Worldline Moves to Sell PaymentIQ… and It Shows Exactly How the Company Is Resetting

Hey Payments Fanatics!

Worldline just announced the planned sale of PaymentIQ to Incore Invest for roughly €160M.

The company is pushing forward with its refocus on core European payments and trying to streamline everything around its North Star plan.

The move is all about simplification and tightening the portfolio. More room to allocate capital where it actually compounds. Management says it should strengthen the financial profile and free up focus for merchant and FI activities.

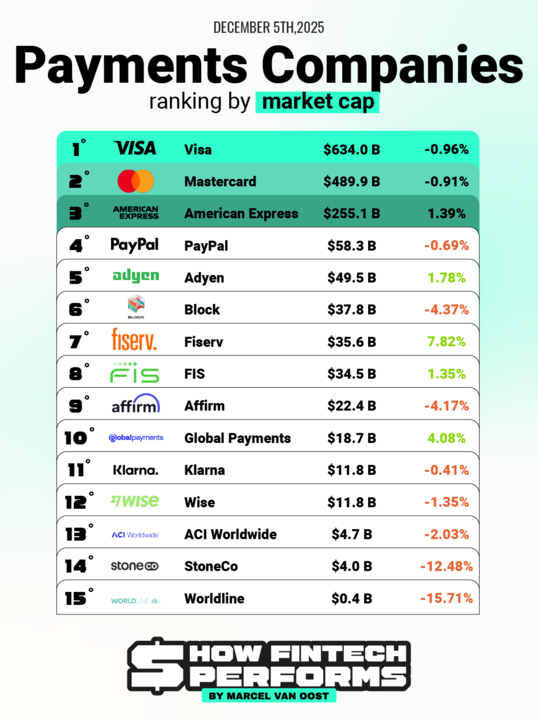

If you missed it, Worldline’s stock dropped 15%. I broke that down in our public markets newsletter A Week of Contrasts, our deep markets read for anyone tracking what’s moving FinTech valuations.

And since we’re talking market pressure, take a look at the Payments leaderboard below. It puts everything into perspective 👇

If you like staying ahead of the payments curve, keep scrolling. I’ll see you back here tomorrow!

Cheers,

INSIGHTS

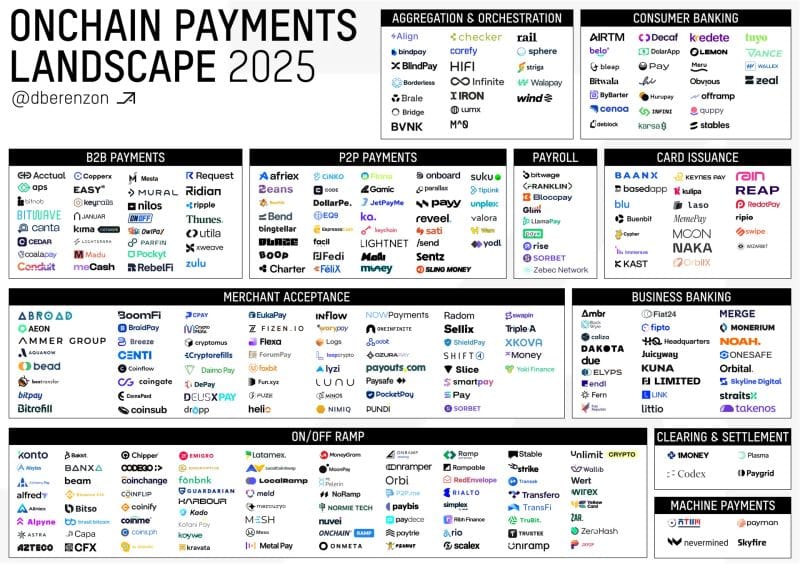

➡️ There are currently ~320 payment companies building on cryptorails 👇

Which company is missing from this map?

NEWS

🇺🇸 Airwallex raises $330M Series G at $8B valuation. The investment will fuel Airwallex’s continued growth in the U.S. and key markets worldwide. Airwallex has established a second global headquarters in San Francisco and will deploy more than $1 billion from 2026-2029 to scale its U.S. operations, attract top talent, and expand its physical and brand footprint.

