Visa Gets the FX Green Light in Brazil… as Nuvei and FreedomPay Unify Enterprise Payments

Hey Payments Fanatic!

Visa Conecta just received approval from Central Bank of Brazil to operate in the FX market, officially expanding its scope beyond payments.

That means buying and selling foreign currencies is now on the table. It’s a meaningful step as Visa doubles down on Brazil and pushes deeper into Open Finance.

Visa Conecta was only created in 2025, backed by Visa Inc., and this approval significantly broadens what it can do locally.

What I find interesting here is how this aligns with the current Payments industry backdrop. FX and Open Finance coming together under one roof points to a much tighter Payments stack in Brazil...

Meanwhile, on the enterprise side…

Nuvei just partnered with FreedomPay to unify in-store and digital payments for large merchants globally.

This gives enterprise brands faster rollout of new channels, consistent experiences across locations, and unified reporting and tokenization behind the scenes.

Less rebuilding. Less friction.

According to Phil Fayer, Chairman and Chief Executive Officer at Nuvei, the focus is on helping merchants create connected payment journeys that drive loyalty without adding operational complexity.

Curious about what’s shaping Payments right now? Scroll down and catch today's updates? 👇

Cheers,

INSIGHTS

➡️ Payments companies with key stablecoin offerings announced in 2025 👇

NEWS

🇺🇸 Nuvei and FreedomPay announce partnership to unify enterprise payments globally. By integrating FreedomPay's platform with Nuvei's scalable payments infrastructure, merchants gain a single solution for creating frictionless checkout experiences that are secure, connected, and insight-driven.

🇧🇷 Visa Conecta receives approval from the Central Bank to operate in the foreign exchange market. This means that the company can now operate in the buying and selling of foreign currencies, expanding the scope of services within the payments sector.

🇺🇸 Papaya Global considers a sale with a valuation up to $4.5 billion amid B2B growth. The company is negotiating with multiple international parties, including a private equity fund and enterprise software firms such as SAP and Oracle. The company’s cross-border payroll software operates in 160 countries and supports 130 currencies.

🇺🇸 Crypto.com and Stripe partner to enable better crypto payments. Crypto.com is the first cryptocurrency platform to be integrated with Stripe for direct payments from a balance. Now customers will be able to check out and pay with their preferred cryptocurrency, in addition to the ability to pay with stablecoins.

🇰🇷 Crypto.com and Kyobo Lifeplanet collaborate to accelerate digital asset adoption in Korea. The partnership will explore new ways to expand access to digital assets and enhance customer value through integrated, digital‑first financial experiences.

🇺🇸 Modulr expands to the U.S. with FIS partnership to power real-time payments for banks. This partnership builds on FIS’s broader modernization strategy, reinforcing its commitment to simplifying and optimizing how money moves across the entire money lifecycle.

🇺🇸 Barclays has invested in Ubyx as tokenized infrastructure advances. Ubyx is building a common settlement framework to enable tokenized money to move between issuers and institutions, supporting the exchange and redemption of tokenized funds at par value.

🇺🇸 PayPal Ads launches Transaction Graph Insights and Measurement to improve commerce advertising outcomes. PayPal's Transaction Graph helps identify high-intent shoppers as PayPal is the only platform connecting search, shop, and share signals across more than 430 million consumer accounts and tens of millions of merchants.

🇨🇦 Tether and Rumble launch Rumble Wallet, bringing self-custodial crypto payments to millions of creators and users. At launch, Rumble Wallet supports Tether USD, Tether Gold, and Bitcoin, allowing audiences to tip creators natively in crypto and to make direct, borderless payments without relying on traditional financial intermediaries.

🌎 Tether launches Scudo Denomination to enable everyday XAUt gold payments. It is a gold-backed crypto, which represents the ownership of physical gold. As gold prices have reached record highs, Tether aimed for everyday payments in gold, expanding its token use case beyond a traditional store of value.

🇺🇸 SmartMoving acquires Remedy Payments to bring profit-focused payments into the core platform. By combining Remedy’s payments infrastructure with SmartMoving’s operational system of record, payments can be connected directly to how jobs are sold, scheduled, and completed.

🇺🇸 Fireblocks acquires crypto accounting platform TRES in $130M cash and equity deal. The acquisition aims to expand Fireblocks’ infrastructure to meet rising compliance and operational demands from enterprise clients. Keep reading

🇲🇽 Mercado Pago strengthens its digital payments network in anticipation of increased demand due to the World Cup. The company is reinforcing its commitment to the digitization of cash in Mexico with a strategy focused on the deployment of payment infrastructure. Additionally, Mercado Pago launches a new credit scoring tool in Brazil. The feature promises to provide a clear view of each user’s score and indicate concrete recommendations for measures that can improve conditions within the digital bank’s ecosystem.

