Tabby Eyes IPO in 12–18 Months, But Market Conditions Hold the Key

Hey Payments Fanatic!

UAE-born, Riyadh-based BNPL giant Tabby is gearing up for a public listing that could happen as soon as 12 months from now, according to CEO Hosam Arab. While the official IPO window is 12–18 months, Arab notes the faster track depends on whether global markets bounce back sooner rather than later.

Tabby, fresh off a $160M Series E round, is under no financial pressure to go public right away. Arab called the February raise “definitely the right call,” ensuring the company has a solid buffer against market volatility.

Still, challenges remain — from oil price swings and recession fears to the untested waters of tech IPO pricing in the region. Arab reflected on this: “We grew 85% last year. For investors in this region to price this hasn’t been tested yet. We have seen investors very comfortable around yield plays, so there is a question mark for us.”

Tabby joins a small but rising wave of regional tech firms eyeing the public markets, a space long dominated by state-led and real estate IPOs. Whether they tap international or local investors, all eyes are on how the region will handle its next wave of tech growth stories.

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

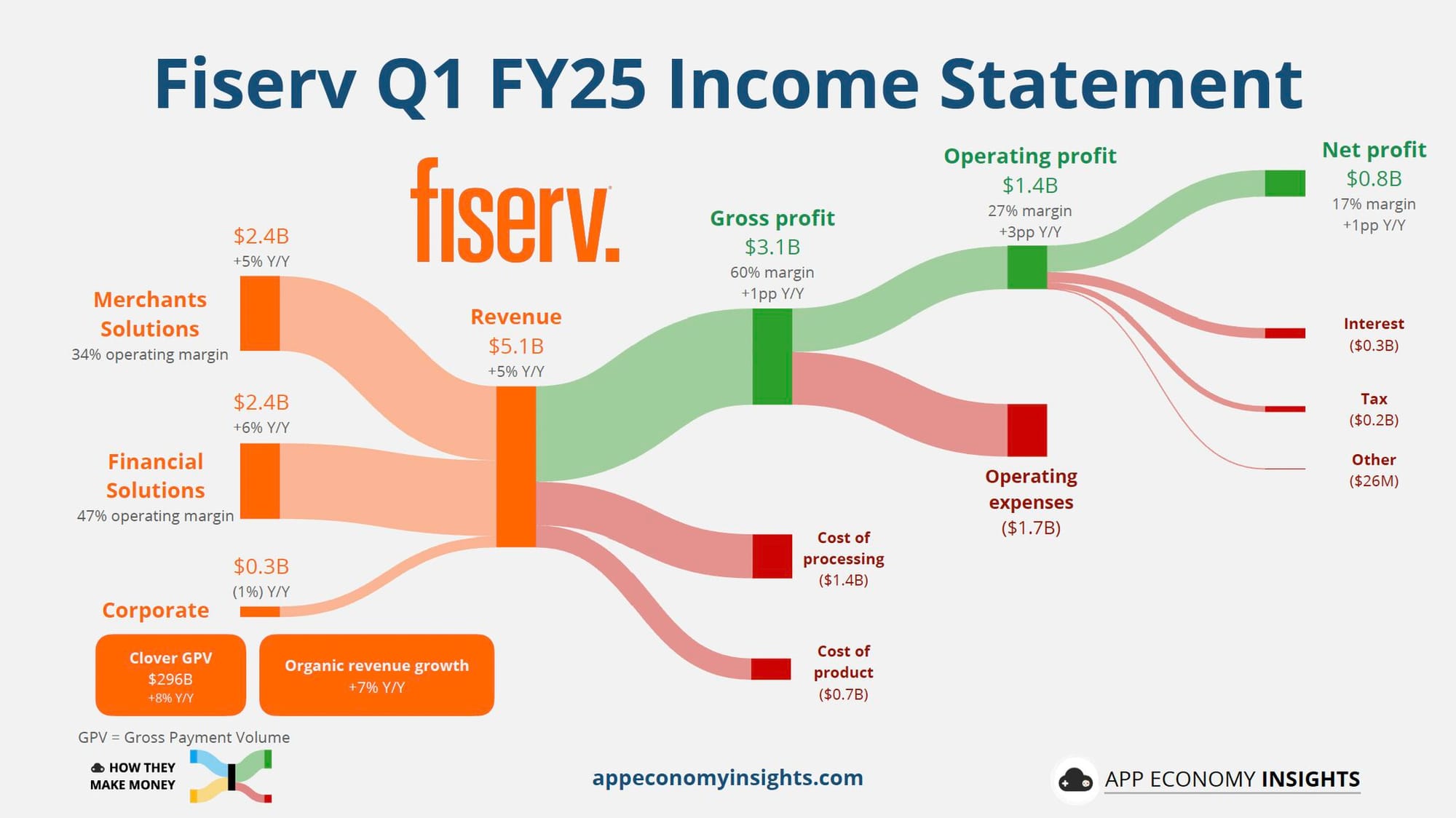

🇺🇸 Fiserv has begun processing card transactions under its merchant acquirer limited purpose bank (MALPB) charter.

PAYMENTS NEWS

🇸🇪 The 150 leading organisations confirmed to attend NextGen Nordics 2025. The event addressed key industry themes such as the DORA, VoP, CBDCs, instant payments, fraud prevention, and the use of Generative AI in financial services. ACI Worldwide's participation highlighted its ongoing commitment to secure and innovative payment solutions in the rapidly evolving Nordic financial landscape.

🌎 Immediate payment systems in Latin America. Over the last decade, the region has seen notable progress in strengthening these systems. In 2023, real-time payments reached 266.2 billion globally — a 42.2% increase compared to 2022 — according to the Prime Time for Real-Time 2024 report by ACI Worldwide.

🇬🇧 Visa Compelling Evidence 3.0: How to save $10M in revenue in one year with Solidgate. This article explores the functionality of CE3.0 and explains why it may serve as a critical component in a comprehensive strategy to safeguard revenue. Read the full article here

🇺🇸 Visa makes landmark BVNK investment in ‘powerful validation’ of stablecoins’ payments future. It follows a variety of other stablecoin-related partnerships by Visa as it works to connect its ecosystem of around 4.8 billion cards, 150 million accepting merchants, and 14,500 financial institutions with the crypto ecosystem.