🇨🇳 TenPay Global and Mastercard collaborate to enable fast and secure remittances to Weixin Pay. Eligible senders around the world will be able to send salaries and family support directly to Weixin Pay Wallet Balance or linked bank cards in Weixin Pay.

🇫🇷 Worldline announces the contemplated divestment of its payments orchestration platform, PaymentIQ, to Incore Invest. This transaction will simplify operations, optimise resource allocation, and enable increased management focus on core payment activities for merchants and financial institutions.

🇺🇸 Rosen Law Firm encourages Klarna Group investors to inquire about securities class action investigation. Following a Yahoo! Finance article noting that Klarna’s first post-IPO earnings showed record revenue but higher-than-expected provisions for credit losses, resulting in a $95 million net loss and a stock drop of 9.3% on November 18, 2025.

🇺🇸 AllScale raises $5m seed led by YZi Labs to build the world's first self-custody stablecoin neobank. The company’s mission is to provide the underlying payment infrastructure for the next generation of "super individuals" and small and medium-sized businesses (SMBs).

🇮🇳 Wise to double down on cross-border payments and roll out prepaid forex card. The UK-based FinTech is rolling out a multi-currency prepaid forex card for users in India as the company is doubling down on expanding its presence in the cross-border payments space in the country.

🇧🇷 Pix sets a new record, surpassing 313 million transfers in a single day. In a statement, the Central Bank affirmed that the performance demonstrates the consolidation of Pix as one of the main digital tools in the country, directly impacting the pace of economic activities.

🌎 Remittance FinTech Bless Payments raises $3.75 million Seed round. The funds will be used to support expansion into Canada, the UK, and the US. The company serves over 1,500 users, offers remittances to 60 countries, and has launched a no-fee travel card, with its mission focused on providing transparent, low-cost financial tools for migrants.

🇨🇦 Canadian FinTech Tuhk Inc. raises US$6 million seed round led by FINTOP, with Lloyds Banking Group and Capital One Ventures. The platform aims to revolutionize payments by enabling secure, real-time collaboration among merchants, banks, and service providers to combat the global US$10.5 trillion cybercrime threat.

🇩🇰 Danish unicorn Flatpay bets on door-to-door sales to triple ARR by the end of 2026, aiming for €400-€500M by leveraging an intensive door-to-door sales model for small businesses, which involves in-person demos and setup, driving rapid adoption despite higher costs.

🇺🇸 Stripe is partnering with Instacart to enable direct checkout in ChatGPT. This new AI commerce experience is powered by the Agentic Commerce Protocol (ACP) Stripe launched with OpenAI a few months ago. Keep reading

🌍 Aspora names Varun Sridhar CEO to lead global FinTech expansion. At Aspora, his mandate will focus on accelerating the company’s entry into priority markets such as the US, UK, UAE, Germany, Italy, and Ireland, alongside building tailored wealth and loan products for globally mobile Indian professionals and families.

🇬🇧 Volt appoints ex-Checkout.com Product Director Mathew Tuvesson as VP of Product. Mathew will take centre stage in delivering a new generation of Volt’s product suite, as the company ramps up its evolution and prepares to add stablecoin payments and treasury solutions to its real-time payments capabilities.

🇦🇪 Bybit and Circle forge a strategic partnership to advance global USDC adoption. As part of this partnership, Bybit will enhance USDC liquidity across spot and derivatives markets, enabling a more efficient trading environment for retail and institutional users.

🌍 OPay appoints James Perry as Chief Financial Officer. In this role, Jim will lead OPay’s financial strategy, capital planning, and investor relations as we continue to scale our FinTech ecosystem across Africa and expand globally. Keep reading

🇨🇴 Cards that drive the evolution of digital payments in Colombia. Colombia’s payments ecosystem is rapidly modernizing as credit, debit, and prepaid cards shift from simple payment tools to digital platforms, driving inclusion and innovation. With credit card issuance up 59% and debit cards up 17.2% in early 2025.