🇦🇪 RAKBANK secures in-principle approval for AED-backed stablecoin. RAKBANK said the proposed stablecoin is designed to combine the security and trust of traditional banking with the efficiency and programmability of blockchain technology.

🇧🇷 PicPay requests authorization to have its own bet. The operation in this segment will be through Nosso Time iGaming. PicPay stated that the goal of Nosso Time iGaming is to operate in sports betting at major events, taking all necessary precautions regarding responsible gaming and financial education.

🌎 Makachain and Estable.IO collaborate to simplify stablecoin payments for everyday use. The collaboration aims to provide technology solutions for crypto and stablecoin-related adoption with public and private sector institutions, including initiatives in Argentina and other Latin American countries.

🇺🇸 Fiserv and Wink partner to bring biometric payments to Clover platform. The partnership will incorporate Wink's face and palm recognition technology into Clover's payment system, allowing merchants to offer checkout experiences that use biometric authentication instead of physical payment cards or devices.

🇺🇸 Jupiter launches Native Stablecoin JupUSD, backed by BlackRock‑Linked Assets. The move highlights growing competition among stablecoin issuers on reserve quality, transparency, and yield generation, while enabling DeFi-native use across trading and lending.

GOLDEN NUGGET

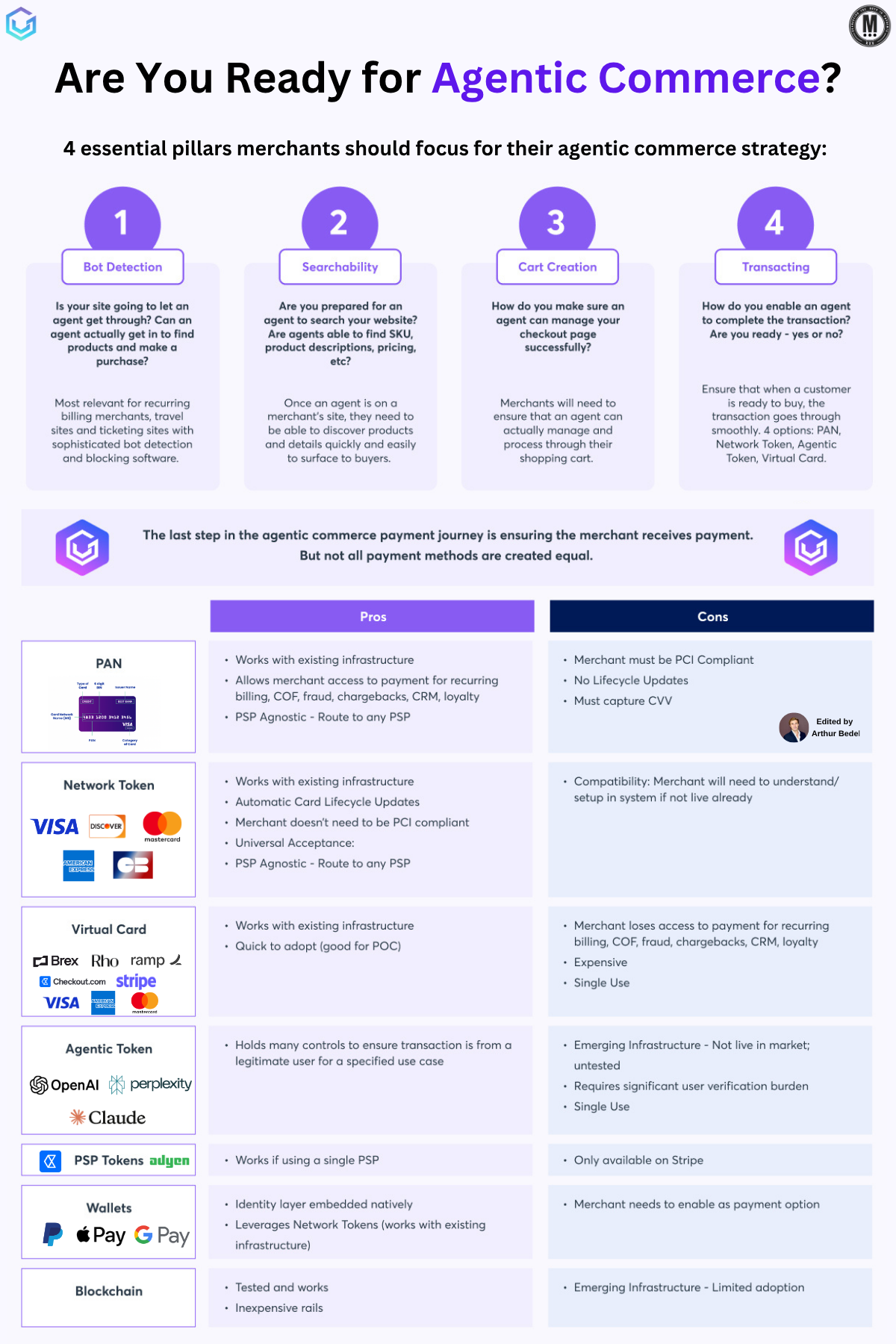

𝐀𝐫𝐞 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭𝐬 𝐑𝐞𝐚𝐝𝐲 𝐟𝐨𝐫 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞?👇Created by Arthur Bedel 💳 ♻️

The shift: AI agents won’t assist checkout — they’ll perform it. They’ll read your catalog, add items to cart, apply loyalty, calculate shipping, and execute payment — autonomously.

𝐓𝐡𝐞 4 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭 𝐑𝐞𝐚𝐝𝐢𝐧𝐞𝐬𝐬 𝐏𝐢𝐥𝐥𝐚𝐫𝐬

1️⃣ 𝐁𝐨𝐭 & 𝐀𝐠𝐞𝐧𝐭 𝐀𝐜𝐜𝐞𝐬𝐬

Fraud systems must distinguish approved agents from malicious bots.

If good agents are blocked, revenue never enters the funnel.

2️⃣ 𝐒𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞𝐝 𝐏𝐫𝐨𝐝𝐮𝐜𝐭 𝐒𝐞𝐚𝐫𝐜𝐡𝐚𝐛𝐢𝐥𝐢𝐭𝐲

Agents don’t browse — they query.

If your product data (SKU, pricing, stock, shipping rules) isn’t structured + discoverable:

→ The agent simply cannot add to cart.

3️⃣ 𝐂𝐚𝐫𝐭 𝐍𝐚𝐯𝐢𝐠𝐚𝐭𝐢𝐨𝐧 & 𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭 𝐋𝐨𝐠𝐢𝐜

