, and place your cell phone near the machine.

🇮🇳 China's Ant Group to sell 4% stake in India's Paytm for $242 million, term sheet shows. Ant, an affiliate of Chinese conglomerate Alibaba Group, will sell the stake at 809.75 rupees per share, a discount of 6.5% to Paytm's closing price on Monday.

🇺🇸 Stripe’s billionaire Collison brothers say remote work solves the ‘two-body problem’ faced by working couples. Stripe has been a rare holdout against a broader remote-work pullback, with an estimated 40% of employees working remotely. Its cofounders have resisted landing firmly on either side of the debate, though, indicating it should be down to the context of each company.

🌍 Raiffeisen Bank and Wise Platform are transforming cross-border payments for customers in Central and Eastern Europe. The partnership enables fast, secure, low-cost, and transparent international payments for personal and business customers across the region.

🇺🇸 Cleo and Paystand team to automate B2B payments. Cleo’s platform automates the creation of sales orders and invoices within customers’ ERP systems, after which Paystand takes over by automating accounts receivable processes through seamless fund reconciliation.

GOLDEN NUGGET

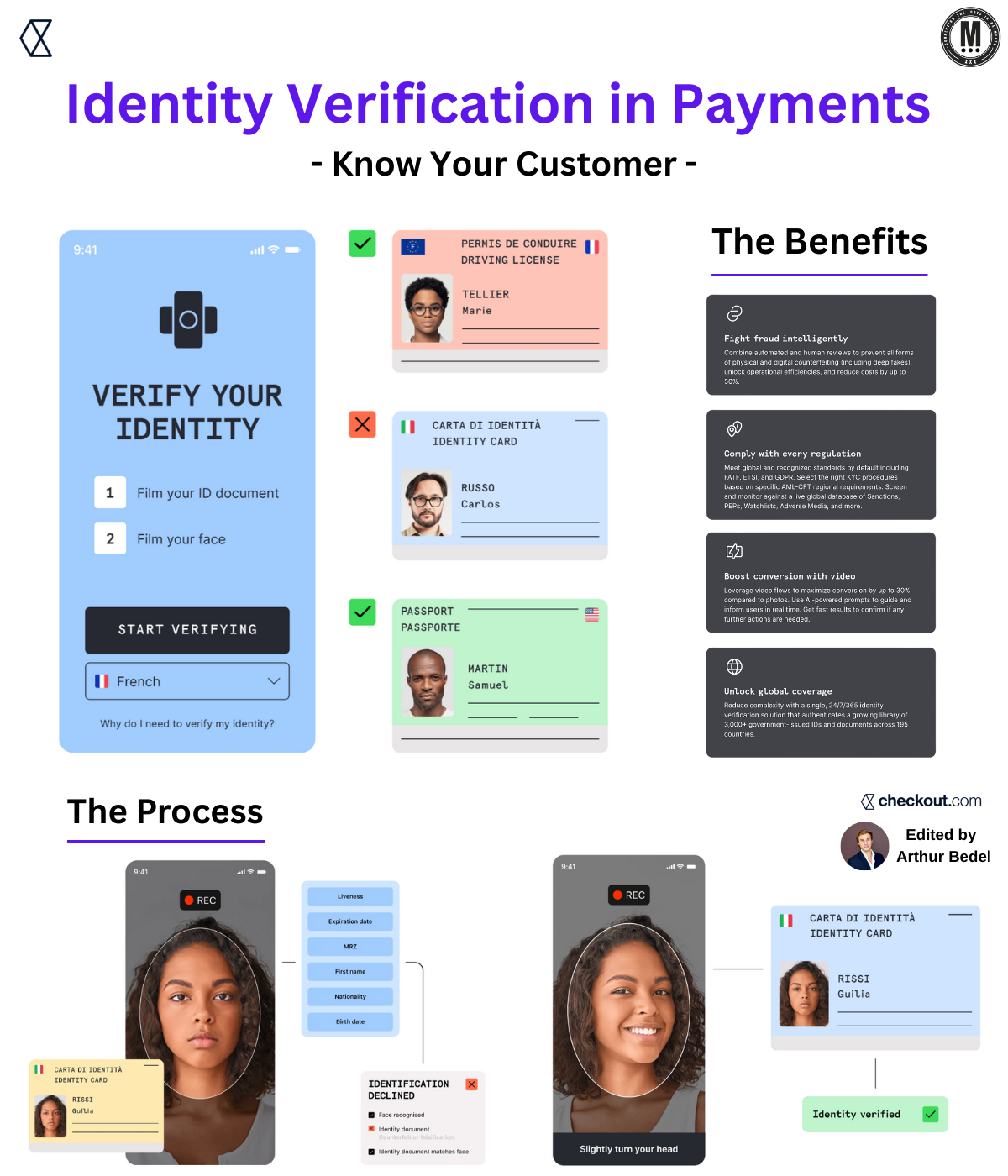

Welcome to 𝐓𝐡𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐀𝐜𝐚𝐝𝐞𝐦𝐲 by Checkout.com — Episode 13 👋 Created by Arthur Bedel