GOLDEN NUGGET

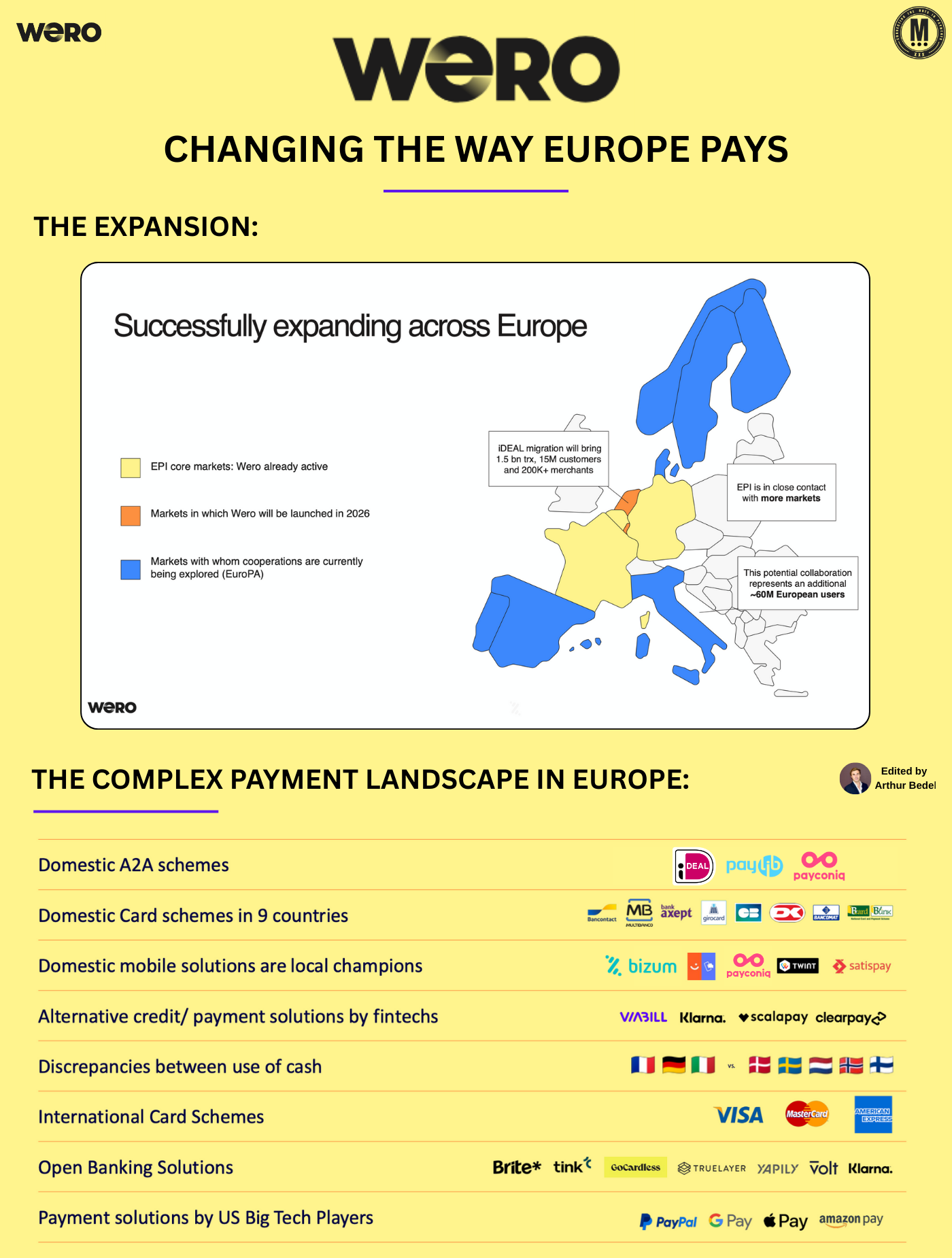

Welcome to 𝐓𝐡𝐞 𝐄𝐮𝐫𝐨𝐩𝐞𝐚𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐒𝐞𝐫𝐢𝐞𝐬 by 𝐖𝐞𝐫𝐨 🇪🇺 — Episode 1 👇Created by Arthur Bedel 💳 ♻️