Agents must be able to:

→ Create/modify carts

→ Apply promos

→ Determine shipping

→ Submit orders via API

Breaks here cause silent, invisible cart abandonment (no error message, no retry).

4️⃣ 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 & 𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐢𝐨𝐧

This is where the readiness gap is most visible: payment credentials behave very differently in agent-driven checkout.

𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐂𝐫𝐞𝐝𝐞𝐧𝐭𝐢𝐚𝐥𝐬: 𝐑𝐞𝐚𝐥 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭 𝐓𝐫𝐚𝐝𝐞𝐨𝐟𝐟𝐬

𝐑𝐚𝐰 𝐏𝐀𝐍 (Card Number)

• Works everywhere and supports recurring + chargebacks

• But: Requires PCI compliance, no lifecycle updates, lower auth rates over time

𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐓𝐨𝐤𝐞𝐧𝐬 (Visa / Mastercard)

• Higher authorization rates + automatic lifecycle updates

• Universal, PSP-agnostic routing flexibility

• But: Merchants will need to understand and set up their systems to accept NTs

𝐕𝐢𝐫𝐭𝐮𝐚𝐥 𝐂𝐚𝐫𝐝𝐬

• Fast to deploy with granular spend controls

• But: Single-use → weaker for loyalty/recurring → expensive

𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐓𝐨𝐤𝐞𝐧𝐬 (AI-linked identity/intent credentials)

• Adds identity + context between agent and merchant

• But: Not live → single use → requires significant identity burden

𝐖𝐚𝐥𝐥𝐞𝐭𝐬 (Apple Pay / Google Pay)

• Built-in identity + tokenization → strong conversion

• But: Must be activated + optimized regionally to unlock the gains

𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧𝐬 / 𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧 𝐒𝐞𝐭𝐭𝐥𝐞𝐦𝐞𝐧𝐭

• Low-cost, global, programmable settlement layer

• But: Merchant support + accounting treatment varies by geography and risk posture

𝐖𝐢𝐧𝐧𝐢𝐧𝐠 𝐦𝐞𝐫𝐜𝐡𝐚𝐧𝐭𝐬 𝐰𝐢𝐥𝐥:

• Expose structured, indexable product catalogs

• Standardize cart & checkout APIs

• Shift from raw PAN → tokenized payment credentials

• Treat payments as programmable infrastructure, not a static utility

𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐓𝐨𝐤𝐞𝐧𝐬 will be at the core of this shift. Being "familiar" with them isn't enough, this needs to be your bread and butter.

Those preparing now will be the ones the agents buy from first.

Source: VGS

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()