𝐈𝐝𝐞𝐧𝐭𝐢𝐭𝐲 𝐕𝐞𝐫𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧 in 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬

→ Identity Verification is a cornerstone of secure digital commerce. It ensures the individual initiating a transaction is who they claim to be—reducing fraud, enabling compliance, and preserving customer trust.

𝐖𝐡𝐚𝐭 𝐚𝐫𝐞 𝐭𝐡𝐞 𝐌𝐞𝐭𝐡𝐨𝐝𝐬 𝐨𝐟 𝐈𝐝𝐞𝐧𝐭𝐢𝐭𝐲 𝐕𝐞𝐫𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧?

► 𝐃𝐨𝐜𝐮𝐦𝐞𝐧𝐭 𝐕𝐞𝐫𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧

Scans government-issued IDs (e.g., passport, driver’s license).

→ High assurance | – May require manual review

► 𝐁𝐢𝐨𝐦𝐞𝐭𝐫𝐢𝐜 𝐕𝐞𝐫𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧

Uses facial or fingerprint recognition.

→ Secure and user-friendly | – Device compatibility required

► 𝐊𝐧𝐨𝐰𝐥𝐞𝐝𝐠𝐞-𝐁𝐚𝐬𝐞𝐝 𝐀𝐮𝐭𝐡𝐞𝐧𝐭𝐢𝐜𝐚𝐭𝐢𝐨𝐧 (#KBA)

Security questions based on personal data.

→ Familiar to users | – Prone to fraud due to data leaks

► 𝐓𝐰𝐨-𝐅𝐚𝐜𝐭𝐨𝐫 𝐀𝐮𝐭𝐡𝐞𝐧𝐭𝐢𝐜𝐚𝐭𝐢𝐨𝐧 (#2FA)

Combines a password with a second verification layer.

→ Stronger security | – Can increase friction

𝐅𝐚𝐜𝐞 𝐀𝐮𝐭𝐡𝐞𝐧𝐭𝐢𝐜𝐚𝐭𝐢𝐨𝐧: 𝐒𝐞𝐜𝐮𝐫𝐞, 𝐒𝐞𝐚𝐦𝐥𝐞𝐬𝐬, 𝐁𝐢𝐨𝐦𝐞𝐭𝐫𝐢𝐜

Face authentication is a biometric method that uses facial recognition and liveness detection to verify a user’s identity. The process converts facial data into a secure biometric token, enabling future verification without storing sensitive images.

✅ Real-time identity confirmation

✅ Protection against spoofing

✅ Privacy-first with tokenized data

𝐈𝐦𝐩𝐚𝐜𝐭:

→ Up to 30% higher onboarding conversion

→ Up to 50% reduction in identity fraud

𝐖𝐡𝐲 𝐈𝐝𝐞𝐧𝐭𝐢𝐭𝐲 𝐕𝐞𝐫𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧 𝐌𝐚𝐭𝐭𝐞𝐫𝐬

✅ Prevents fraud and identity theft

✅ Enables global compliance (KYC, AML, PSD2, GDPR)

✅ Enhances trust and safety throughout the payment journey

𝐈𝐬 𝐈𝐝𝐞𝐧𝐭𝐢𝐭𝐲 𝐕𝐞𝐫𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧 𝐭𝐡𝐞 𝐬𝐚𝐦𝐞 𝐚𝐬 𝐊𝐘𝐂?

Not quite.

► 𝐈𝐝𝐞𝐧𝐭𝐢𝐭𝐲 𝐕𝐞𝐫𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧 is the process of validating a user’s identity

► 𝐊𝐘𝐂 (Know Your Customer) is the regulatory framework that includes verification, due diligence, and ongoing monitoring

𝐓𝐡𝐞 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬 𝐨𝐟 𝐈𝐝𝐞𝐧𝐭𝐢𝐭𝐲 𝐕𝐞𝐫𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧

→ Intelligent fraud prevention

→ Global reach with support for 3,000+ ID types

→ Faster, frictionless onboarding

→ Built-in compliance capabilities

𝐍𝐞𝐱𝐭 𝐔𝐩: 3DS Authentication — enhancing security without sacrificing conversion

Source: Checkout.com x Connecting the dots in payments...

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()