𝐖𝐞𝐫𝐨 is 𝐄𝐮𝐫𝐨𝐩𝐞’𝐬 payment scheme and 𝐝𝐢𝐠𝐢𝐭𝐚𝐥 w𝐚𝐥𝐥𝐞𝐭. Developed by the EPI Company to provide a unified, secure, and bank-led alternative to legacy card schemes and fragmented A2A solutions. Currently operational in Germany, France, and Belgium — with the Netherlands and Luxembourg coming soon.

𝐓𝐡𝐞 𝐂𝐡𝐚𝐥𝐥𝐞𝐧𝐠𝐞: A fragmented payments landscape in Europe with no pan-European solution in front of international card schemes and wallets

► Domestic A2A schemes → iDEAL (NL), Paylib (FR), Payconiq International (BE/LUX)

► Domestic Mobile wallets → Vipps, Swish, TWINT, Bizum, Satispay

This complexity results in inconsistent consumer experiences, increased costs for merchants, and limited cross-border interoperability.

𝐇𝐨𝐰 𝐝𝐨𝐞𝐬 𝐖𝐞𝐫𝐨 𝐰𝐨𝐫𝐤?

EPI Company developed Wero with its own proprietary APIs which issuers and acquirers implement. SCT INST is used for settlement and has the flexibility to use other settlement layers for new or different use cases. It is deployed through two main channels:

1️⃣ 𝐌𝐨𝐛𝐢𝐥𝐞 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐀𝐩𝐩 𝐈𝐧𝐭𝐞𝐠𝐫𝐚𝐭𝐢𝐨𝐧 — Leveraging the trust and reach of consumer banks

2️⃣ 𝐖𝐞𝐫𝐨 Digital Wallet 𝐀𝐩𝐩 — A consistent, cross-market interface

→ 𝐂𝐨𝐧𝐬𝐞𝐧𝐭-𝐁𝐚𝐬𝐞𝐝 𝐀𝐫𝐜𝐡𝐢𝐭𝐞𝐜𝐭𝐮𝐫𝐞

Wero’s consent model: commercial payments involve four steps: consent, authorization with SCA (biometrics), capture and settlement for flexible integration that easily adaptable to different payment use cases from one-time payments to subscriptions.

→ 𝐎𝐦𝐧𝐢𝐜𝐡𝐚𝐧𝐧𝐞𝐥 𝐄𝐧𝐚𝐛𝐥𝐞𝐦𝐞𝐧𝐭

• One-time payments

• Subscriptions and recurring billing

• Pay-on-shipment, availability of goods, fulfilment of service, and delivery.

• QR-based point-of-sale payments to come

• Self-service kiosks

• P2P and upcoming P2Pro transactions

𝐓𝐡𝐞 𝐒𝐨𝐥𝐮𝐭𝐢𝐨𝐧:

→ 𝐂𝐨𝐧𝐬𝐮𝐦𝐞𝐫𝐬

• No need for card or IBAN entry

• Bank-grade protection with SCA, fraud scoring additional to banks’, and dispute resolution

• Consumers can fulfil all their payment needs - e-commerce, in-store, P2P payments - from their Wero wallet.

→ 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭𝐬

• Access to main European markets through one European payment method

• Lower total cost of acceptance compared to cards

• Loyalty and ID verification to come

→ 𝐄𝐮𝐫𝐨𝐩𝐞

• Backed by 24+ major PSPs and acquirers

• Consolidates Paylib, iDEAL, and Payconiq International under one framework

• Designed to comply with PSD2 and aligned to EU regulation

𝐖𝐞𝐫𝐨’𝐬 𝐌𝐨𝐦𝐞𝐧𝐭𝐮𝐦 𝐒𝐨 𝐅𝐚𝐫

• 46M+ users enrolled

• €9.8 bn transferred since inception

• 25 banks/banking groups live with P2P solution

• Migrations from iDEAL, Paylib, and Payconiq International underway

Source: EPI Company

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()