Airwallex Ramps Up in Israel After 315% Revenue Surge

Hey Payments Fanatic!

Airwallex is quietly turning Israel into one of its fastest-growing markets.

Revenue there jumped 315% year-on-year... Transaction volume in Q4 alone was up 406%. For a company that only launched locally in 2023, that’s serious momentum.

After securing its Payment Service License in July 2025, Airwallex rolled out its full stack on the ground: treasury, acquiring, and card issuing. Now it plans to increase its Israel workforce by 43% by the end of the year.

According to Or Liban, Head of Israel at Airwallex, "Since launching in Israel nearly three years ago, the team has seen strong growth with new customers and regional hires.”

What this really signals to me is a shift:

With a larger team, a full product suite live, and the local license secured, Airwallex is positioning itself as a real infrastructure for Israeli companies looking to scale globally.

Now, let’s look at what else is moving in Payments today 👇 I'll be back tomorrow with more news from the sector to keep you informed.

Cheers,

Get the Latest in Paytech! Join my new Telegram channel for daily updates on paytech trends and exclusive insights. Connect with industry enthusiasts and stay on top of innovation!

NEWS

🇮🇳 Mastercard's AI agent-led pay awaits approval. Mastercard demonstrated India’s first AI-driven agentic commerce transaction in a controlled sandbox, with real payments but simulated merchant environments. The technology aims to automate purchases without human input while using existing secure payment systems like cards or UPI.

🇸🇦 Mastercard cardholders can now use Google Pay in Saudi Arabia. The service enables cardholders to make fast, contactless payments at physical stores. With a simple tap of an Android phone or a click at checkout, users can complete purchases instantly, helping people and families manage their finances with greater confidence and control.

🇦🇺 MYOB taps Mastercard to boost SME open banking feeds. The new connections will feed banking data into MYOB's cloud products, including MYOB Business and AccountRight. They add another way for customers to connect bank feeds alongside existing methods.

🇮🇱 Airwallex plans to boost the Israel workforce by 43% by end of year and is preparing to move into a larger Tel Aviv office in the first half of next year to accommodate new hires. Airwallex has expanded in Israel after securing a Payment Service License in July 2025, enabling it to offer its full suite of treasury, acquiring, and card issuing services.

🇨🇦 Nautilus Plus selects Nuvei to power omnichannel payments across its gym network and Ultimate Fit digital platform. With Nuvei’s platform, Nautilus Plus and Ultime Fit now offer a consistent and streamlined omnichannel payment experience across point of sale, mobile, and online channels.

🌍 Mesh partners with Adyen to accelerate the scale of its European and U.K. operations. This collaboration is designed to aggressively scale Mesh’s established operations across the United Kingdom and Europe, supporting the company’s rapidly expanding roster of global enterprise clients.

🇿🇦 Araxi has agreed to acquire an 80% stake in Pay@ Holdings and its affiliate IHPL for R1 billion through its subsidiary African Resonance. Araxi said that the acquisition of the Pay@ Group will significantly strengthen its payment capabilities, enabling the group to deliver an expanded, more competitive offering to customers.

🇮🇳 NPCI collaborates with Nvidia to advance India's sovereign AI infrastructure for digital payments. The initiative will support the evolving requirements of large-scale, real-time payment systems, with an emphasis on trust, resilience, security, and ecosystem enablement, NPCI said in a statement.

🇪🇺 ECB and ONCE Foundation launch collaboration. The ECB is collaborating with the Spanish financial inclusion agency, the Once Foundation, to get technical advice on the accessibility requirements and features of the digital euro app, and testing once the first prototypes are available.

🇮🇹 Nexi Group announced the launch of Nexi Ready, a new category of fully managed, plug-and-play digital issuing solutions. Nexi Ready alleviates a significant burden for banks, corporates, and FinTechs, enabling them to quickly deploy modern, compliant, and scalable digital issuing services without having to build and operate their own infrastructure.

🇫🇷 Societe Generale - FORGE has officially launched its euro-denominated stablecoin EUR CoinVertible on the XRP Ledger. With this integration, SG-FORGE intends to increase adoption and benefit from the scalability, speed, and low cost of the XRPL, a secure and decentralized Layer 1 blockchain.