🇧🇷 Mercado Pago has introduced "Point Tap," a solution that transforms smartphones into payment terminals using NFC technology. This innovation allows merchants to accept credit and debit card payments directly through their Android or iPhone devices without the need for additional hardware.

🇬🇧 £1.2bn Alpha unanimously rejects US takeover bid. The all-cash preliminary proposal came from Corpay, a firm that offers tools that allow businesses to make payments to vendors. “The board carefully considered the proposal, together with its financial advisers, and unanimously rejected it,” Alpha said in a notice.

🇦🇺 Blinq lands $25M to further its mission to make business cards passé. The app lets users create several customized digital business cards for different needs and connect with contacts using them. The app can also automatically capture details and sync them with CRM systems.

🇩🇪 Brite Payments expands instant payments reach in Germany with OXID eSales. The partnership brings the extensive benefits of Brite Instant Payments and Brite Instant Payouts to users of OXID’s shop system through an easy-to-integrate plugin.

🌍 Bitget Wallet teams up with Paydify to expand global crypto acceptance. This initiative allows merchants to accept stablecoin payments from Bitget Wallet users, optimising crypto payments infrastructure and expanding the practical use of digital assets in daily transaction settings.

🇺🇾 dLocal and PayPal expand access to local payments across emerging markets. By leveraging dLocal’s platform, global customers of PayPal can easily accept cards and process local and alternative payment methods across Latin America, EMEA, and APAC markets without needing to establish local entities.

🌏 XWeave secures US$3 million funding for stablecoin cross-border payments. The funding will be used to expand XWeave’s network across non-G10 payment corridors in Asia and the Middle East, including the UAE, Indonesia, Japan, and Hong Kong.

🇺🇸 Former Global Head of Visa Commercial Alan Koenigsberg joins Cardlay Advisory Board. Koenigsberg’s deep expertise in the payments industry will be instrumental in scaling operations and forging key partnerships across North America.

🇸🇬 Visa’s Shailesh Paul set to take over as CEO of PayU-owned Wibmo. He replaces Suresh Rajagopalan, who left in March. Wibmo, acquired by PayU in 2019, is expanding its focus to include full-stack payment solutions and business payments for future growth.

🇬🇧 UK payments regulator to be axed. The government announcement that regulation will soon be ‘cut back’ will not result in a free-for-all in the payments space, as two financial services regulatory partners talk to CDR about the likely changes to come.