🇺🇸 Stripe's stablecoin firm Bridge wins initial approval of national bank trust charter. "This approval positions Bridge to help enterprises, FinTechs, crypto businesses, and financial institutions build with digital dollars inside a clear federal framework," the company said in the press release.

🇺🇸 Delaware-based Rizon has secured $2 million in pre-seed funding as demand for borderless U.S. dollar banking accelerates worldwide. The fresh capital will help Rizon scale its user base globally and deepen its footprint in new markets where access to reliable dollar banking remains limited.

🇦🇪 eNovate and Cobi launch large-scale AI-powered digital payment infrastructure. The partnership combines eNovate’s digital payments product suite and Cobi’s AI-powered engagement platform to give financial institutions a new level of intelligence, personalisation, and behavioural insight across their customer base.

🇪🇺 Revolut Bank has begun checking old transfers from Russians living in the EU. The checks specifically concern SWIFT transfers, card number transfers, and transactions through Sberbank. Several clients were asked to confirm the origin of funds transferred from Kazakhstan or other CIS countries.

🌍 Salt Edge and NoCFO to bring Pay by Bank to entrepreneurs in Finland and Germany. The collaboration integrates Salt Edge’s payment initiation capabilities directly into the NoCFO platform, transforming the user experience by enabling complete financial workflows, including Pay by Bank, without users having to leave the app.

🇲🇽 KIRA and OXXO are betting on innovation in sending money to Mexico. This collaboration aims to improve the experience of those receiving money from abroad, with clear, user-friendly processes aligned with people's real needs. Keep reading