🇴🇲 Beyond ONE™ launches FRiENDi Pay in Oman, transforming digital payments for the sultanate’s residents. FRiENDi Pay offers a comprehensive financial solution for all Oman residents and citizens seeking hassle-free money transfers.

🇳🇴 Mastercard and Bits extend NICS clearing partnership. The firms have signed a new five-year agreement under which Mastercard will continue providing interbank clearing services for Norway’s financial institutions. The partnership supports the operation of the Norwegian Interbank Clearing System (NICS).

GOLDEN NUGGET

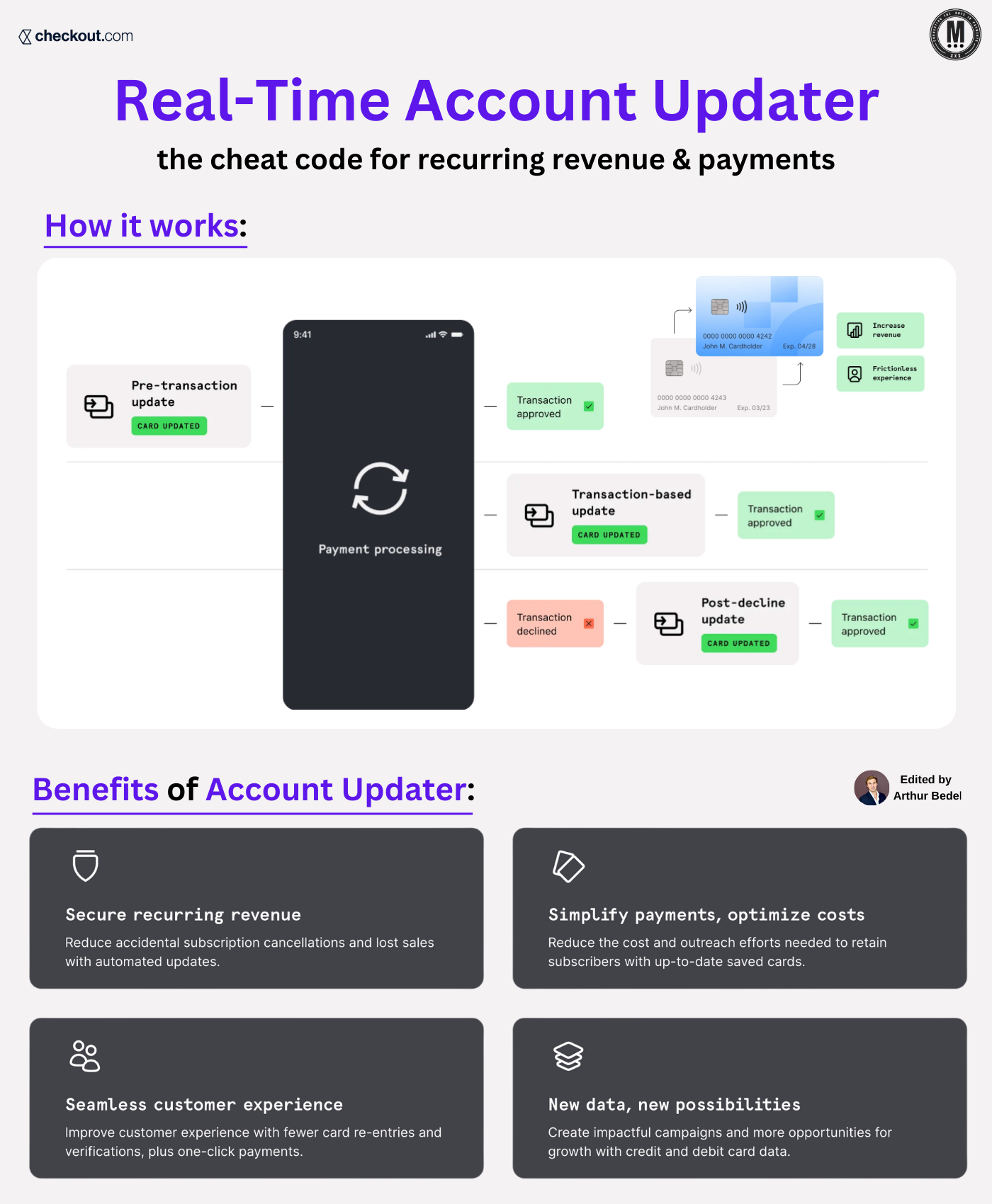

Welcome to 𝐓𝐡𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐀𝐜𝐚𝐝𝐞𝐦𝐲 by Checkout.com — Episode 13 👋 Created by Arthur Bedel