GOLDEN NUGGET

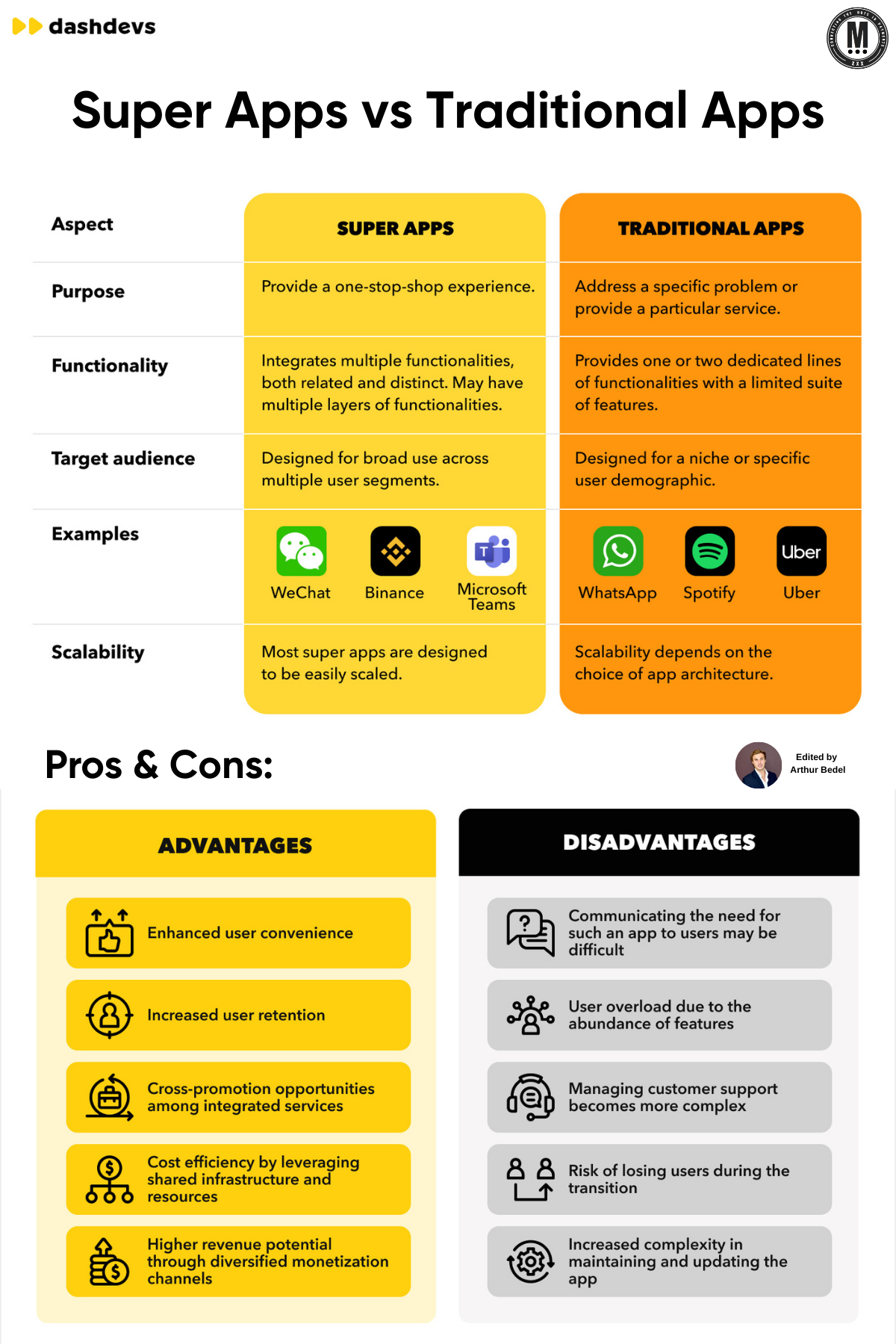

𝐓𝐡𝐞 "𝐒𝐮𝐩𝐞𝐫 𝐀𝐩𝐩" 𝐢𝐬𝐧'𝐭 𝐚𝐧 𝐚𝐩𝐩 — 𝐢𝐭'𝐬 𝐚 𝐭𝐚𝐤𝐞𝐨𝐯𝐞𝐫 𝐬𝐭𝐫𝐚𝐭𝐞𝐠𝐲 👇Created by Arthur Bedel 💳 ♻️

Think about the last time you opened an app.

You didn't open it because you love apps.

You opened it because you needed something done:

message someone, order food, book a ride, pay a bill, buy something.

𝐓𝐫𝐚𝐝𝐢𝐭𝐢𝐨𝐧𝐚𝐥 𝐚𝐩𝐩𝐬 are built for that moment.

↳ One problem. One flow. One outcome.

A 𝐒𝐮𝐩𝐞𝐫 𝐚𝐩𝐩 plays a different game.

→ It doesn't want to win a single transaction.

↳ It wants to become the place you start your day... and the place you end it.

That's the shift:

→ 𝐓𝐫𝐚𝐝𝐢𝐭𝐢𝐨𝐧𝐚𝐥 𝐚𝐩𝐩𝐬 = a tool

→ 𝐒𝐮𝐩𝐞𝐫 𝐚𝐩𝐩𝐬 = an ecosystem

And the reason they scale so fast is simple:

→ they don't fight for attention every time... they build 𝐡𝐚𝐛𝐢𝐭.

1️⃣ One service brings you in.

2️⃣ Another keeps you there.

3️⃣ A third makes you come back tomorrow.

And somewhere in the middle of all that...

→ 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 becomes invisible.

↳ Not a "checkout experience"... but a background function.

This is why super apps are so powerful in payments. They don't ask users to "go pay". They embed payments inside daily actions:

↳ chat

↳ mobility

↳ food

↳ shopping

↳ tickets

↳ subscriptions

↳ financial services

Result:

✔️ The wallet becomes the glue.

✔️ The data becomes the moat.

✔️ And the distribution becomes unfair.

Of course, it's not all upside. The same thing that makes super apps strong... makes them hard to build.

❌ More features = more complexity.

❌ You now need to manage:

customer support across multiple products

↳ operational overhead at scale

↳ product overload for users

↳ constant iteration without breaking the experience

So yes, 𝐒𝐮𝐩𝐞𝐫 𝐚𝐩𝐩𝐬 can win big. But they can also collapse under their own weight.

𝐌𝐲 𝐭𝐚𝐤𝐞𝐚𝐰𝐚𝐲:

A traditional app optimizes for 𝐟𝐞𝐚𝐭𝐮𝐫𝐞 depth.

A super app optimizes for 𝐥𝐢𝐟𝐞 coverage.

And if you're in #FinTech...

→ This isn't a product trend.

↳ It's a distribution war.

Who do you think has the best shot at building a 𝐭𝐫𝐮𝐞 𝐬𝐮𝐩𝐞𝐫 𝐚𝐩𝐩 𝐢𝐧 𝐭𝐡𝐞 𝐖𝐞𝐬𝐭?

Source: DashDevs LLC

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()