𝐑𝐞𝐚𝐥-𝐓𝐢𝐦𝐞 𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐔𝐩𝐝𝐚𝐭𝐞𝐫 – 𝐓𝐡𝐞 𝐁𝐚𝐬𝐢𝐜𝐬 & 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬

► A Real-Time Account Updater (RTAU) is a service that updates stored card details instantly when there’s a change—like an expiration date or a reissued card—ensuring recurring payments continue uninterrupted.

This is essential for subscription-based, on-demand, and one-click checkout experiences where outdated credentials could lead to payment declines.

𝐑𝐞𝐚𝐥-𝐓𝐢𝐦𝐞 𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐔𝐩𝐝𝐚𝐭𝐞𝐫 vs 𝐒𝐭𝐚𝐧𝐝𝐚𝐫𝐝 𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐔𝐩𝐝𝐚𝐭𝐞𝐫:

► 𝐒𝐭𝐚𝐧𝐝𝐚𝐫𝐝 𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐔𝐩𝐝𝐚𝐭𝐞𝐫 (AU) → Operates on a scheduled batch basis (e.g. once a week).

► 𝐑𝐞𝐚𝐥-𝐓𝐢𝐦𝐞 𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐔𝐩𝐝𝐚𝐭𝐞𝐫 (RTAU) → Runs live, even during or just after a transaction—salvaging failed payments in real time.

RTAU drastically reduces declines, improves authorization rates, and protects revenue in real time.

𝐓𝐡𝐞 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬 & 𝐑𝐞𝐚𝐥 𝐋𝐢𝐟𝐞 𝐑𝐞𝐬𝐮𝐥𝐭𝐬 𝐨𝐟 𝐑𝐓𝐀𝐔:

✅ 𝐒𝐚𝐯𝐞 𝐫𝐞𝐯𝐞𝐧𝐮𝐞 𝐰𝐢𝐭𝐡 𝐢𝐧𝐬𝐭𝐚𝐧𝐭 𝐮𝐩𝐝𝐚𝐭𝐞𝐬

Prevent unnecessary declines by ensuring payment credentials are always up to date — no customer action required.

✅ 𝐅𝐫𝐢𝐜𝐭𝐢𝐨𝐧-𝐟𝐫𝐞𝐞 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬

Customers experience smooth renewals, auto-refills, and recurring payments — improving satisfaction and reducing churn.

✅ 𝐍𝐞𝐰 𝐝𝐚𝐭𝐚, 𝐧𝐞𝐰 𝐩𝐨𝐬𝐬𝐢𝐛𝐢𝐥𝐢𝐭𝐢𝐞𝐬

Leverage updated card metadata (e.g. BIN changes, product type) to refine payment routing, authorization strategies, and compliance segmentation.

✅ 𝐓𝐡𝐞 𝐑𝐞𝐬𝐮𝐥𝐭𝐬 𝐨𝐟 𝐑𝐓𝐀𝐔:

✔ Secure your recurring revenue

✔ Simplify operations and reduce costs

✔ Deliver a frictionless experience

✔ Leverage up-to-date data to boost performance

𝐖𝐡𝐨 𝐎𝐟𝐟𝐞𝐫𝐬 𝐈𝐭:

► 𝐀𝐜𝐪𝐮𝐢𝐫𝐞𝐫𝐬 → Checkout.com, Stripe, Adyen, Nuvei

► 𝐓𝐨𝐤𝐞𝐧 𝐒𝐞𝐫𝐯𝐢𝐜𝐞 𝐏𝐫𝐨𝐯𝐢𝐝𝐞𝐫𝐬 → VGS, TokenEX

► 𝐆𝐚𝐭𝐞𝐰𝐚𝐲𝐬 | 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝐏𝐥𝐚𝐭𝐟𝐨𝐫𝐦𝐬 → DEUNA, ACI Worldwide, CellPoint Digital, Yuno

► 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬 → Visa Account Updater, Mastercard ABU, American Express CardRefresher, Discover Financial Services Account Updater (via providers)

Source: Checkout.com x Connecting the dots in payments...

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()